On Thursday (19 January 2023), Arthur Hayes, Co-Founder and former CEO of BitMEX, shared his thoughts on the crypto market.

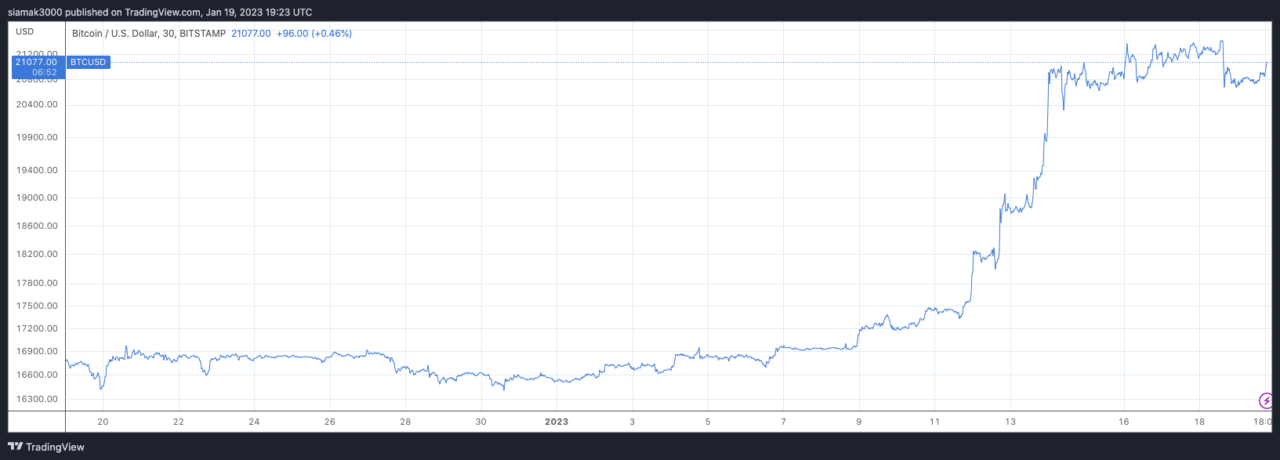

According to data from TradingView, in the past 10 days, the Bitcoin price has gone from around $17,115 to $21,077, which is a gain of 23.15% vs USD.

In a blog post published earlier today, the former BitMEX CEO said that it is evident that Bitcoin is experiencing an upward surge from a relatively low point and that this prompts the consideration of various possible explanations for this rally.

Scenario 1: This rally is simply a natural rebound from the recent local lows of sub $16K, and Bitcoin will subsequently stabilize at a new plateau until the conditions for USD liquidity improve.

Scenario 2: The market is anticipating a resurgence in Fed-induced money printing, which could manifest in two distinct scenarios:

- Scenario 2A: If the Fed does not proceed with this course of action, or if multiple Fed governors negate any expectations of such a pivot, it is likely that Bitcoin will experience a significant decline toward previous lows.

- Scenario 2B: If the Fed does follow through with this pivot, it is probable that Bitcoin will continue to perform strongly and that this rally will signify the onset of a prolonged period of bullish market conditions.

Hayes believes that “we are actually going to be facing some combination of Scenarios 1 and 2A ,” which is causing him to be uncertain about buying more Bitcoin.

On 9 December 2022, Hayes explained how he is “earning a yield” while waiting for “the crypto bull market to return.”

In his blog post, Hayes shared his medium-term outlook for crypto prices:

“I don’t know if $15,900 was this cycle’s bottom. But, I do have confidence that it was due to the cessation of forced selling brought on by a credit contraction. I don’t know when or if the US Federal Reserve will start printing money again. However, I believe the US Treasury market will become dysfunctional at some point in 2023 due to the Fed’s tightening monetary policies. At that point, I expect the Fed will turn the printer bank on, and then boom shaka-laka — Bitcoin and all other risk assets will spike higher.“

Although Hayes could get nearly 5% by investing in “US Treasury bills with durations shorter than 12 months”, he wants to earn a much higher yield than that while he waits for “the crypto bull market to return” (which he is sure will happen since “everything is cyclical”).

Image Credit

Featured Image via Pixabay