On Tuesday (29 November 2022), crypto analytics startup Santiment, which provides tools that make “powerful OnChain, Social & Financial analysis accessible to anyone”, commented on Ethereum’s recent price action.

Santiment based its prediction on the fact that on 28 November 2022 “Ethereum’s active addresses surged to its highest level in over 6 weeks.”

Then, yesterday (30 November 2022), Santiment said that “Ethereum’s large key addresses have been growing in number since the FTX debacle in early November,” and that “the number of 100 to 100k $ETH addresses is at a 20-month high.”

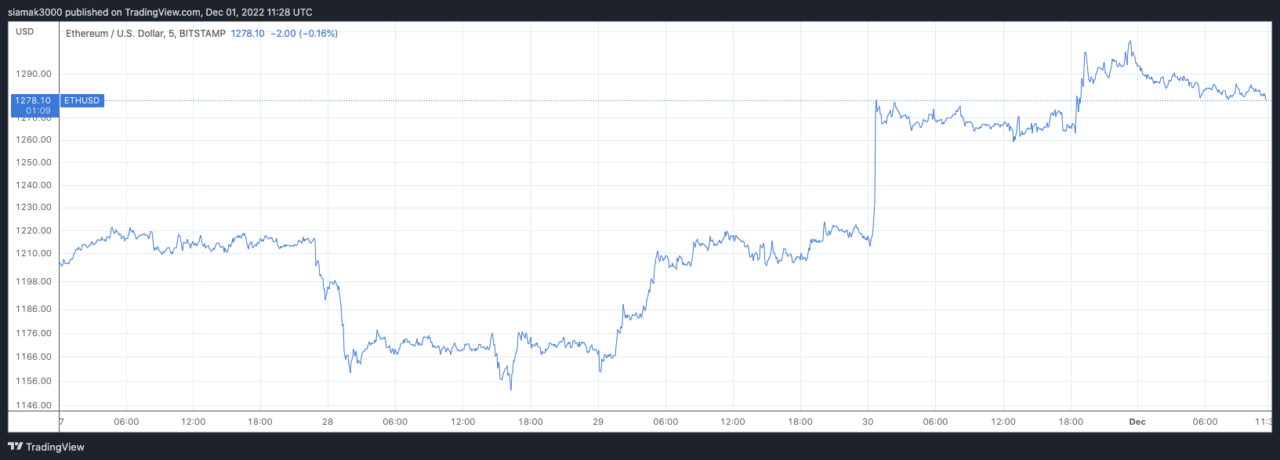

According to data by TradingView, $ETH is currently (as of 11:28 a.m. UTC on 1 December 2022), trading around $1,278, up around 1% in the past 24-hour period.

On 27 November 2022, crypto analyst Benjamin Cowen shared his thoughts on Bitcoin’s and Ethereum’s price action.

Cowen’s comments were made during an interview on “Altcoin Daily” that was released yesterday.

According to a report by The Daily Hodl, with regard to Ethereum, he said:

“The worst case scenario would be dependent on how bad this potential recession ends up being. It’s hard to know exactly how that’s going to affect crypto, but I would say for Ethereum, the main levels I’m watching are the $400-$600 range… I don’t know if it’s going to go all the way down to $400, but I do think a $600 ETH is potentially in the cards mainly because I think there’s a lot of evidence to suggest that it’s about one cycle behind Bitcoin in terms of volatility.

“[ETH’s] first cycle [was] a solid 95% bear market and Bitcoin’s first bear market was 94%. Bitcoin’s second bear market was around 87% so if Ethereum goes down 87% from its all-time high this time, or even 88%, that’s gonna put it at just below $600, so I think there’s a case to be made that Ethereum could have this final capitulation down into the $400-$600 range.“

On 13 November 2022, crypto analyst Benjamin Cowen said this about $ETH’s price actions:

“We’ve talked about this throughout this year and the general expectation is that Ethereum goes through a series of bull runs, but It ultimately just heads home at the end of the day and that’s back to its logarithmic regression band fit to “non-bubble data” and we’re sort of seeing that same trend take place for the fifth time…

“If you remember back to 2018, the drawdown that Ethereum had was about 95% or so. I’m not saying Ethereum is going to go down 95%, but even if it went down, say 87%, which is what Bitcoin went down after its 95% bear market, that would still put Ethereum at $600…

“It takes a long time, I mean it’s taking a really long time for us to get there, but I do think we will get there eventually and it will take us going to those levels in the regression band, in my opinion, before we can actually support another bull run and support a sustained move in the market… Eventually, once we get down to levels that are really deep value, it might be time to sort of flip back to the bullish side…“

Image Credit

Featured Image via Pixabay