On Saturday (31 December 2022), Joe Burnett, Head Analyst at Blockware Solutions, explained how recently his firm’s research had concluded that if Bitcoin becomes the dominant store of value the $BTC price could reach nearly $23 million.

Burnet told his over 41K Twitter followers:

Blockware, which is a pioneer in Bitcoin mining, has services that include “hardware procurement, mining rig colocation, and professional mining and staking pool operations.”

In a research report titled “Purchasing Power Under a Bitcoin Standard”, Blockware Intelligence forecasted “the future purchasing power of BTC as it becomes the dominant store of value through the demonetization of other asset classes.”

The report said:

“The nominal value of assets is determined by their utility value plus a monetary/savings premium. Fiat currencies have failed to store wealth across time thus incentivizing humans to use non-cash assets in order to preserve wealth; resulting in some percentage of said asset’s nominal value being a monetary premium. A hyperbitcoinized world will result in BTC absorbing the monetary premium of other asset classes…

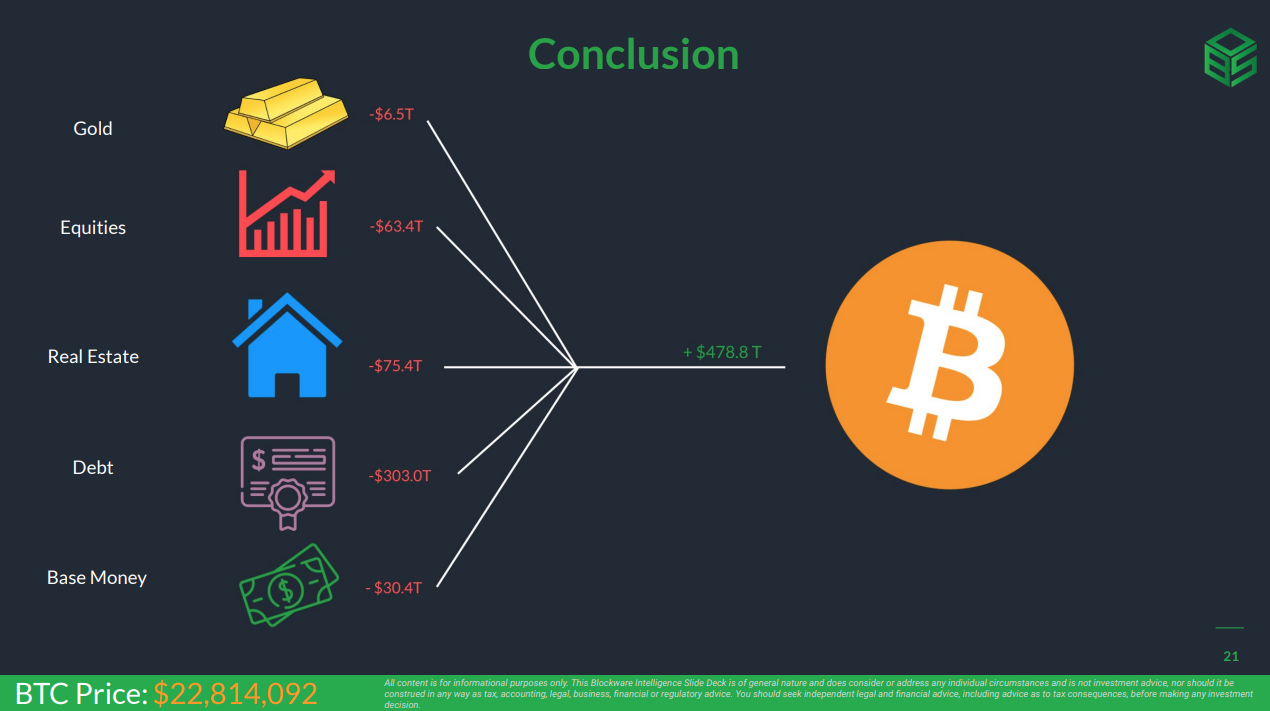

“The market cap of BTC is currently ~0.05% of the total market cap of all financial assets. Gold, Base Money, Equities, Debt, and Real Estate represent the other 99.95%. Should BTC cannibalize the monetary premium of these financial assets it would then represent ~61.38% of the total market cap of financial assets…

“The devaluation of fiat money via monetary expansion results in it poorly servicing the unit of account monetary function as $1 yields a diminishing quantity of real goods over time. Our forecasts are quantified using 2021 US Dollars as the unit of account. However, should the hyperbitcoinization thesis play out, expansion of the fiat monetary base will be a driving factor. As such, the nominal growth of BTC’s market cap, as well as the nominal demonetization of the market caps of other asset classes, will likely be much higher than the real values projected in our forecast...

“After completing the demonetization of other asset classes, the purchasing power of Bitcoin will comprise of roughly 61.4% of the total global market cap of financial assets. 1 BTC will have a purchasing power equivalent to ~$22,814,092, 2021 US Dollars. The last point to note is that the purchasing power of BTC will increase in perpetuity corresponding to productivity increases. As discussed in the equity and real estate sections, technological advancements increase economic productivity over time…

“As such, the real cost of goods and services, which, on a Bitcoin standard, will be measured in BTC, will decrease every year. Holders of BTC will accrue purchasing power without having to invest in risk-on assets. This appreciation in purchasing power will represent the new “risk-free rate” that is the opportunity cost and target return of all investments. Under the fiat standard the “risk-free rate” has been that of government treasuries. Assuming an average annual global GDP growth rate of 2%, the purchasing power of BTC will double every 36 years.“

Image Credit

Featured Image via Pixabay