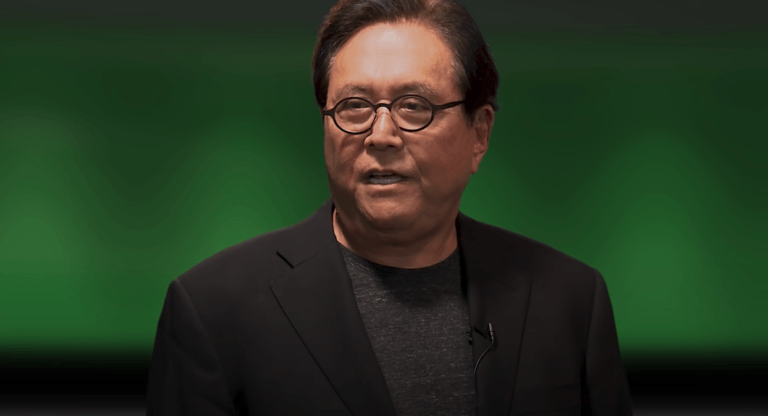

In a recent interview, Robert Kiyosaki, the highly successful author of the “Rich Dad Poor Dad” series of personal finance books, explained why he trusts Bitcoin, silver, and gold more than fiat money.

“Rich Dad Poor Dad, “which is one of the top 10 personal finance books of all time, “advocates the importance of financial literacy (financial education), financial independence, and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence (financial IQ) to improve one’s business and financial aptitude.”

At various times during the past three years, Kiyosaki has been criticizing the Federal Reserve’s response to the resulting economic fallout and strongly urging his large following on social media platforms to protect themselves from what he feels is inevitable high inflation (and possibly hyperinflation) in the future by using their fiat holdings to buy silver, gold, and Bitcoin.

Episode #263 of Anthony Pompliano’s “Pomp Podcast,” released on 7 April 2021, featured an interview with Kiyosaki.

During that interview, Pompliano asked Kiyosaki about “traditional inflation hedge” assets.

Kiyosaki said:

“Gold and silver are God’s money. Bitcoin is open source people’s money.“

On 30 December 2022, Kiyosaki told his 2.3 million followers that he is bullish on Bitcoin because, unlike most other crypto assets, it is a commodity and therefore not impacted by future actions of the U.S. Securities and Exchange Commission (“SEC”):

In the medium term, he believes that the Fed will be forced to print so much money in the future that the Bitcoin price will reach $500K by 2025.

Anyway, according to a report by The Daily Hodl, on February 22, while speaking with Michelle Makori, Kitco’s Lead Anchor and Editor-in-Chief, at the 2023 Vancouver Resource Investment Conference, Kiyosaki had this to say about Bitcoin:

“When I saw Bitcoin go to $20,000, I don’t know when it was, then it dropped down… But then it came roaring back. So when it hit $6,000, I bought 60 Bitcoin at $6,000. I think today it is at $20,000… so the more I’m in it, the more I realize it has sustainability. So the reason people buy Bitcoin is the same reason I buy this [silver]. And I buy this [gold]. I don’t trust this [dollar bills].”