A report published by leading digital asset data provider CryptoCompare has revealed that smart contract platform Cardano ($ADA) has seen the number of daily active users jump 15.6% in November after the collapse of the popular cryptocurrency exchange FTX.

In its latest Asset Report, CryptoCompare revealed that following the collapse of FTX there was a rising trend in users moving their assets off of centralized cryptocurrency platforms and moving them to decentralized solutions and self-custody.

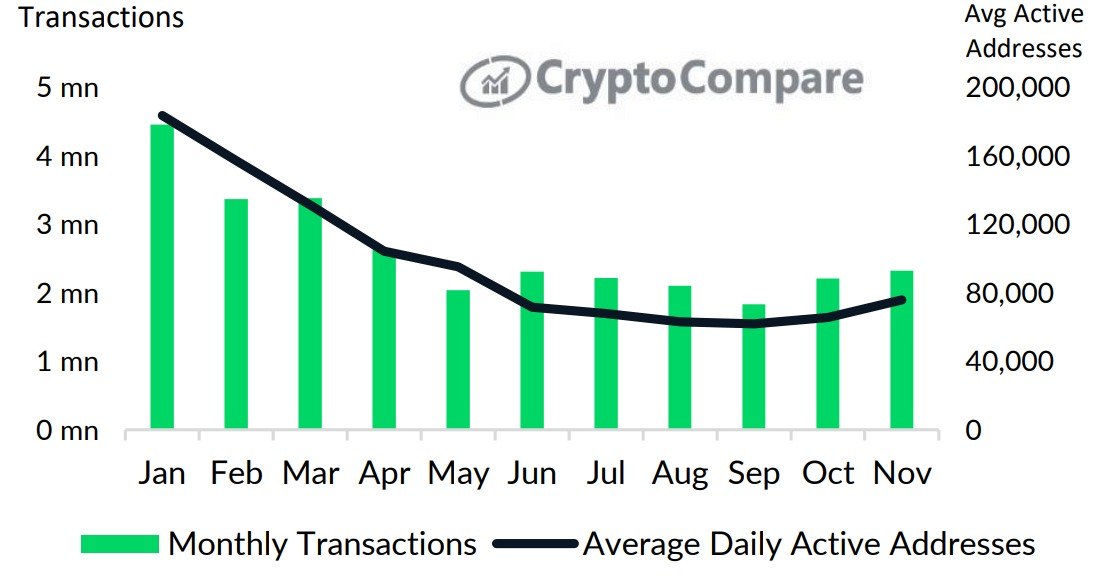

The move, CryptoCompare wrote, led to a spike in average daily active users on the smart contract platform. In total, Cardano’s daily active users rose 15.6% to 75,800 last month, the highest number recorded since May.

Similarly, monthly transactions on the Cardano network also rose 5.34% to 2.32 million last month, marking the largest transaction volume since April. As CryptoGlobe reported, data from the cryptocurrency’s network shows that the number of wallets on it has grown by over 100,000 last month.

The collapse of FTX accelerated the growth of Cardano’s on-chain metrics after the exchange endured a bank run. The bank run saw FTX halt withdrawals and, later on, filed for Chapter 11 bankruptcy protection.

After FTX’s bankruptcy filings, contagion hit the cryptocurrency space, and confidence in centralized platforms was severely affected. Cryptocurrency lender BlockFi, which had relied on FTX after facing liquidity issues earlier this year, has also filed for bankruptcy as a result of FTX’s collapse.

CryptoCompare’s report also details that November 28 marked the first anniversary of DeFi on the Cardano blockchain. MuesliSwap launched on the network in late 2021 and reached $1 million in total value locked soon after.

Total value locked on the Cardano network fell 16.6% last month to $58 million, the lowest value recorded in the year. MinSwap, a multipool decentralized exchange, dominates Cardano’s DeFi space with a 48.7% market share.

Cardano enthusiasts, the report adds, are hoping the launch of multiple developments, including sidechains, Cardano’s Ethereum Virtual Machine, and its privacy-focused sidechain Midnight will bring more utility to the network’s DeFi ecosystem.

As CryptoGlobe reported, an artificial intelligence-based price prediction model is suggesting that the price of Cardano’s native token $ADA is going to surge to trade at $0.42 by the end of this year, representing a 35% increase from the cryptocurrency’s current price.

Image Credit

Featured Image via Unsplash