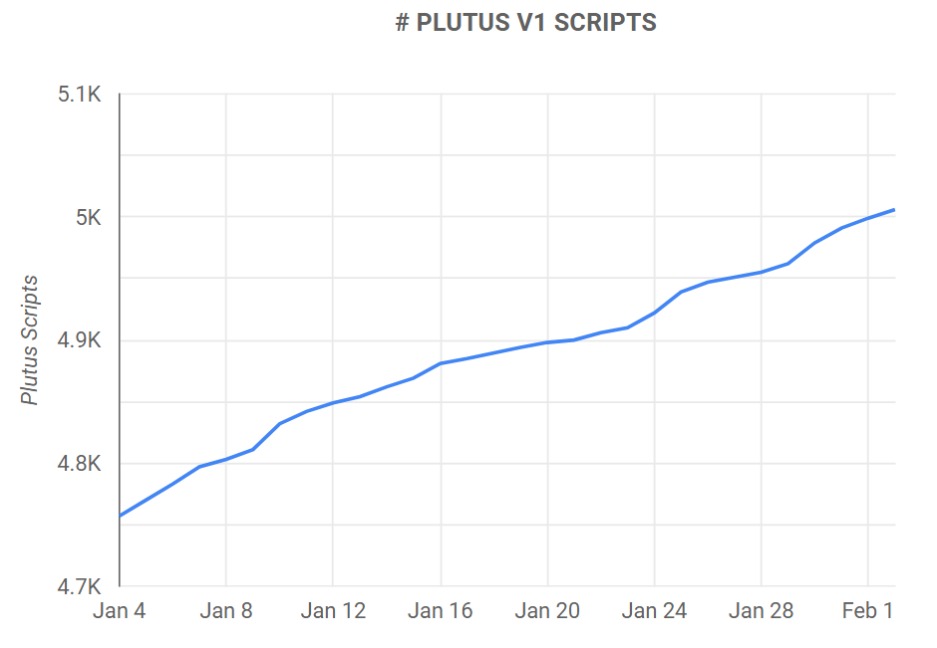

The number of smart contracts deployed on the Cardano ($ADA) network has surpassed the 5,000 mark for the first time as the network keeps growing and the cryptocurrency market recovers.

According to data from Cardano Blockchain Insights, as Finbold reports, there were around 4,000 smart contracts on Cardano in early December, and the number has surged to surpass 5,000 at the time of writing.

Plutus, it’s worth noting, is the “smart contract platform of the Cardano blockchain” that allows users to “write applications that interact with the Cardano blockchain.”

The number of smart contracts on Cardano surpassed 1,000 back in January of this year after the price of ADA exploded last year with the rollout of the widely anticipated Alonzo hard fork, which brought smart contracts into the network, allowing it to compete with other blockchains such as the BNB Chain ($BNB), Ethereum ($ETH), and Solana ($SOL).

As CryptoGlobe reported, Cardano surpassed the 3,000 smart contract mark in August of last year, after adding around 100 smart contracts in a month at the time. The Cardano Foundation has notably recently revealed that in January the network kept on growing, with over 60.2 million transactions recorded, and over 7.66 million native tokens deployed.

As CryptoGlobe reported, the cryptocurrency community has set a bullish price target for smart contract platform Cardano this month, with the average of nearly 1,800 cryptocurrency community members pointing to the smart contract platform’s price trading at $0.45 by the end of February, representing a near 15% rise from $ADA’s current $0.38 level.

The cryptocurrency community seemingly becomes more bearish on the cryptocurrency as time goes on, with estimates for the end of May being at $0.3, representing an upside of over 12% for the smart contract platform.

It’s important to point out that the cryptocurrency community’s predictions may not come to life at all. According to the platform, the community’s historical accuracy is of little over 48%, with recent data showing it was at around 60% in September and October 2022 to hit 6.8% in December. In January it surged to over 80%

Notably, the community’s price target for January represented a 94.6% rise for $ADA, which was then trading at $0.254 and was expected to rise to $0.495.

Image Credit

Featured Image via Pixabay