Although the macro-economic outlook for the remainder of this year seems bearish, $ADA HODLers have several good reasons to be excited and to feel optimistic this month.

The Macro Outlook

On August 26, Federal Reserve Chair Jerome Powell gave an important speech at the 2022 Economic Policy Symposium (in Jackson Hole, Wyoming), which was hosted by the Federal Reserve Bank of Kansas City.

In a speech titled “Monetary Policy and Price Stability”, Powell said:

“The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone…

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

“July’s increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook. At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.“

As CNBC reported, on August 30, John Williams, President and CEO of Federal Reserve Bank of New York, said at a virtual event hosted by the Wall Street Journal:

“I do think with demand far exceeding supply, we do need to get real interest rates … above zero. We need to have somewhat restrictive policy to slow demand, and we’re not there yet… We’re still quite a ways from that.“

And Madis Müller, governor of Estonia’s central bank (i.e. the Bank of Estonia) told Reuters:

“I think 75 basis points should be among the options for September given that the inflation outlook has not improved… Still, I’m going into the meeting with an open mind and I want to both see the new projections and hear my colleague’s arguments… We should not be too timid with policy moves as inflation has been too high for too long and we are still far below the neutral rate.“

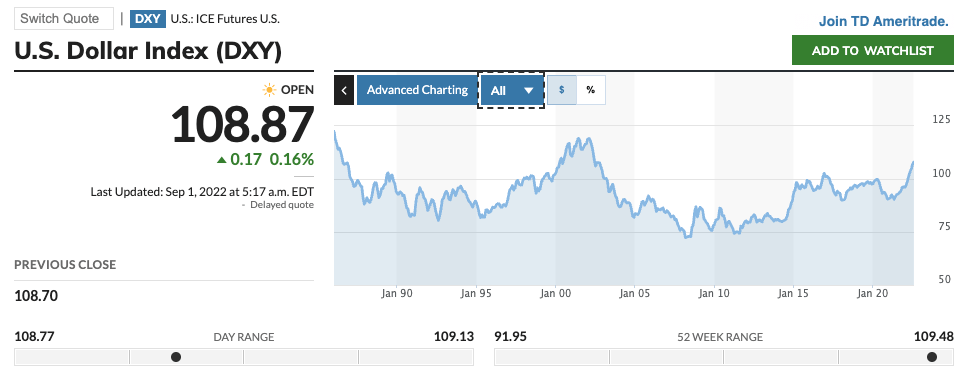

The risk-off investor sentiment has helped the U.S. dollar index to reach highs not seen since June 2002, and bringing pain to the markets for stocks and crypto.

Three Reasons to Be Excited for Cardano ($ADA) in September

Yesterday (August 31), Cardano-powered crypto lending startup Aada Finance announced that it is launching theAada Finance V1 lending and borrowing protocol on the Cardano mainnet on September 13.

The team’s press release, which was published on Cointelegraph, went on to say:

“After months of public testnet, Aada Finance is finally ready to deploy its eagerly anticipated app. The release brings lending and borrowing to Cardano, introducing decentralized finance (DeFi) primitives to the network for the first time. The event marks a significant milestone in the blockchain’s development, which will surely benefit the entire ecosystem.

“Aada Finance plans to launch in anticipation of the Vasil hard fork, which will update the Cardano network. The team aims to leverage the first-mover advantage thanks to its V1 protocol’s peer-to-peer approach. While it provides a straightforward and efficient solution, the smart contract concept will mitigate future risks associated with hard fork migration.“

One prominent member of the Cardano community did a great job of Twitter of succinctly explaining why Aada’s mainnet launch on September 13 is such a big deal:

Also, Binance.US announced staking support for $ADA (currently, you can earn 6.10% APY):

As far as the Vasil upgrade — i.e. Vasil hard fork combinator (HFC) event — is concerned, the current status of Cardano ecosystem readiness is looking very healthy, as IOG explained in a Twitter thread, and suggests that within the next one or two weeks IOG will be announcing the date for triggering the Vasil HFC on the Cardano mainnet:

Image Credit

Featured Image via Pixabay