On Thursday (August 11), BlackRock, which is the world’s top asset management firm by total AUM, launched a new spot Bitcoin trust aimed at U.S. institutional clients.

BlackRock, which was founded in 1988, started with just eight people working in one room. It made its Initial Public Offering on the New York Stock Exchange on 1 October 1999 at $14 a share. In 2006, BlackRock acquired Merrill Lynch Investment Management. Then in 2009, it acquired Barclay’s Global Investors (BGI), “becoming the world’s largest asset manager, with employees in 24 countries.” As of the end of Q2 2022, BlackRock had $8.48 trillion in assets under management (AUM).

On 13 October 2017, at an Institute of International Finance (IIF) meeting, Larry Fink, Co-Founder, Chairman and CEO of BlackRock, called Bitcoin an “index of money laundering”:

“Bitcoin just shows you how much demand for money laundering there is in the world… That’s all it is.“

On Thursday (August 4), Coinbase’s Brett Tejpaul (who is Head of Coinbase Institutional) and Greg Tusar (who is Head of Institutional Product) published a blog post, in which they stated that “Coinbase and BlackRock to create new access points for institutional crypto adoption by connecting Coinbase Prime and Aladdin.”

The blog post went on to say that “Coinbase is partnering with BlackRock, the world’s largest asset manager, to provide institutional clients of Aladdin®, BlackRock’s end-to-end investment management platform, with direct access to crypto, starting with bitcoin, through connectivity with Coinbase Prime.” Apparently, Coinbase Prime will “provide crypto trading, custody, prime brokerage, and reporting capabilities to Aladdin’s Institutional client base who are also clients of Coinbase.”

Joseph Chalom, Global Head of Strategic Ecosystem Partnerships at BlackRock, had this to say:

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets. This connectivity with Aladdin will allow clients to manage their bitcoin exposures directly in their existing portfolio management and trading workflows for a whole portfolio view of risk across asset classes.“

Well, earlier today, BlackRock announced the launch of “BlackRock Bitcoin Private Trust”, which “seeks to track the performance of bitcoin, less expenses and liabilities of the trust.” BlackRock went on to say:

“… we are still seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities.“

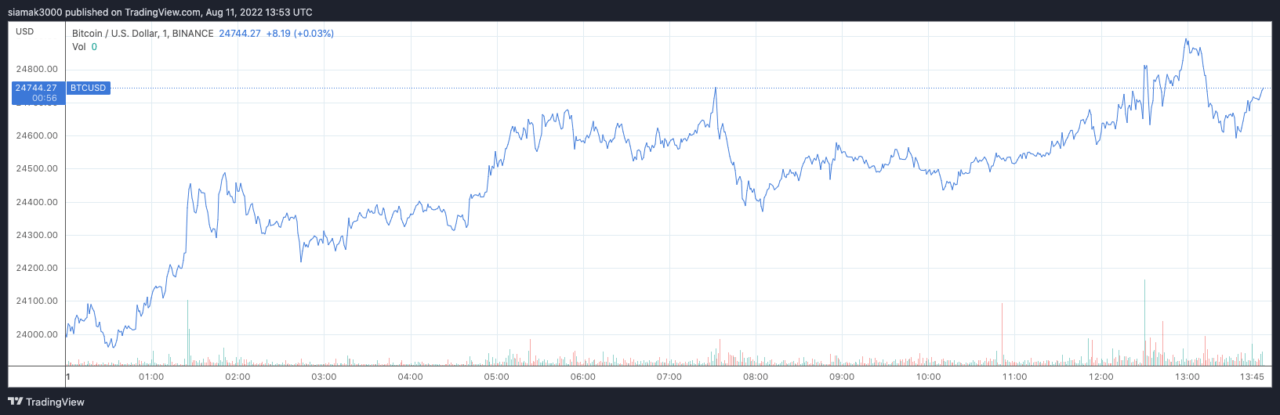

According to data by TradingView, on Binance, at 12:59 p.m. UTC on August 11, the Bitcoin price hit $24,893, which is the highest it has been since June 13.

Image Credit

Featured Image via Pixabay