On Wednesday (October 12), Bank of Canada (which is Canada’s central bank), highlighted five findings from a report that studied “the dynamics of Bitcoin awareness and ownership from 2016 to 2021” using its Bitcoin Omnibus Surveys (BTCOS).

On October 12, Bank of Canada published a blog post that highlighted five findings from this report (titled “Private Digital Cryptoassests as Investment? Bitcoin Ownership and Use in Canada, 2016-2021”):

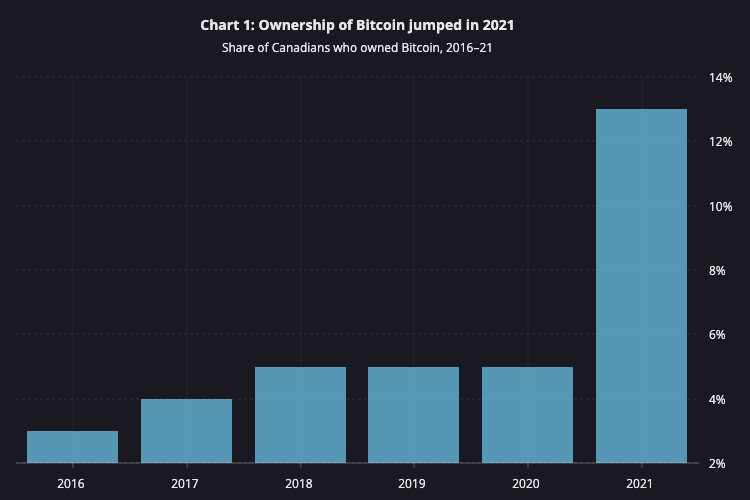

- “Bitcoin ownership among Canadians increased sharply in 2021“

- “Most Canadians are aware of Bitcoin“

- “Investment reasons have largely driven the recent surge in Bitcoin ownership“

- “Most Bitcoin owners hold small amounts“

- “Large price corrections are the most common incident reported by cryptoasset owners“

Now, let’s take a look at the first takeaway, ie. the sharp increase in Bitcoin ownership in 2021. Here is what Bank of Canada had to say on this:

“The share of Canadians owning Bitcoin rose from 5% in 2018–20 to 13% in 2021… This increase occurred following widespread increases in the savings and wealth of Canadians during the pandemic. At the same time, some fintech companies began to offer cryptocurrencies alongside traditional investment products, providing consumers with a wider range of accessible and user-friendly platforms to buy Bitcoin. The results of the survey also revealed that Bitcoin purchasers in 2020 and 2021 relied increasingly on mobile apps to buy their Bitcoin. Purchasers used mobile apps much more than web-based exchanges, mining or visiting a Bitcoin ATM.“

Image Credit

Featured Image via Unsplash