On Saturday (26 November 2022), prominent Bitcoin developer, educator and entrepreneur Jimmy Song expressed how he feels about Ethereum 2.0’s Proof-of-Stake (PoS) consensus mechanism.

Around 7:00 a.m. UTC on September 15, Ethereum’s Merge upgrade was completed, which meant that the Ethereum network moved to PoS consensus from the much more energy-hungry Proof-of-Work (PoW) consensus.

Ethereum co-creator Vitalik Buterin called this successful upgrade “a big moment for the Ethereum ecosystem”:

Two problems with staking in Ethereum 2.0 are that your stake is locked (unlike in some other PoS networks, such as Cardano) and that currently withdrawals are not allowed.

On the day the Merge was completed, one Cardano fan pointed out that Kraken has recently told its users that $ETH unstaking will not be available until Ethereum has its Shanghai protocol upgrade (which was expected to take place in 2023). Cardano and Ethereum co-founder Charles Hoskinson then sent out a tweet that mocked Ethereum’s PoS model by subtly noting that Cardano’s PoS design and implementation does not suffer from this problem:

Then, on16 September 2022, after $ADA stake pool operator pointed out that no date has been announced for Ethereum’s Shanghai upgrade, the IOG CEO compared the situation that $ETH stakers find themselves in to being stuck in “Hotel California”.

As you may know, “Hotel California” is “the title track from the Eagles’ album of the same name and was released as a single in February 1977.” This is the last part of the song:

“Last thing I remember, I was

Running for the door

I had to find the passage back

To the place I was before

‘Relax, ‘ said the night man

‘We are programmed to receive

You can check out any time you like

But you can never leave’“

Before the Merge, here is what an FAQ on Ethereum Foundation’s website was saying about withdrawals:

“Staked ETH, staking rewards to date, and newly issued ETH immediately after The Merge will still be locked on the Beacon Chain without the ability to withdraw.

“Withdrawals are planned for the Shanghai upgrade, the next major upgrade following The Merge. This means that newly issued ETH, though accumulating on the Beacon Chain, will remain locked and illiquid for at least 6-12 months following The Merge.“

This means that the Shanghai upgrade was estimated to take place sometime in 2023. However, after the Merge was completed, Ethereum Foundation decided it was better not to make any promises about the expected date of the Shanghai upgrade:

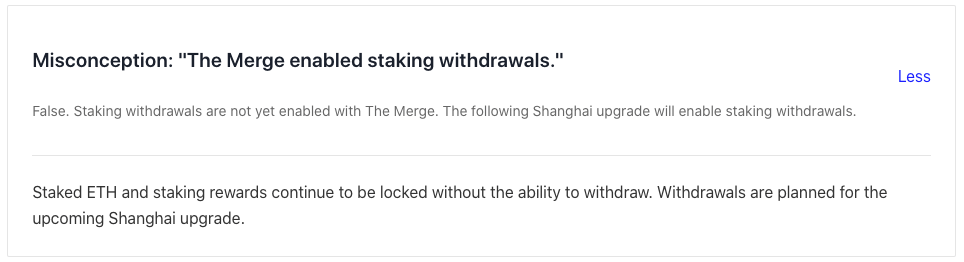

As of 26 November 2022, here is what the withdrawals section of the FAQ on the Ethereum Foundation’s website says:

Earlier today, Jimmy Song decided to share his thoughts on this current lack of stake withdrawal capability in Ethereum 2.0:

In an op-ed piece (titled “Bitcoin Songsheet: How Altcoiners Use Bitcoin To Rent Seek”) for Bitcoin Magazine that was published on 19 September 2022, Song said that altcoiners “criticize Bitcoin whenever they get a chance to build interest in their own coin” and that they “practice self-interested mental gymnastics worthy of the most partisan politician”. He also mentioned that their behavior should not be ignored because “they are causing tremendous amounts of harm”.

Song then went on to “explain how altcoins impede Bitcoin adoption, destroy value and create terrible habits”, i.e. why they are “unequivocally immoral”:

- Altcoin projects are “rent seekers”; by calling themselves “decentralized” cryptocurrencies, they associate themseleves with Bitcoin, which” legitimizes their project in the eyes of the public, or at least to the extent that Bitcoin is legitimate” and “absolves them of any responsibility should anything go wrong”.

- Altcoin projects hinder Bitcoin adoption by “the muddying of the waters”, creating “all sorts of confusion by saying things like ‘Decentralization is a spectrum,’ and ‘Blockchain technology has many use cases’.

- Since altcoins are “fiat money complete with a central bank, monetary machinations and control”, they “inherit all the moral problems of fiat money”.

- “Altcoins are based on trust that is easily abused for the benefit of the VCs”, which could lead to “destruction of value”.

- “Altcoins take advantage of the most basic instincts of people, which are to get something for nothing.”

- “Altcoiners are not only sowing confusion and co-opting Bitcoin’s legitimacy, but they actively attack Bitcoin. For example, they assert that proof-of-work is bad because it uses too much energy.”

Image Credit

Featured Image via Pixabay