On Friday (13 January 2023), Robin Vince, President and CEO of BNY Mellon, the world’s largest custodian bank and securities services company, shared his thoughts on crypto.

According to the transcript provided by Seeking Alpha, during the Prepared Remarks section of his company’s Q4 2022 earnings call, the BNY Mellon CEO said:

“In Asset Servicing, we’ve been growing sales. And at the same time, we’re leaning into the future with things like digital assets and we’re focusing on the expense base as well. So again, it’s something for the near term and for the medium term.“

And then during the Q&A section, Vince said:

“But specifically for digital assets, it’s the longest term play out of any of the things that we’ve talked about. I expect it to be negligible from a revenue point of view over the course of the next couple of years, it might be negligible for the next five years. But as the world’s largest custodian, we are in the business of looking after stuff. We look after $44 trillion worth of stuff.

“And if there’s going to be new stuff to look after, we should be in the business of looking after it. If the way in which we look after stuff, which is the point about the technology changes, we have to adapt to that. And so we’re investing for a future that probably will come to be, but it may not. But if it does come to be, we have to be there.

“It would be like being the custodian of 50 years ago and sticking with paper and not adopting a computer, that’s not going to be us. So we’re investing, we’re being cautious, we’re being deliberate and we’ve got R&D in different parts of the company and it’s measured. But we do think it’s important for us to participate in the broader digital asset space.“

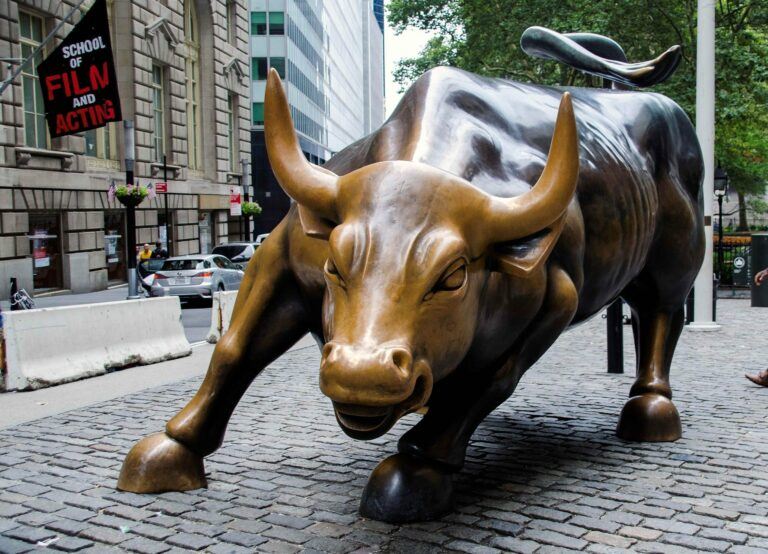

Image Credit

Featured Image via Pixabay