On Monday (28 November 2022), crypto analyst Tory Green shard his thoughts on Chainlink, which he called “one of the most important, yet least understood, pillars of the crypto ecosystem.”

Green said:

“Chainlink is a ‘decentralized oracle network’ that allows blockchains to connect to real-world data (we’ll explain this in a second)… It has a market cap of $3.6B, FDV of $7.2B and its $LINK token trades at $7.15… During the last #crypto bull market, the price exceeded $50…

“Chainlink is the largest decentralized oracle network, offering solutions to a variety of industries including: • DeFi • Enterprise • NFTs and Gaming • Social Impact • Climate Markets…

“The ecosystem is powered by the $LINK token, which has three purposes. It’s: • Used by clients to pay for services • Received by oracles as compensation for work performed • Serves as collateral to ensure that oracles behave properly…

“Chainlink occupies a unique position as the dominant “middleware” layer transferring data between blockchains and the real world… Since it’s already transferring data, it’s not a huge leap to perform computations on that data, store or even transmit it… This is exactly what the protocol plans to do with the release of Chainlink 2.0…

“It’s utilizing ‘hybrid smart contracts’ – computer programs that that combine ON-chain data with OFF-chain data – to create a new layer that can perform computations off-chain… If executed correctly, this hybrid smart contract layer could create a lot of benefits, such as: 1. Scalability 2. Privacy 3. Interoperability…

“In a way, Chainlink could function as an ‘upside down’ Cosmos or Polkadot Instead of connecting multiple L1s at a base, or “L0” layer, it could connect them at the L2 layer If successful, this could be huge, as it could replace traditional interoperability solutions… While it’s too early to tell whether Chainlink 2.0 will succeed, if it does it could represent a major paradigm shift in Web3 – a unified “middleware” layer that provides the functionality of a: • Privacy tool • Layer 2 • Bridge…

“Chainlink has achieved significant traction to date, it: • Has enabled over $6 trillion in transaction volume • Delivered 5 billion data points on-chain • Supports 14+ blockchains and L2s… The protocol has also partnered with a variety of players in Web 2.0, such as Google Cloud and Oracle and dozens of projects across the Web3 ecosystem…

“It’s difficult to value Chainlink because there is no real-world analog to an oracle network While oracles are important, they are a unique phenomenon to Web3 But that’s not too concerning, as I’m not sure that $LINK should be valued as an oracle anyway… Given the plans for Chainlink 2.0, I don’t think it’s unrealistic to value Chainlink as a Layer 1 In a sense, it could achieve what Cosmos and Polkadot are hoping to do and provide a unified layer for: • Privacy • Scalability • Interoperability…

“Layer1s have already achieved substantial valuations – Ethereum crossed $500B in 2021 and both Solana and BNB exceeded have $100B in FDV in the past As such, I don’t think a long-term valuation of $500B to $1T is impossible for LINK… At 1B total tokens, this would imply a price of $500 to $1K per token, a 75x to 150x return over today and 10x to 20x over its ATH.“

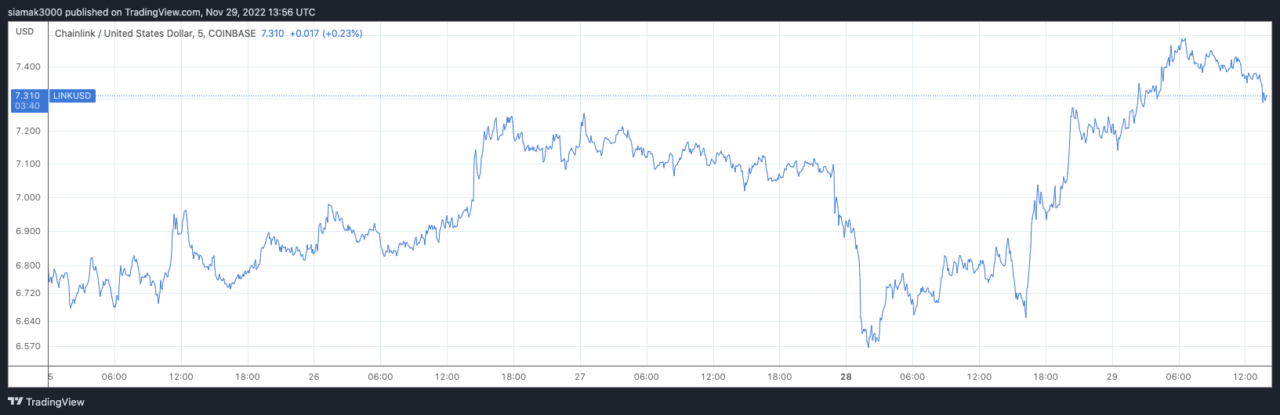

According to data by TradingView, currently (as of 1:56 p.m. UTC on 29 November 2022) $LINK is trading around $7.310, up 7.03% in the past 24-hour period.

Here is what a few other crypto analysts are thinking of latest $LINK’s price action:

Image Credit

Featured Image via Pixabay