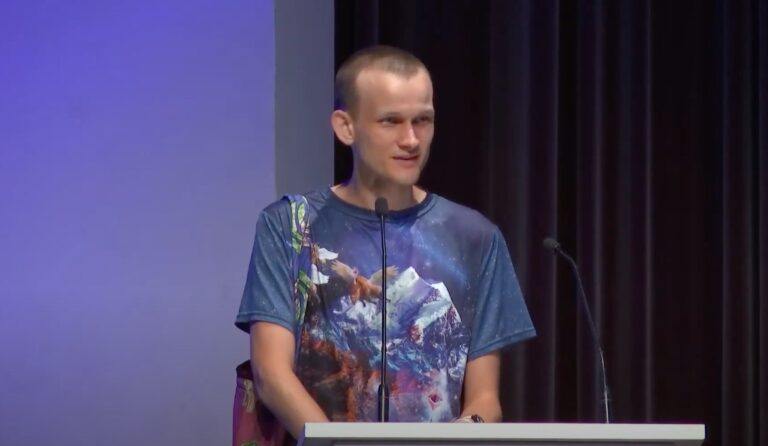

On Friday (11 November 2022), Ethereum Co-Founder Vitalik Buterin shared his thoughts on this week’s collapse of crypto exchange FTX.

As you probably now, Samuel Bankman-Fried (aka “SBF”), the Co-Founder and CEO of troubled crypto exchange FTX, took to Twitter on Thursday (10 November 2022) to talk about how he had “f*ucked up” at FTX International:

He went on to say:

“FTX International currently has a total market value of assets/collateral higher than client deposits (moves with prices!). But that’s different from liquidity for delivery–as you can tell from the state of withdrawals. The liquidity varies widely, from very to very little… The full story here is one I’m still fleshing out every detail of, but as a very high level, I fucked up twice. The first time, a poor internal labeling of bank-related accounts meant that I was substantially off on my sense of users’ margin. I thought it was way lower…

“My sense before: Leverage: 0x USD liquidity ready to deliver: 24x average daily withdrawals Actual: Leverage: 1.7x Liquidity: 0.8x Sunday’s withdrawals Because, of course, when it rains, it pours. We saw roughly $5b of withdrawals on Sunday–the largest by a huge margin…

“And so I was off twice. Which tells me a lot of things, both specifically and generally, that I was shit at. And a third time, in not communicating enough. I should have said more. I’m sorry–I was slammed with things to do and didn’t give updates to you all… And so we are where we are. Which sucks, and that’s on me. I’m sorry…“

FTX issued the following press release on Friday (11 November 2022):

And here is how SBF announced the collapse of the FTX empire:

Crypto exchange Bybit has created a nice summary of the history of the FTX empire from its rise in November 2017 (the founding of Alameda Research) to its fall in November 2022 (FTX Group companies commencing Chapter 11 Proceedings in the U.S.):

Anyway, here is how Vitalik compared the collapse of Mt. Gox with that of FTX:

On 30 October 2022, Vitalik explained on Twitter why he is “actually kinda happy” that so many crypto ETFs have been delayed in the U.S. (due to the lack of interested by the U.S. SEC to approve any such proposals):

“Should I publicly blab my opinions about crypto regulation more? Feels unfair to let other people get attacked by CT but never actually poke my own head out… I don’t think we should be enthusiastically pursuing large institutional capital at full speed. I’m actually kinda happy a lot of the ETFs are getting delayed. The ecosystem needs time to mature before we get even more attention…

“Basically, especially at this time, regulation that leaves the crypto space free to act internally but makes it harder for crypto projects to reach the mainstream is much less bad than regulation that intrudes on how crypto works internally… The ‘KYC on defi frontends’ idea does not seem very pointful to me: it would annoy users but do nothing against hackers. Hackers write custom code to interact with contracts already. Exchanges are clearly a much more sensible place to do the KYC, and that’s happening already…

“Basically, there’s two main classes of regulatory policy goals: (i) consumer protection, (ii) making it harder for baddies to move large amounts of money around. The issues around (ii) are concentrated not in defi, but in large-scale crypto payments in general… Regs on defi frontends that could be more helpful may include: (i) limits on leverage (ii) requiring transparency about what audits, FV or other security checks were done on contract code (iii) usage gated by knowledge-based tests instead of plutocratic net-worth minimum rules…

“Also, I would love to see rules written in such a way that requirements can be satisfied by zero knowledge proofs as much as possible. ZKPs offer lots of new opportunities to satisfy reg policy goals and preserve privacy at the same time, and we should take advantage of this!“