Despite initial market euphoria over the announcements from the CEOs of FTX and Binance, now that the market has had time a little time to digest the news, it seems that crypto traders and investors are thinking that the crypto market’s troubles may be far from over.

Earlier today, Binance CEO Changpeng Zhao (aka “CZ”) and Samuel Bankman-Fried (aka “SBF”) shook the crypto market with a pair of stunning announcements:

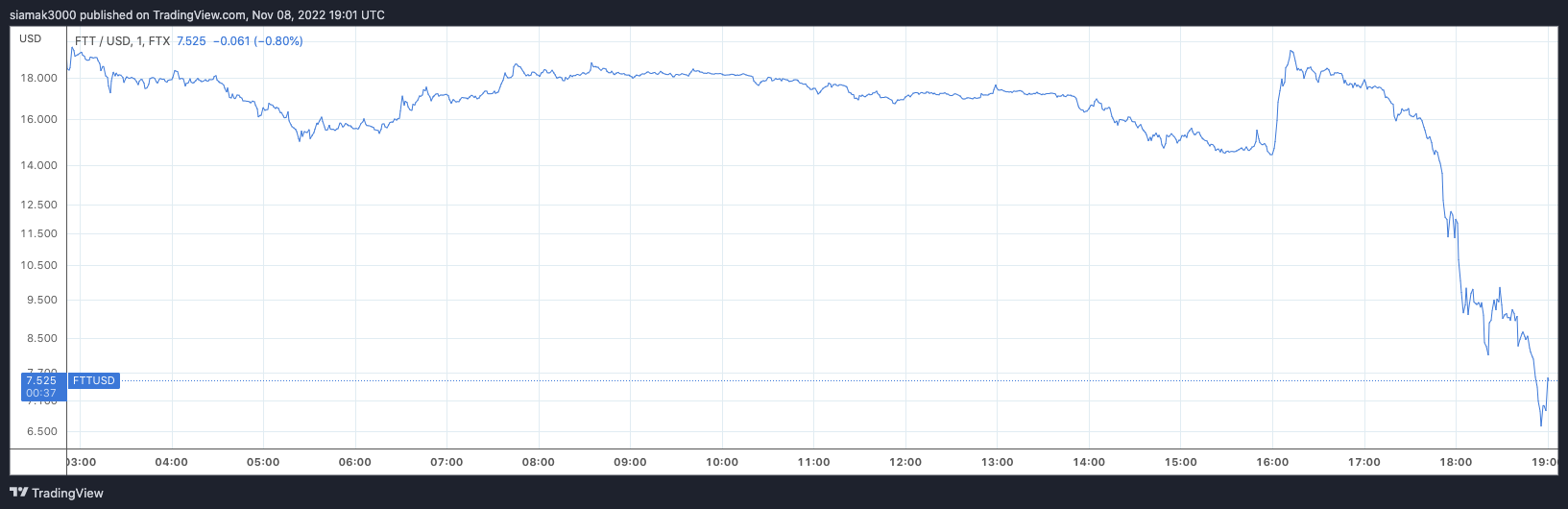

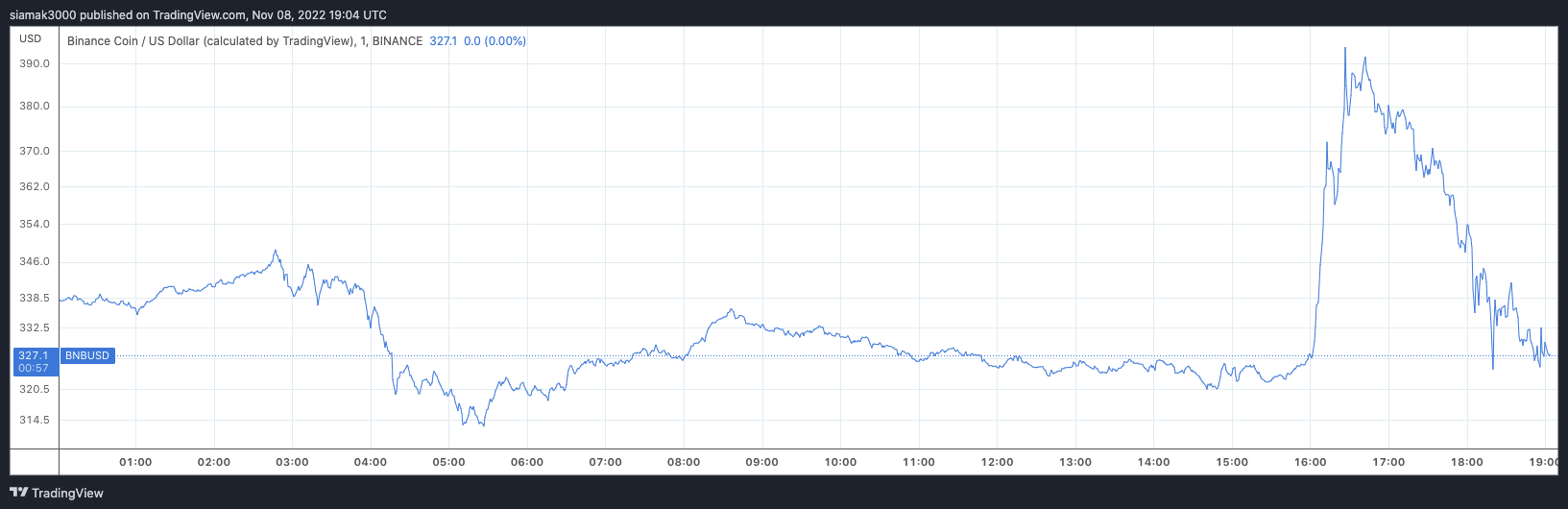

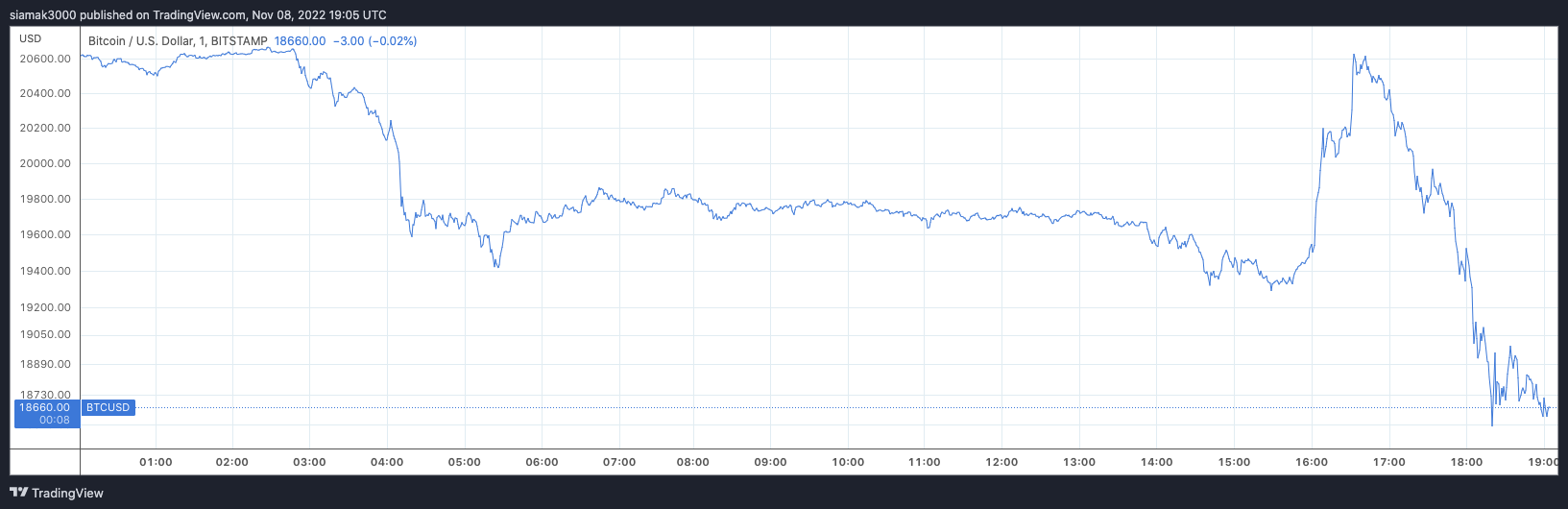

This pair of announcements from the two most influential figures in the crypto space had an immediate positive effect on the price of $FTT, $BNB, and most other non-stablecoin cryptocurrencies with the possible exception of $SOL. For example, within 30 minutes, $FTT jumped from $14.43 to $19.50, $BNB went from $327.20 to $379.40, and $BTC surged from $19,539 to $20,629.

However, currently (as of 7:10 p.m. UTC on 8 November 2022), $FTT, $BNB, and $BTC are trading around $6.24 (-68.76), $322.05 (-4.48%), and $18,570 (-10.26%).

So, why does the market look so worried right now?

Well, there are probably two main reasons.

First, as CZ explained in the Twitter thread mentioned above, Binance signed “a non-binding LOI” and they are going to be doing “full” due diligence checks “in the coming days”. If Binance discovers that FTX is in a bigger mess than they originally thought, it has the right to not go ahead with the deal, and under that scenario, it is not clear if there is another crypto exchange that would be willing to take over FTX.

Second, there is no mention of Alameda Research in the above-mentioned tweets by SBF and CZ, and so it does not appear that Binance or anyone else is coming to their rescue. And if Alameda Research becomes insolvent, then all of their counter-parties could potentially get into serious trouble.

As for $FTT, if FTX does end up being owned by Binance, what utility and value will it have? Does it have any floor price at the moment given all the uncertainty?

Here are some post-announcement reactions from the crypto community: