The cryptocurrency community is expecting the price of smart contract platform Solana ($SOL) to surge in October, as the network’s congestions seemingly become a thing of the past and it processes an astounding number of transactions.

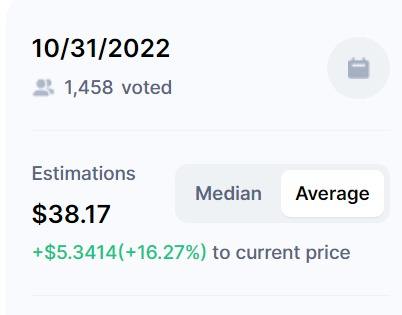

According to data from CoinMarketCap’s price estimates feature, nearly 1,500 cryptocurrency community members have predicted that Solana’s price will trade at $38.17 on average, representing a 13% rise from $SOL’s current $33.8 price tag.

Notably, the cryptocurrency community’s predictions for the end of the year remain at around the same level, with users on average predicting $SOL will trade at $38.8, up nearly 15% from current levels.

As CryptoGlobe reported, the total number of transactions conducted on Solana has surpassed the 100 billion mark, at a time in which institutional investor bets on the cryptocurrency keep trickling in, despite the ongoing bear market.

According to data from Solana’s blockchain explorer, the network has now processed a total of 100.06 billion transactions and is currently processing an average of 2,777 transactions per second, well below the network’s touted capacity of up to 50,000.

The total value locked on Solana’s decentralized finance (DeFi) space has been dropping, presumably because the network has suffered a number of outages so far this year that affected users’ confidence in it. Solana’s co-founder, Anatoly Yakovenko, has said in an interview that outages are the network’s “biggest challenge.”

According to CryptoCompare’s latest Asset Report, the dominance of the five largest protocols on the network has nevertheless risen over the same period, hitting a 51.6% peak on August 9. Solana, the report adds, benefits from a “well-diversified set of DeFi applications ranging from DEXes to lending, liquid staking, and yield services.”

Despite the setbacks, institutional investments in cryptocurrency investment products offering exposure to SOL have been growing after seeing $1.4 million worth of inflows last week and $1.9 million month-to-date.

Image Credit

Featured Image via Unsplash