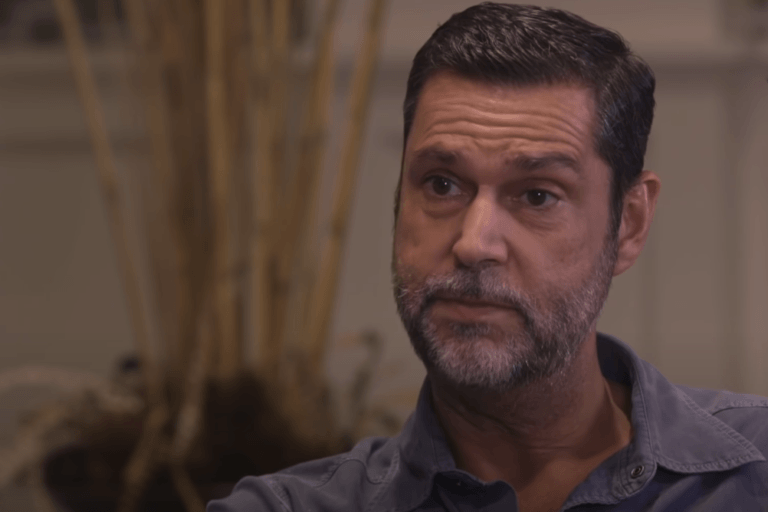

Recently, former Goldman Sachs executive Raoul Pal explained why he is bullish on the NFT sector.

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

In the April 2020 issue of the GMI newsletter, Pal explained why he believes that Bitcoin, which he called “the future”, could one day have a $10 trillion valuation. In that issue, Pal said that the idea of a $10 trillion valuation for Bitcoin is not so crazy:

“After all, it isn’t just a currency or even a store of value. It is an entire trusted, verified, secure financial and accounting system of digital value that can never be created outside of the cryptographic algorithm… It is nothing short of the future of our entire medium of exchange system, and of money itself and the platform on which it operates.“

Yesterday (5 November 2022), Pal took to Twitter to talk about the huge potential of NFTs, where he said:

“Right now, people think of NFT as art or community. Both are amazing use cases for NFT’s. We will see all cultural assets digitised and tokenised… While the tokenisation of culture is almost infinite and has only just started, most people miss the even bigger picture… ALL contracts will get tokenised as NFT’s as they more efficient, cheaper, faster and more secure…

“ALL: ID, tickets, reservations (hotels, airlines, trains, restaurants etc), all insurance contracts, internet permissions, hotel keys, car documents, real estate, certifications… …advertising, supply chain contracts, inventory management, business deals, driving licenses, medical records, employment history, references, etc etc… but it gets even bigger…

“The entire financial industry is based around contracts at a truly VAST scale – too big for the old City of London “My Word is My Bond” system to work and a two party, audited ledger/database… There are somewhere between $650trn and $4 QUADRILLION of derivatives, $250trn of equities, same in bonds, etc. These are all non-fungible contracts of sorts (some are large and some are 1 of 1’s like a special OTC option)…

“All asset management and funds will be tokenised too. It is much faster, accessible, transparent and more efficient… AND the ‘smart’ element of NFT’s mean that enforcement or dispute resolution is automatic, cheaper and faster, as is ‘storage or ownership’…

“No one can get their heads around this. Everyones anchors of a linear path of what is happening today but miss the BIG picture, which is truly exponential in nature. Some of it will happen fast and some over time. It also has other benefits… It frees up velocity of money through less trapped capital, settlement, dispute, enforcement, etc. It makes the system infinitely less capital intensive. It is also transparent. And it can create liquid(ish) secondary markets of all of it…creating capital efficiency…

“And you thought it was just about the BIG concept of ownership of digital assets in a digital age… My frens… you are missing the REALLY BIG picture. EVERYTHING will be tokenised. NFT’s, fungible tokens and blockchains (and who knows what else is to come) will run it all.“

On 29 September 2022, Pal explained why he expects the total crypto market cap to reach around $300 trillion in the next 10-15 yers. His comments about the crypto space were made as part of an interview he did for an episode of YouTube series “Google TechTalks”.

According to a report by The Daily Hodl, Pal told the show’s host Raphael Hyde:

“All the big Web2 players are involved. Everybody in the financial system is involved – everybody. You just don’t see it really, because they’re cautiously moving forward because of regulatory issues. But everybody knows that this is where it’s all going. I’ve never seen anything like it, personally. It’s kind of a little bit like the internet, but it’s just faster-paced and actually larger in scope, which sounds crazy, but it is because it accrues value itself to these protocol layers.

“So there’s this massive value accretion that comes. If I compare where we are now, call it a trillion dollars of asset valuation in digital assets. Well, almost all the traditional asset markets are $200 trillion to $300 trillion each. We’re going to get there in probably 10 to 15 years.“

On 3 July 2022, Pal talked about why he is so excited about the new Web3-focused business (ScienceMagic.Studios) he has recently co-founded.

ScienceMagic.Studios describes itself as “a digital asset venture studio” that advises and implements “the creation of digital assets (e.g., NFTs and social tokens) and web3 economies for brands, talent and their communities.”

Its three founders are David Pemsell, the former CEO of Guardian Media Group; Kevin Kelly, who is “a co-founder of Delphi Digital, the leading research & consulting firm dedicated to web3 and digital assets, and a partner at Delphi Ventures, the firm’s investment arm”; and Raoul Pal.

As The Block reported on 14 June 2022, the firm “raised $10 million in pre-seed funding” from an impressive set of backers that included Coinbase Ventures, Digital Currency Group, and Liberty City Ventures.

On 3 July 2022, the Real Vision CEO took to Twitter to explain what his new firm is trying to do:

He went on to say:

- “Our mission is to tokenize the worlds largest cultural communities – music, fashion, movies/book/TV franchises and sports – utilizing NFT’s, social tokens and metaverse to build community, utility and experience.“

- “There are $63trn of intangibles on global balance sheets of corporations. Tokenization turns brand and community into tangibles and shares the utility and network with the community. It is potentially the biggest change in business models in a very very long time.“

- “We’ve been alluding to this for a long time! It is one of the biggest opportunities in Web 3, helping big brands move into Web 3 in the right way – creatively but cautiously and meticulously. We are already in talks with some monumental people/brands. Really, really exciting!“