Strategists at Wall Street giant JPMorgan have suggested that the price of Bitcoin ($BTC) could collapse to $13,000 amid a “cascade of margin calls” triggered by the liquidity crisis at popular cryptocurrency exchange FTX.

According to a report from Bloomberg, strategists led by Nikolaos Panigirtzoglou wrote in a note that a “cascade of margin calls” is likely to be underway given the connection between FTX and its sister company, trading firm Alameda Research, and the rest of the cryptocurrency ecosystem. In a note, the analysts wrote:

What makes this new phase of crypto deleveraging induced by the apparent collapse of Alameda Research and FTX more problematic is that the number of entities with stronger balance sheets able to rescue those with low capital and high leverage is shrinking.

As CryptoGlobe reported, after a leaked balance sheet of Alameda Research showed the firm’s collateral heavily relied on FTX’s FTT and Solana-based altcoins with low liquidity, crypto exchange Binance announced it was selling the FTT holdings that it had after leaving an equity investment in the exchange.

Binance’s announcement coupled with the balance sheet leak triggered a bank run on the trading platform, which revealed it was unable to cover users’ withdrawals, despite its CEO Sam Bankman-Fried saying it had users’ funds numerous times.

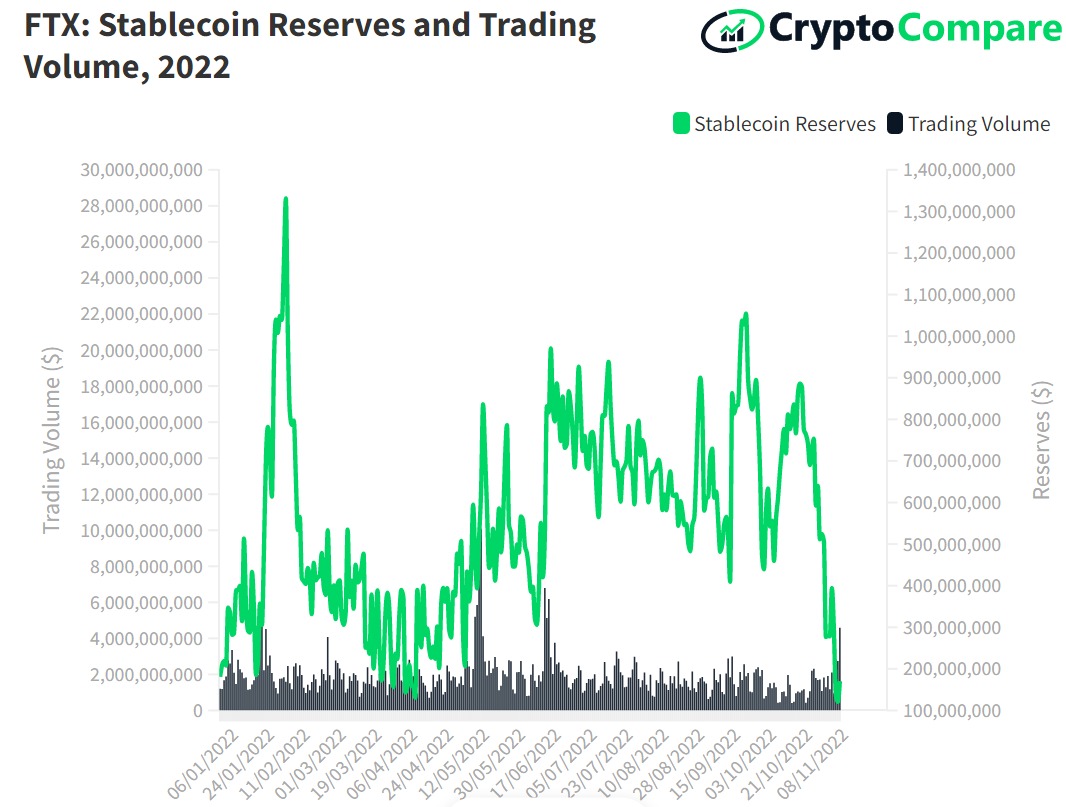

According to CrypotCompare’s deep dive into FTX’s insolvency, FTX saw outflows of 19,947 BTC, worth over $340 million, on November 7, the largest figure since September 10, 2021 when the exchange recorded more than 45,000 BTC outflows.

Leading stablecoin provider Tether recently froze $46 million of USDT held by the embattled cryptocurrency exchange FTX at the request of law enforcement “while an investigation occurs.”

The Bahamas securities regulator has meanwhile frozen the assets of Sam Bankman-Fried’s exchange and moved to appoint a liquidator for one of its entities as the exchange looks to secure funds from various investors.

As a result of FTX’s crisis, crypto lender BlockFi has suspended withdrawals and won’t be “able to operate business as usual” given the bank run on FTX and the lack of clarity as to what is happening with the cryptocurrency exchange.

In a statement, BlockFi said they are “shocked and dismayed by the news regarding FTX and Alameda” and its top priority “will continue to be to protect our clients and their interests.”

In July, BlockFi signed a $680 million deal with FTX.US that included a $400 million credit line and an option for FTX to acquire the company for $280 million. The deal was made after the collapse of the Terra ecosystem and of Three Arrows Capital as the lender struggled.

JPMorgan’s strategists pointed to the $13,000 level based on Bitcoin’s production cost, which essentially measures the electricity needed to operate the machines mining BTC and securing the network. The strategists wrote the cost stands at $15,000 but is likely to revisit the $13,000 low seen over the summer months.”

Other analysts have also pointed to the $13,000 mark as a potential low for the cryptocurrency. Notably, data has shown BTC investors are moving to buy the dip after the cryptocurrency’s price plunged from around $20,000 to $16,000.

Image Credit

Featured Image via Unsplash