Wall Street giant Goldman Sachs has revealed it expects gold to outperform the flagship cryptocurrency Bitcoin ($BTC) over the long-term over its demand drivers, while expecting the cryptocurrency to be more influenced by tighter financial conditions.

In a research note, the bank wrote that gold is a “useful portfolio diversifier” as it has developed non-speculative use cases, while $BTC is, in their view, still looking for one. Goldman’s analysts, according to Reuters, showed that while traders use gold to hedge against inflation and dollar debasement, BTC resembles a “risk-on high-growth tech company stock.”

According to the bank, the cryptocurrency is a “solution looking for a problem,” whose value proposition comes from its future real use cases. For now it’s more volatile and speculative than the precious metal.

The bank forecast that as financial conditions become tighter, investors’ willingness to explore decentralized digital currencies may erode. Referring to hedge fund Three Arrows Capital, lenders BlockFi and Celsius, and FTX, the bank wrote:

Bitcoin’s volatility to the downside was also enhanced by systemic concerns as several large players filed for bankruptcy

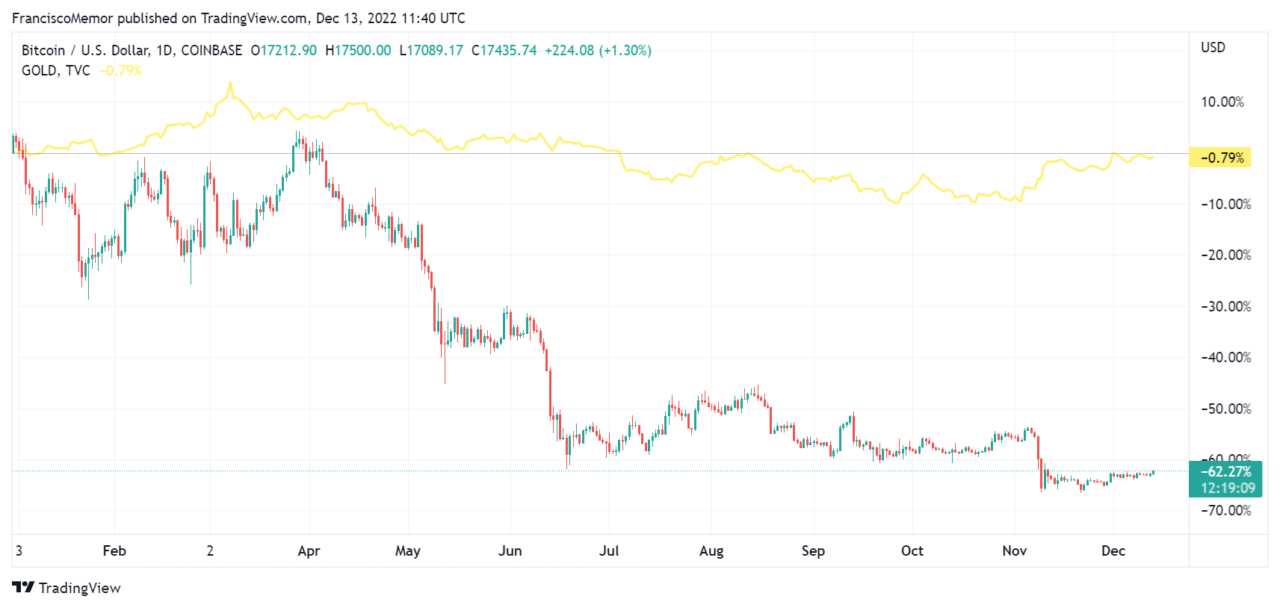

According to Goldman Sachs, the net speculative positions in both gold and bitcoin have fallen significantly over the last year. However, gold has slightly increased in value year-on-year, while bitcoin has fallen by 75%. Tighter liquidity, the bank wrote, should be a “smaller drag on gold, which is more exposed to real demand drivers.” These include Asian consumer buying, central ban monetary demand, and industrial applications.

As CryptoGlobe reported, some investors are still bullish on BTC. Earlier this month billionaire investor Tim Draper, the founder of Draper Associates and one of Silicon Valle’s best-known investors, doubled down on his $250,000 Bitcoin price prediction, saying the cryptocurrency will hit that mark by June of next year.

Draper isn’t the only billionaire bullish on crypto. Billionaire investor Mike Novogratz has revealed that he still believes BTC will trade at $500,000 per coin in the future, but delayed his prediction over the Federal Reserve and other central banks raising interest rates to rein in inflation.

Novogratz said that he believes $BTC will trade at $500,000 but “not in five years,” as per his words Federal Reserve chairman Jerome Powell found “his central banking superpowers.”

Image Credit

Featured Image via Unsplash