On Thursday (October 6), Zurich-based SIX Swiss Exchange announced that it is offering for the first time a comprehensive suite of high quality cryptocurrency data to its clients thanks to a partnership with leading global cryptocurrency market data provider CryptoCompare.

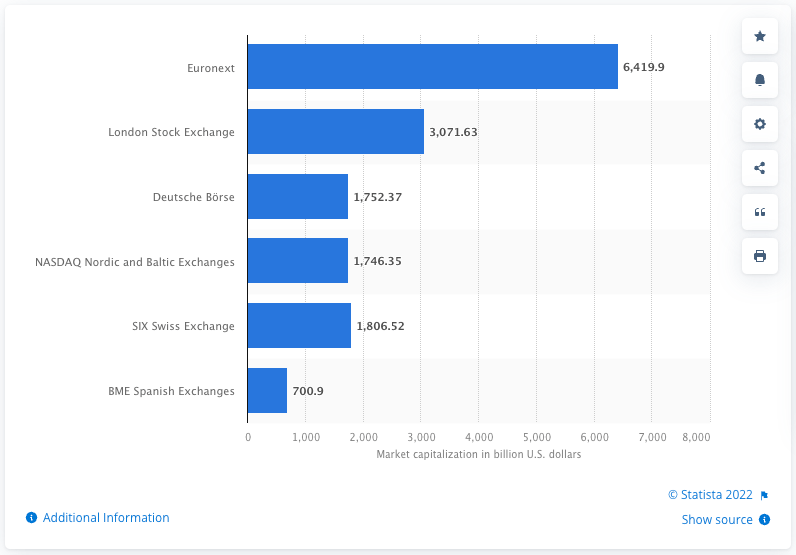

SIX Swiss Exchange, which is a wholly-owned subsidiary of SIX Group, is Switzerland’s principal stock exchange (the other being Berne-based BX Swiss, which is operated by BX Swiss AG). It is the third largest stock exchange (after Euronext and London Stock Exchange) in Europe by domestic market capitalization (as of June 2022).

London-headquartered and FCA-authorized CryptoCompare, which was founded in 2014 by Charles Hayter (CEO) and Vlad Cealicu, is the leading global cryptocurrency market data provider, giving institutional and retail investors access to real-time, high-quality, reliable market and pricing data on 5,300+ coins and 240,000+ currency pairs, as well as institutional-grade digital asset real-time and settlement indices.

By aggregating and analysing tick data from globally recognised exchanges, and seamlessly integrating different datasets in the cryptocurrency price, CryptoCompare provides a comprehensive, holistic overview of the market. To ensure the integrity of its data, CryptoCompare regularly reviews crypto exchanges, monitors for market abuse, and takes regional anomalies and geographical movements into consideration.

In a press release issued earlier today, SIX, which is one of Europe’s leading financial information providers, stated that “CryptoCompare’s cryptocurrency data is now available for the broad customer base of SIX to further strengthen their activities in digital asset markets,” which means that SIX can now “cover more than 85% of all cryptocurrency market activities worldwide.”

SIX went on to say that:

“As market participants are expanding their digital asset offering, they need access to high quality data This is especially important as regulatory bodies place digital assets under greater scrutiny to protect investors and ensure transparency in these markets,evidenced by ESMA with the introduction of the Markets in Crypto-assets (MiCA) Regulation…

“SIX is continuously evaluating and enabling market needs in regards to digital assetsprovide market participants with high-quality crypto market data, standardized by SIX, the company’s data offering. As such, SIX decided to partner with CryptoCompare due to the company’s vast coverage of cryptocurrency markets and ease of integration through a single API source, enabling SIX to provide digital asset data to its clients via the same delivery channels as its leading reference, pricing, corporate actions, regulatory, tax and ESG data.“

Berta Ares Lomban, Head Digital Assets Financial Information at SIX, had this to say:

“Through this collaboration with CryptoCompare, we are helping our customers navigate the digital assets markets. Our clients will be able to access the information they need to realize the opportunities and manage the risks in cryptocurrency markets, as well as comply with emerging regulations, through a trusted and reliable data partner.”

And according to CryptoCompare’ press release, Charles Hayter, CEO and Co-Founder of CryptoCompare, added:

“CryptoCompare is delighted to work with SIX to provide its clients with high-quality and wide-ranging digital asset data, built upon our market-leading methodologies that safeguard data integrity. We look forward to advancing our relationship with SIX, assisting as the company explores new opportunities to meet the growing appetite of their clients for digital assets exposure.”