A key indicator shared by cryptocurrency analytics firm Santiment that has been used to accurately time previous Bitcoin bear market bottoms is currently suggesting that two metaverse-focused altcoins, Decentraland ($MANA) and The Sandbox ($SAND) are “still undervalued.”

In a tweet the firm shared with its over 150,000 subscribers on the microblogging platform, it noted that while ApeCoin ($APE) still has a 1-year MVRV index of 16%, $MANA and $SAND have much lower figures of -60% and -33%, suggesting they are “still undervalued” despite recent prices surges in the cryptocurrency space.

The MVRV ratio compares a crypto asset’s total market capitalization to its realized capitalization to assess whether its price is over or undervalued. A high value suggests potential selling pressure as holders may take profits, while a negative value indicates a lower risk of selling pressure.

The indicator has been used to accurately predict $BTC bear market bottoms. According to analyst Ali Martinez, back in 2015 Bitcoin’s MVRV index, which is calculated by dividing Market Value by Realized Value, drooped to -56.85% to “mark the end of the bear market.” In December 2018, after Bitcoin’s price plunged from a high near $20,000 to little over $3,000, it dropped to -55.62%.

he MVRV index, according to Santiment, increases as more people will be “willing to sell as the potential profits increase” and “gives an idea of how much overvalued or undervalued an asset is.” Per the firm, if the MVRV is at 100%, if all holders sell their coins at current prices they lock in a profit of 100%. On the other end, it indicates how undervalued an asset is, on average.

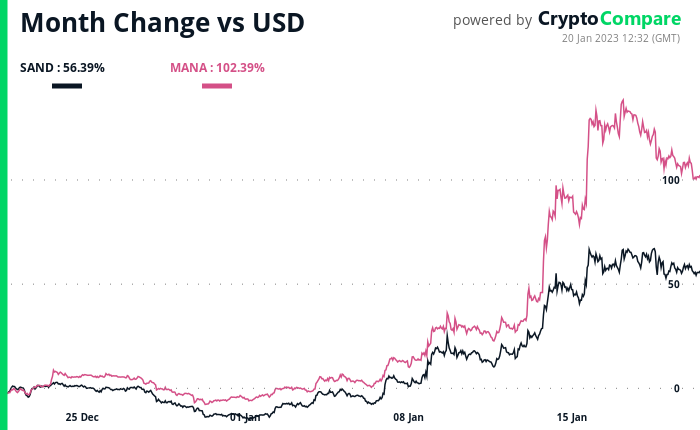

According to CryptoCompare data, the price of $SAND has moved up over 56% over the past 30 days, while the price of $MANA has moved up over 100% over the same period.

These price increases came amid a wider cryptocurrency market recovery that has seen the price of the flagship cryptocurrency surge to hit $21,000, while the total market capitalization of the space is nearing $1 trillion.

Image Credit

Featured image via Unsplash