A continous stream of good news for Polygon over the past three months has helped its gas and governance token $MATIC token to gain over 170% (vs USD).

What Is Polygon ($MATIC)?

Polygon is “a decentralised Ethereum scaling platform that enables developers to build scalable user-friendly dApps with low transaction fees without ever sacrificing on security.” The Polygon Lightpaper describes Polygon as “a protocol and a framework for building an connecting Ethereum-compatible blockchain networks.”

On 18 May 2021, independent Ethereum educator, investor and advisor Anthony Sassano took to Twitter to clear up some of the confusion around Polygon (e.g. some people refer to Polygon as a sidechain to Ethereum, while others call it an L2 blockchain). Below are a few highlights from that Twitter thread:

- “There is the Matic Plasma Chain and the Polygon PoS chain. The vast majority of the activity is happening on the PoS chain.“

- “The PoS chain is what people refer to as a ‘sidechain’ to Ethereum because it has its own permissionless validator set (100+ who are staking MATIC) which means it doesn’t use Ethereum’s security (aka Ethereum’s PoW).“

- “The PoS chain goes beyond a standard sidechain and actually relies on and commits itself to Ethereum (what some people may call a ‘commit-chain’). It relies on Ethereum because all of the validator/staking logic for the PoS chain lives as a smart contract on Ethereum.“

- “This means that if the Ethereum network went offline, the Polygon PoS chain would also go offline. Secondly, the PoS chain actually commits/checkpoints itself to Ethereum every so often.“

- “This has 2 benefits: it provides Ethereum-based finality to the PoS chain & it can help the chain recover in case of catastrophic event. This also means that Polygon is paying Ethereum to use its blockspace (in ETH) & paying for it to secure the contracts & checkpointing.“

Furthermore, Sassano took this opportunity to talk about the two bridges that exist between Ethereum and Polygon:

- “There are 2 bridges – the Plasma bridge which is secured by Ethereum and the PoS bridge which is secured/operated by the PoS chain validator set.“

- “Of course, for the PoS bridge, 2/3 of the validators could theoretically collude and try to steal the bridge funds but there’s $3.4 billion at stake so this is risky. If this attack did happen, the checkpointing & social coordination could be the only recourse.“

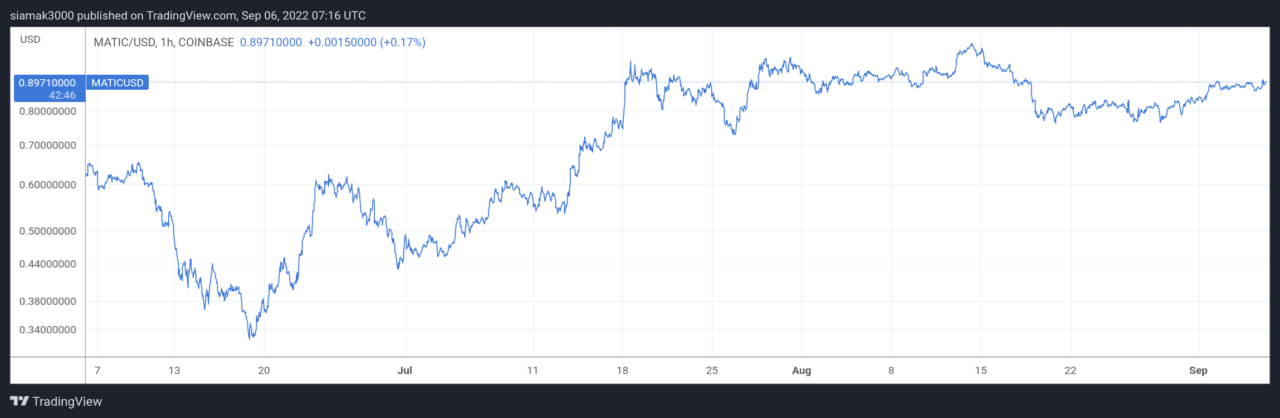

$MATIC’s Price Action

According to data from TradingView, at 1:00 a.m. UTC on September 6, the $MATIC reached $0.9168, which means that the $MATIC price has gone up (vs USD) over 170% since its June 18 low of $0.3392.

On Monday (September 5), prominent New Zealand based crypto analyst Lark Davis pointed out that Polygon had reached an important milestone:

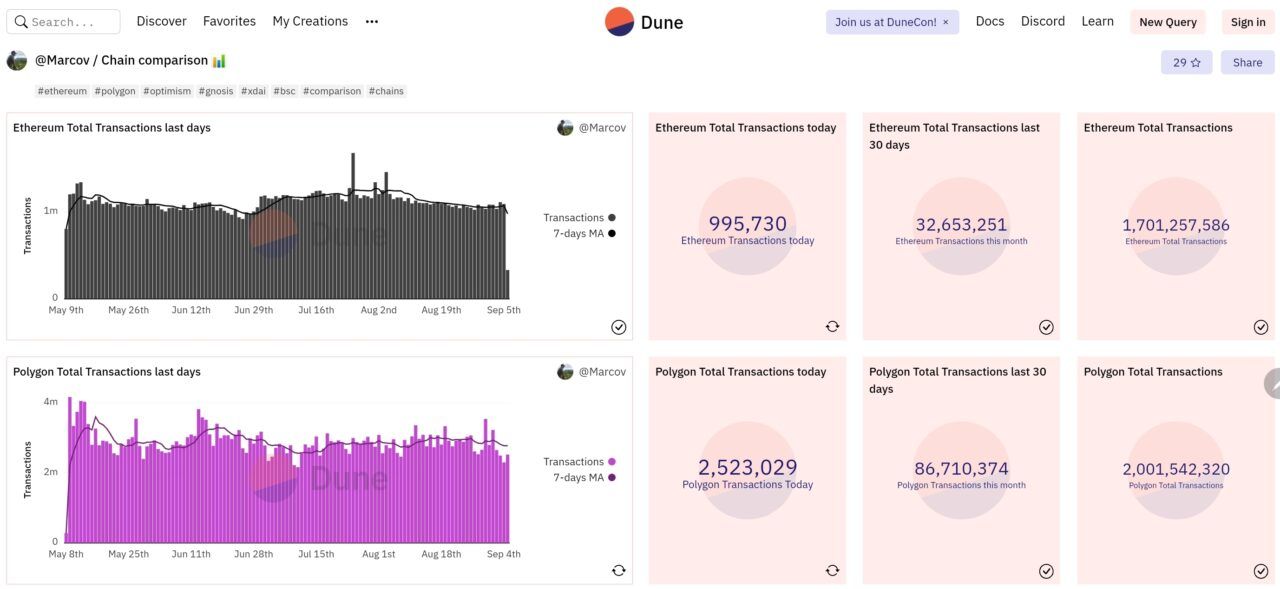

Data from Dune Anaytics confirms that as of 6 September 2022, Polygon’s total transaction count is indeed over two billion:

On August 31, the Polygon team announced that popular commission-free trading platform Robinhood had “launched support for deposits and withdrawals of MATIC on the Polygon Proof-of-Stake (PoS) chain,” which will “bring all of the benefits of Ethereum’s Layer-2 (L2) solutions to Robinhood users for the first time, including faster transactions and lower fees as compared to Ethereum.”

And earlier today, Polygon Studios CEO Ryan Watt sumamrized some of the recent good news that $MATIC HODLers have enjoyed hearing about:

Image Credit

Featured Image via Pixabay