A popular Cardano ($ADA) influencer has recently explained he expects transaction volumes on the cryptocurrency’s blockchain to “absolutely explode” over a number of factors that are coming to the network, partly thanks to new upgrades.

In a tweet, the pseudonymous Cardano influencer known as ADA whale shared with its nearly 100,000 followers that the arrival of popular borrowing and lending platforms will help transaction volumes surge as $ADA users start lending and borrowing tokens. For now, users are just earning yield by staking or liquidity mining.

Moreover, the whale predicted synthetic assets, which are blockchain representations of real-world assets such as stocks, will also help boost transaction volumes, as will stablecoins. While there are Cardano-native stablecoins, leading issuers like Tether do not yet issue their fully collateralized stablecoins on Cardano, despite supporting numerous blockchains including Ethereum, TRON, Solana, Algorand, and Bitcoin Cash.

The influencer also pointed to yield aggregators and world-class trading platforms as potential catalysts for Cardano’s transaction volumes to “absolutely explode,” as well as identity solutions, non-fungible token bookstores, music streaming platforms, and more.

As CryptoGlobe reported, the number of smart contracts deployed on the Cardano ($ADA) network has reached a new milestone above the 3,000 mark for the first time in the cryptocurrency’s history as developers work on it ahead of the Vasil hard fork and as its decentralized finance (DeFi) ecosystem grows.

Plutus, it’s worth noting, is the “smart contract platform of the Cardano blockchain” that allows users to “write applications that interact with the Cardano blockchain.”

Cardano is now moving closer to its Vasil hard fork which is expected to deliver a “massive” performance improvement to the cryptocurrency’s network, but it was delayed by “a few more weeks.”

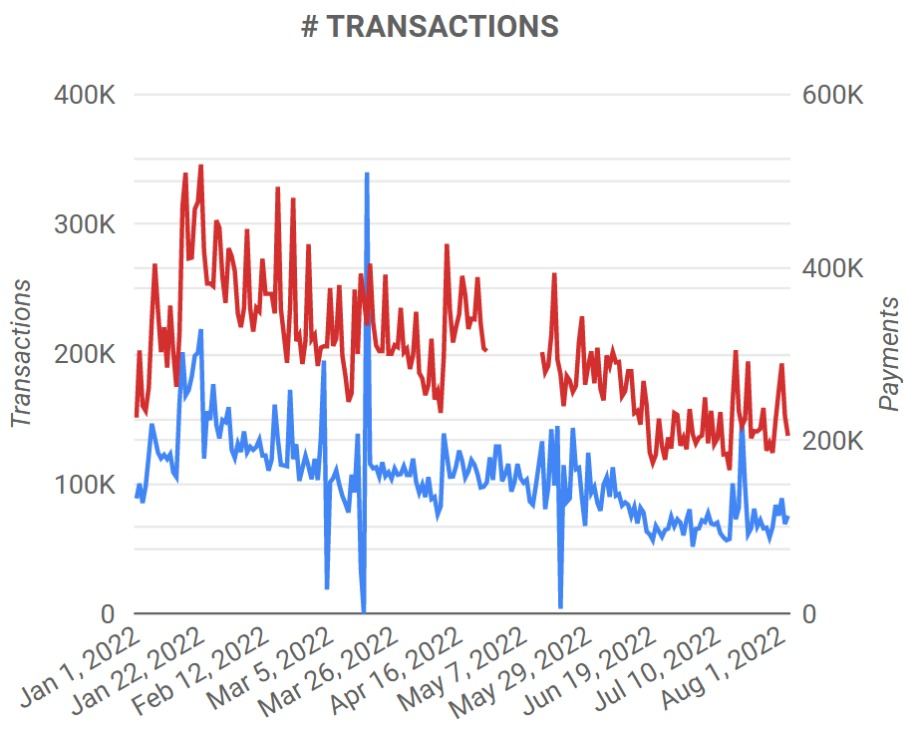

The number of transactions on the cryptocurrency’s network has declined so far this year amid a wider cryptocurrency market downturn, with daily transaction volumes being at around 50,000, down from over 150,000 earlier this year. Similarly, payments are around 200,000 per day, down from around 350,000.

On the Cardano network, it’s worth noting, one transaction can include numerous payments to numerous addresses, and many addresses can send payments to many in one single transaction as well.

Investors have nevertheless been betting on Cardano, with data from Coinbase’s price pages showing that users of the Nasdaq-listed cryptocurrency exchange have a typical ADA hold time of 153 days, meaning that Cardano traders on the platform hold onto their assets for that long before “selling it or sending it to another account or address.”

Cardano was late last month revealed to continue being the king of blockchains when it comes to the frequency of meaningful GitHub activity.

Image Credit

Featured image via Unsplash