Catherine Wood’s ARK Investment Management, LCC (aka ARK Invest) has revealed that the price of Bitcoin ($BTC) could top $1.4 million per coin in the future, based on their bullish case, as the cryptocurrency’s “long-term opportunity is strengthening.”

In a lengthy report on “Big Ideas 2023,” the investment firm noted Bitcoin’s features remain unaltered, as $BTC is still censorship-, seizure-, and inflation-resistant, auditable and transparent, and keeps growing.

The Bitcoin network, according to the firm’s report, transferred $38.7 trillion of value last year, representing over 30% of its $105.3 trillion that have been cumulatively moved since its inception. Bitcoin’s total addresses are now above 1.1 billion, while miner revenue topped $47 billion cumulatively.

The firm added that Bitcoin’s drawdown from its near $69,000 all-time high was the “fifth largest and second longest in history,” but pointed out the flagship cryptocurrency has “outperformed every major asset class over longer time horizons,” showing BTC’s 5-year Compound Annual Growth Rate (CAGR) was 272%, compared to global equities’ 6.1% and gold’s 2.2%.

Per ARK Invest’s report, Bitcoin’s fundamentals are “stronger today than in past drawdowns,” with its hashrate now being at over 260 exahashes per second, and its supply last moved over one year ago being above 66.5% as the capacity of its layer-2 solution, the Lightning Network, grows past 4,700 $BTC.

The report details that the percentage of Bitcoin trading at a loss reached a new all-time high last year as $BTC holders realized record losses of around $200 billion. Nevertheless, it adds that the “extreme market fear fueled by the collapse of several major entities” failed to stop BTC holders from being long-term focused.

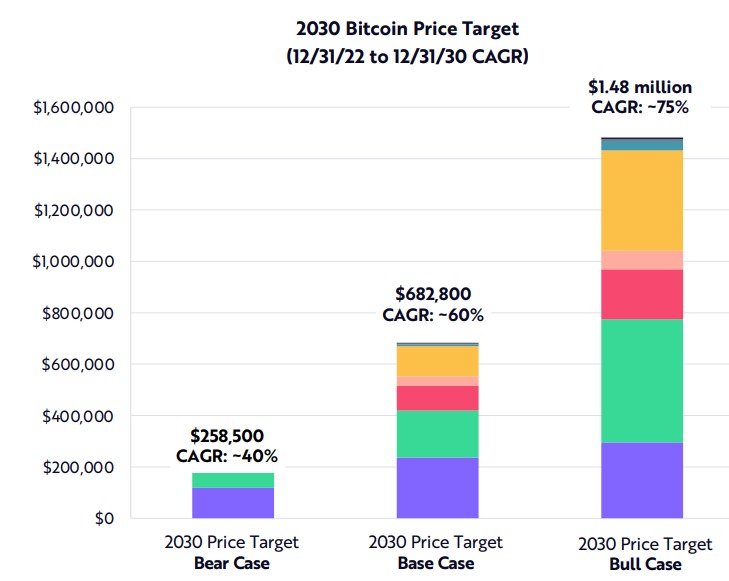

Per the firm, Bitcoin is now “likely to scale into a multi-trillion dollar market.” ARK Invest bases its predictions on $BTC’s penetration rate in several use cases, including as corporate treasury, a remittance asset, nation-state treasury, an emerging market currency, an economic settlement network, a seizure-resistant asset, an institutional investment, and digital gold. In its most bullish case, ARK Invest sees Bitcoin’s price hit $1.48 million by 2030.

Bitcoin is, at the time of writing, trading at around $23,000 per coin after having its best January since 2013, in which it rallied well over 40%, significantly outperforming the stock market and gold.

As CryptoGlobe reported, popular and highly respected on-chain Bitcoin analyst Willy Woo has recently said that the recent rally “coincides with a new pattern emerging of stablecoins flowing into exchanges during work days only. Seems to me like the heat signature of large institutions doing the buying.“

Image Credit

Featured Image via Unsplash