There is no denying that Fed Chair Jerome Powell’s speech about inflation on Friday (August 26) brought major pain to both U.S. stocks and crypto. The question is how much are his comments going to going the affect the $ETH price in the coming days/weeks.

On August 26, Federal Reserve Chair Jerome Powell gave an important speech at the 2022 Economic Policy Symposium (in Jackson Hole, Wyoming), which was hosted by the Federal Reserve Bank of Kansas City.

In a speech titled “Monetary Policy and Price Stability”, Powell said:

“The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone…

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

“July’s increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook. At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.“

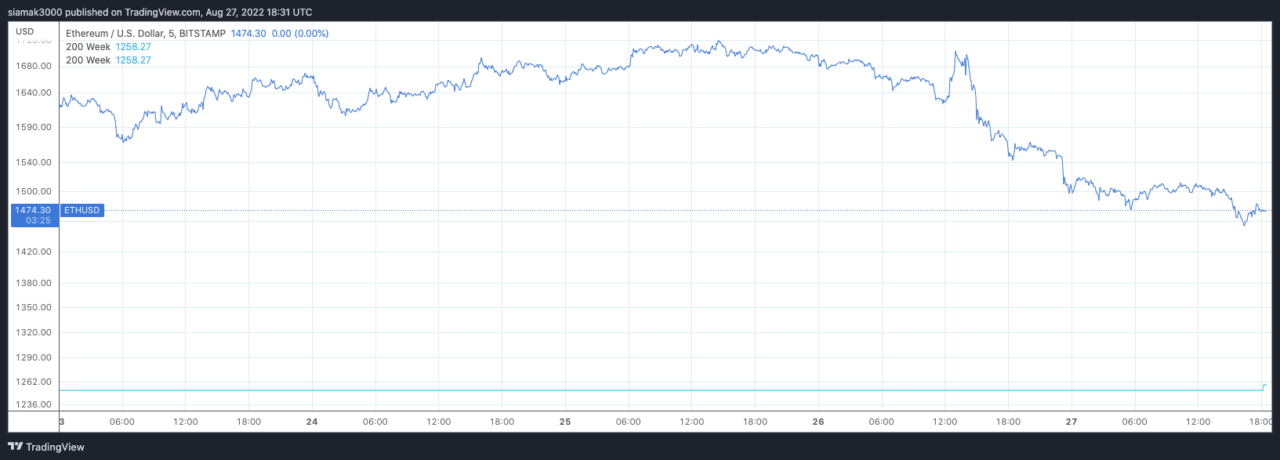

Naturally, Powell’s hawkish tone made investors and traders nervous, leading to a sell-off in both U.S. stocks and cryptocurrencies.

Concern about what Powell would say on August 26 started around August 14, when $ETH had an intraday high of $2,002 (which was the top of an $ETH rally that started on June 18, when the price got as low as $902). Currently (i.e. as of 6:31 p.m. UTC on August 27), on Bitstamp, $ETH is trading around $1,474.

Here is what some popular crypto analysts and traders saying now — post Powell’s Jackson Hole speech — about the short to medium term prospects for the $ETH price:

Image Credit

Featured Image via Unsplash