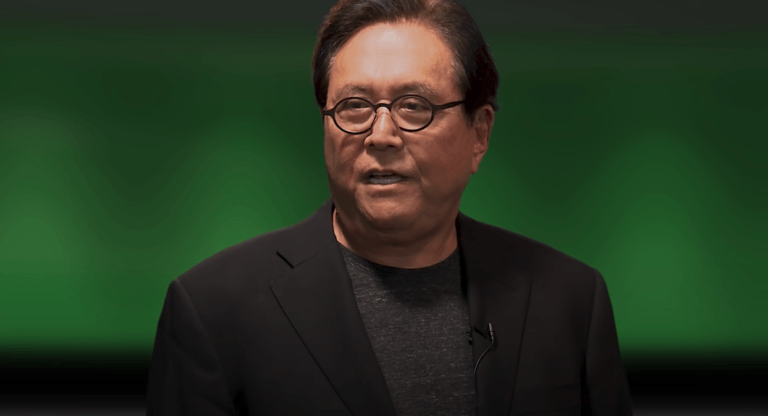

Recently, Robert Kiyosaki, the highly successful author of the “Rich Dad Poor Dad” series of personal finance books, shared his short-term and medium-term price targets for Bitcoin.

“Rich Dad Poor Dad, “which is one of the top 10 personal finance books of all time, “advocates the importance of financial literacy (financial education), financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence (financial IQ) to improve one’s business and financial aptitude.”

At various times during the past three years, Kiyosaki has been criticizing the Federal Reserve’s response to the resulting economic fallout and strongly urging his large following on social media platforms to protect themselves from what he feels is inevitable high inflation (and possibly hyperinflation) in the future by using their fiat holdings to buy silver, gold, and Bitcoin.

Episode #263 of Anthony Pompliano’s “Pomp Podcast,” which was released on 7 April 2021, featured an interview with Kiyosaki.

During that interview, Pompliano asked Kiyosaki’s thoughts on “traditional inflation hedge” assets.

Kiyosaki said:

“Gold and silver are God’s money. Bitcoin is open source people’s money.“

On 30 December 2022, Kiyosaki told his 2.3 million followers that he is bullish on Bitcoin because unlike most other cryptoassets it is a commodity and therefore not impacted by future actions of the U.S. Securities and Exchange Commission (“SEC”):

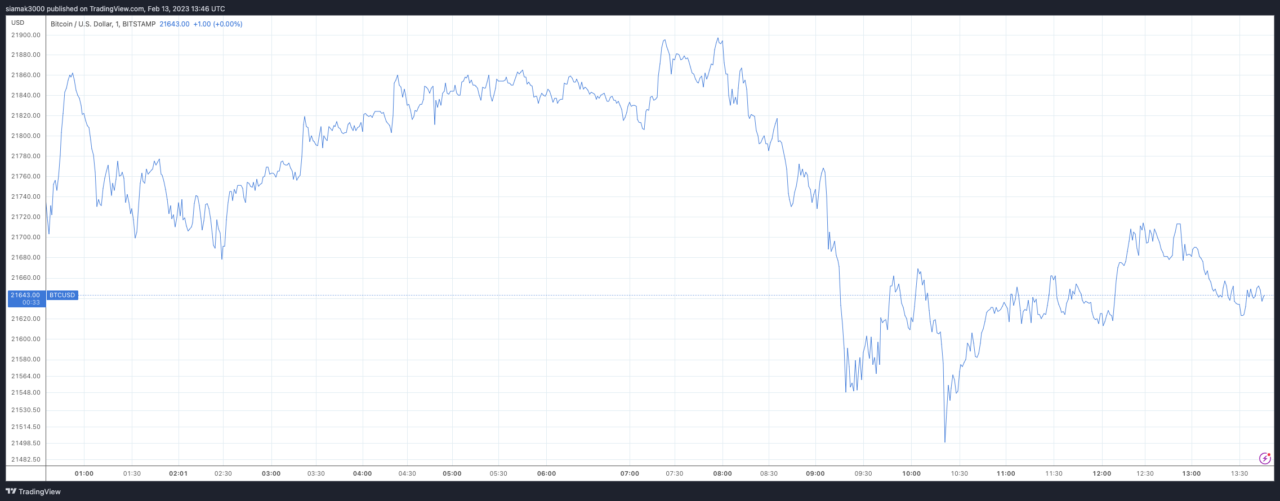

On 10 February 2023, Kiyosaki sent out a tweet that suggested he believes the Bitcoin price will crash in the short term, but he does not appear to be worried because he said that this was good news since it would enable him to use his dollar get his hands on more $BTC.

As for the medium term, he seems highly bullish on Bitcoin since he believes that the Fed will be forced to do so much money printing in the future that the Bitcoin price will reach $500K by 2025.

$500,000 represents a 2,913% price increase from where Bitcoin was trading (i.e. the $21,800 level) at the time of his tweet.