According to a recent note by Kamakshya Trivedi, Head of Global FX, Rates, and EM Strategy at Goldman Sachs, a peak in USD “still feels severely quarter away.”

According to a report by StreetInsider, Trivedi wrote:

“We do not expect the Fed to embark on easing until 2024, and a trough in growth also seems months away. But given the current backdrop of extremely elevated inflation, it may make sense to overweight the experience of the mid-1970s and the mid-1980s, when inflation was similarly high. In those periods, the Dollar appears to have peaked with some Fed easing but US interest rates still near their peak, and with global and US growth still declining rather than at the trough…

“We could be through the worst of Europe’s winter recession, a new leadership at the BoJ may gradually start to tighten policy, and China’s zero covid policies may be on their way out, at the same time as a peak in US rates is finally coming into sight alongside some moderation of US inflation and the labor market. But we are not there yet.“

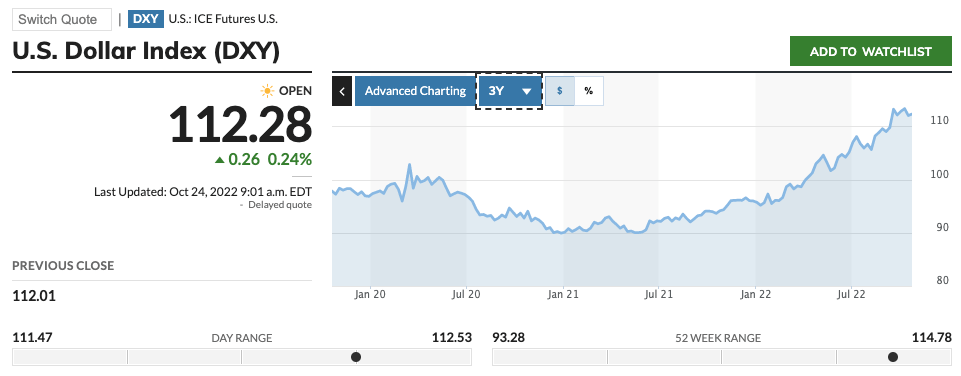

If he is correct, then this means a higher US Dollar Index (DXY), which according to Wikipedia is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies. These other currencies are EUR, GBP, JPY, CAD, SEK, and CHF.

Although it is hard to prove that DXY and BTC are inversely correlated (especially since Bitcoin has not been around for that long), since the start of the COVID-19 pandemic, we have mostly seen BTC (and other cryptoassets) go down when DXY goes up and vice versa.

Image Credit

Featured Image via Pixabay