On Wednesday (October 26), Matt Hougan, CIO of crypto index fund & ETF provider Bitwise Asset Management, explained why several popular altcoins have enjoyed double-digit percentage gains vs the dollar this week.

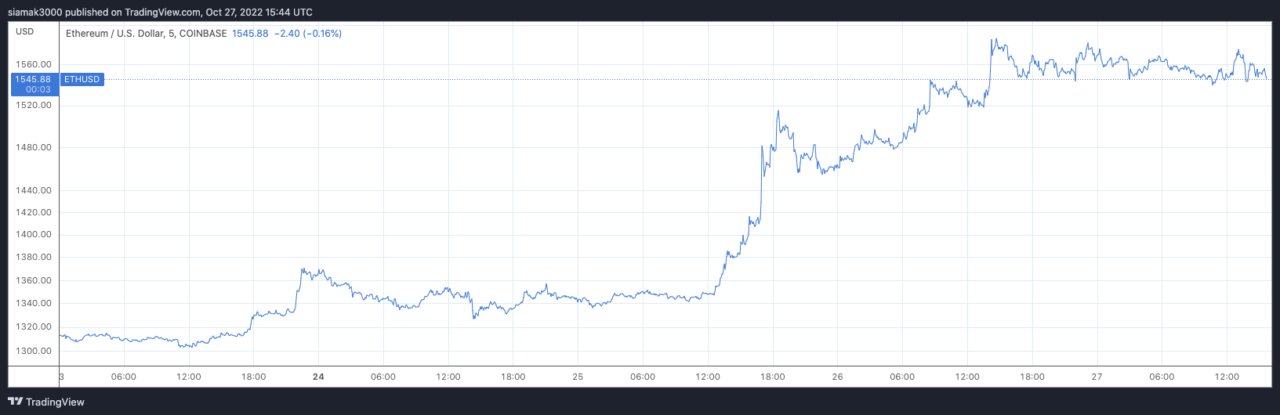

For example, according to data by TradingView, on Coinbase, currently (as of 3:44 p.m. UTC on October 27) ETH-USD is trading around $1,545, which means that it is up over 13% since the start of the week.

After pointing out that he was speaking on his own behalf (and not that of his firm) and not offering any investment advice, Hougan said:

“A helpful analogy to explain these moves is to think about a wildfire… For a wildfire to occur, you need three things: 1) Fuel — the right starting conditions 2) A spark — something to actually start the fire 3) An accelerant — something to drive the growth… We had all three in the crypto markets recently. And that’s why we’re up big…

“The fuel IMHO was that crypto is too cheap. In recent months, we’ve seen meaningful technological progress (ETH’s Merge), regulatory progress (the emerging stablecoin bill), strong VC flows, and solid developer activity. But prices have gone nowhere…

“In fact, in some areas, they’ve retrenched. Take crypto stocks. Companies like Silvergate have reported strong growth, with revenues up 50% year-over-year and a sunny outlook for 2023. But the stock has been crushed, trading at a forward P/E of ~8x. The fuel was there…

“The spark came Tuesday morning when two big events occurred. First, we had bad consumer confidence numbers. The market read this as: “We may be getting close to the end of the rate-hiking cycle.” Then we had Yellen tell us she’s ready to buy bonds. Say what? Pivot already?…

“The accelerant was short liquidations. People were caught leaning the wrong way, and had to buy to cover their shorts. FTX, for instance, reported its largest short liquidations ever, at almost a billion dollars…

“Add those together, and you get big up days. So where do we go from here? If I’m being honest, this feels like a bear market rally; I would not be surprised to see the market pull back from these highs. Generally, I think there’s more volatility ahead this year.“

Hougan went on to say that

“Over the past year, investors have been forced to the sidelines by a challenging macro environment. But they have not lost interest in crypto. They’re just waiting for the all-clear. Once it comes, they will be ready to jump back in… This aligns with what I hear from institutional investors and financial advisors each day. They are still watching crypto, learning, and doing due diligence. It makes me pretty excited for 2023.“

On 20 October 2022, the Bitwise CIO — along with Oliver Linch, CEO of Bittrex and Bill Barhydt, Founder and CEO of Abra — had a conversation with crypto analyst and influencer Scott Melker:

Shortly afterwards, Hougan summarized what he had said during this chat:

Image Credit

Featured Image via Pixabay