Even though the price of shares of business intelligence software company MicroStrategy Inc. (Nasdaq: MSTR) has fallen over 76% from its 52-week high, gold bug Peter Schiff does not consider this stock to be a bargain.

It is worth remembering that on 11 August 2020, MicroStrategy announced via a press release that it had “purchased 21,454 bitcoins at an aggregate purchase price of $250 million” to use as a “primary treasury reserve asset.”

Saylor said at the time:

“Our decision to invest in Bitcoin at this time was driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for our corporate treasury program ― risks that should be addressed proactively.“

Since then MicroStrategy has continued to accumulate Bitcoin and its former CEO has become one of Bitcoin’s most vocal advocates. The firm is now HODLing around 132,500 bitcoins, which were “acquired for ~$4.03billion at an average price of ~$30,397 per bitcoin.”

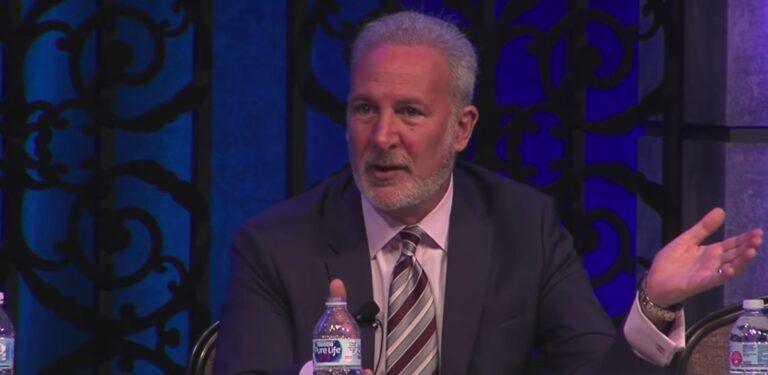

Bitcoin perma-bear Peter Schiff, who is one of Bitcoin’s harshest critics, is the CEO of Euro Pacific Capital, a full-service, registered broker/dealer specializing in foreign markets and securities. He is also Founder and Chairman of SchiffGold, a full-service, discount precious metals dealer.

On 29 December 2022, Schiff told his over 898K Twitter followers:

“Shares of #MicroStrategy just made a new 52-week low, down 90% from the record-high in Feb. 2021. Shareholders will pay dearly for @saylor‘s #Bitcoin obsession. Don’t make the mistake of thinking 90% off is a good buy. This isn’t just a sale, it’s a going-out-of-business sale.“

He went on to add:

“I’ll give @saylor credit for one thing. Adding #Bitcoin to the balance sheet was great for those #MicroStrategy shareholders who sold their stock into the sucker’s rally that followed. But its been a disaster for those suckers who bought $MSTR shares to gain exposure to Bitcoin.“