Most Bitcoin ($BTC) investors have been holding onto their coins throughout the ongoing bear market, with data showing that 62% of addresses on the cryptocurrency’s network haven’t sold their coins for more than a year.

Bitcoin is at the time of writing trading at $19,900 after falling more than 70% from an all-time high near the $70,000 mark back in 2021. The cryptocurrency has over the past few weeks been struggling to remain above the $20,000 mark, which was its high back in late 2017.

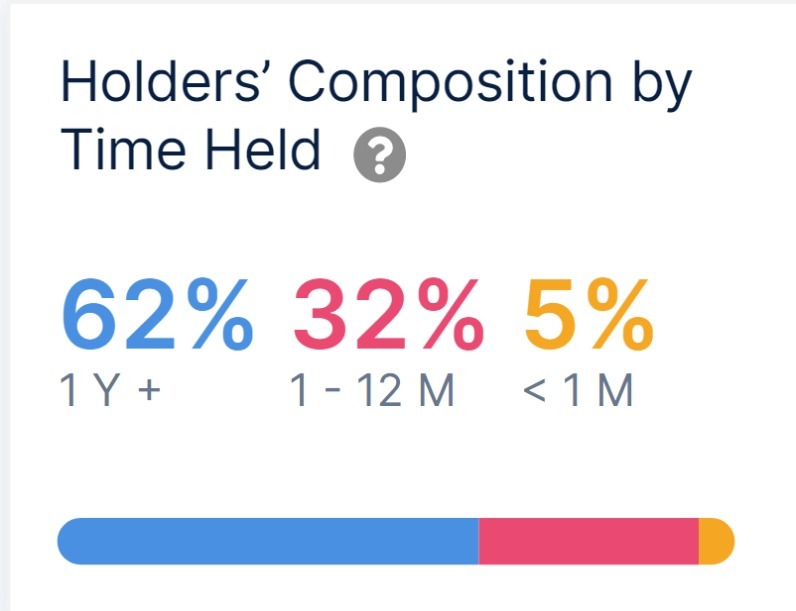

According to data from IntoTheBlock, as first pointed out by Finbold, 62% of addresses on the Bitcoin blockchain haven’t sold their BTC for over a year, while 32% of investors have been HODLing onto their coins for between one and 12 months, meaning that little over 5% have been HODLing for less than a month.

As CryptoGlobe reported, earlier this week U.S. socks and top cryptoassets fell after r comments from the New York Fred President and the governor of the Bank of Estonia suggested that the major central banks are far from getting inflation under control.

John Williams, President and CEO of the Federal Reserve Bank of New York, said at a virtual event hosted by the Wall Street Journal that he believes there’s a “need to get real interest rates … above zero.”

Madis Müller, governor of Estonia’s central bank, said that he believes “75 basis points should be among the options for September given that the inflation outlook has not improved.” Increasing interest rates is believed to heighten the risk of a recession and is seen as a negative for risk assets such as BTC.

Notably, BTC proponents see the bear market as an opportunity to accumulate more coins, betting on a potential rally for cryptocurrency prices. Several analysts, including Bloomberg Intelligence’s Mike McGlone, have said they believe BTC and assets like gold will see a rise in the second half of the year.

Image Credit

Featured Image via Unsplash