A recent survey by CoinShares, which claims to be “Europe’s largest digital asset investment and trading group,” sought to gain insight into the thoughts and actions of professional investors in the digital asset space.

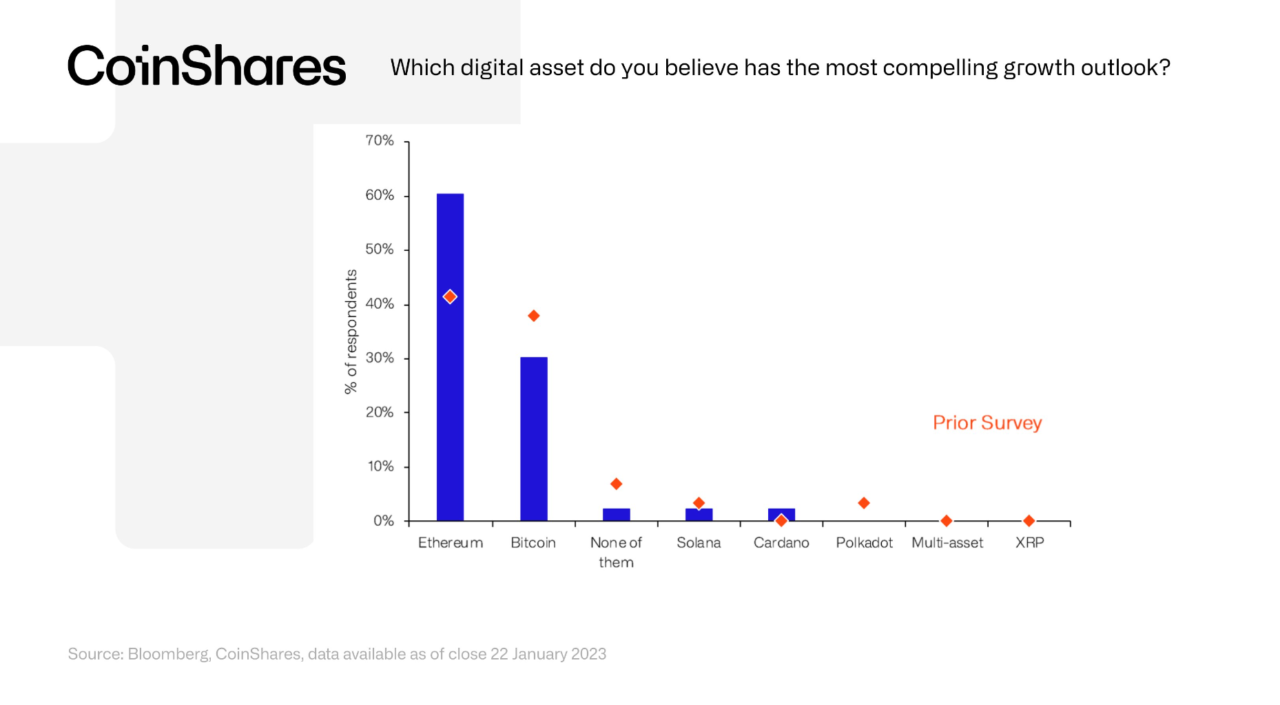

According to the results of CoinShares’ latest Digital Asset Quarterly Fund Manager Survey, 60% of the 43 fund managers surveyed, who have a combined $390 billion in assets under management, believe that Ethereum has the most promising growth prospects in 2023.

The survey also found that investment in Bitcoin and Ethereum has been consolidated and that digital assets are increasingly being included in hedge fund portfolios, rising from 0.7% to 1.1%. The tendency to include digital assets in investment portfolios has been driven by client demand and speculation. Interestingly, some investors view recent market events as opportunities.

When asked about reasons for not investing in digital assets, the survey revealed a decline in the perceived risk of reputational damage, while regulation remains a concern. The likelihood of government bans has decreased, but risks related to custody and volatility have risen.

On Thursday (26 January 2023), crypto analyst Jack Niewold, who is Founder of Crypto Pragmatist, shared his thoughts on Ethereum’s upcoming Shanghai hard fork, which will enable staking withdrawals.

In a series of tweets, Niewold wrote:

“Ethereum’s proof-of-stake chain is called the Beacon Chain, and while it has accepted deposits and paid out yields for years, stakers have never been able to withdraw their ETH. In March this changes, and it will have huge impact on Ethereum.

“The Shanghai/Capella fork will likely go live next month, and one of the things it does is enable withdrawals from the Beacon Chain. That staked ETH that’s been collecting interest will finally be available.

“About 14% of total ETH supply is staked, and it can be unstaked after the Shanghai fork. This makes some people bearish. But that ETH doesn’t come onto the market immediately: it still has to go through a withdrawal queue. It takes time to unstake.“

He went on to discuss how Liquid Staking Derivatives (LSDs), such as Lido, Rocket Pool, and Stakewise, which “allow people to stake their tokens without locking them up,” would be impacted by the Shanghai hard fork.

Image Credit

Featured Image via Pixabay