On Monday (August 8), asset management firm ARK Investment Management LLC (AKA “ARK Invest” and “ARK”) explained why it found the recently-announced partnership BlackRock and Coinbase bullish for Bitcoin.

ARK Invest, which was founded by Catherine Wood in 2014. In issue #328 of its newsletter, which was published yesterday, crypto analyst Yassine Elmandjra took a closer look at an important announcement that was made last week.

Last Thursday (August 4), Coinbase’s Brett Tejpaul (who is Head of Coinbase Institutional) and Greg Tusar (who is Head of Institutional Product) published a blog post, in which they stated that Coinbase and BlackRock were going to “create new access points for institutional crypto adoption by connecting Coinbase Prime and Aladdin.”

The blog post went on to say that “Coinbase is partnering with BlackRock, the world’s largest asset manager, to provide institutional clients of Aladdin®, BlackRock’s end-to-end investment management platform, with direct access to crypto, starting with bitcoin, through connectivity with Coinbase Prime.” Apparently, Coinbase Prime will “provide crypto trading, custody, prime brokerage, and reporting capabilities to Aladdin’s Institutional client base who are also clients of Coinbase.”

Joseph Chalom, Global Head of Strategic Ecosystem Partnerships at BlackRock, had this to say:

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets. This connectivity with Aladdin will allow clients to manage their bitcoin exposures directly in their existing portfolio management and trading workflows for a whole portfolio view of risk across asset classes.“

Max Branzburg, VP of Product at Coinbase, made several great observations in a Twitter thread posted that day, two of which were:

- “Aladdin is Blackrock’s portfolio management software that provides investment professionals a way to view and manage daily investments. Importantly, Aladdin also serves ~300 other large asset managers, representing another $22 trillion in AUM.“

- “It cannot be understated how important Aladdin is for institutions. Managing investments without it is extremely difficult. Now Coinbase Prime will provide crypto trading, custody, prime brokerage, and reporting to this massive new client population.“

- “With today’s announcement, Coinbase is enabling trillions of dollars to enter crypto.“

Anyway, here is what the ARK analyst said about this partnership:

“Blackrock’s decision to partner with Coinbase is a strong signal that institutions consider crypto––starting with bitcoin––a new asset class. We agree that bitcoin has earned an allocation into well diversified portfolios.

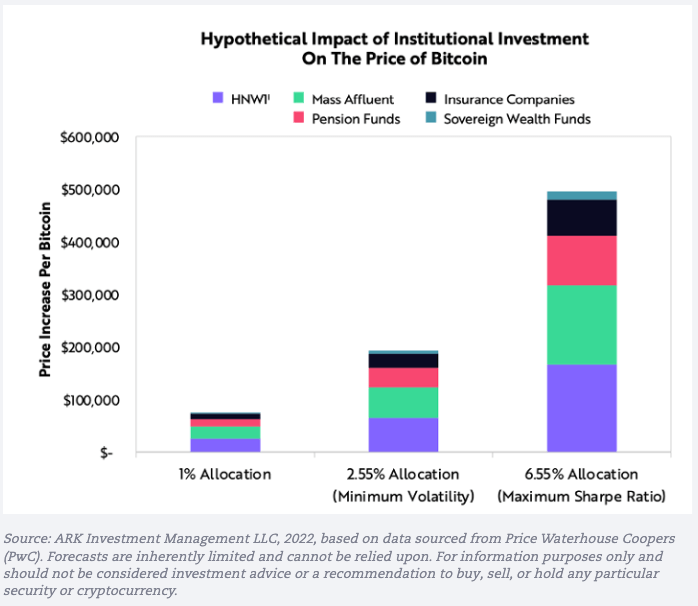

“Based on daily returns across asset classes during the past ten years, our analysis suggests that an allocation to bitcoin in well diversified portfolios should range from 2.55%, when minimizing volatility, to 6.55%, when maximizing returns per unit of risk…

“In this analysis, we ran a Monte Carlo1 simulation of 1,000,000 portfolios composed of various asset classes. The efficient frontier captures the highest returns possible for a given level of volatility. The stars indicate allocations associated with maximizing the Sharpe Ratio and minimizing volatility.

“Based on ARK’s simulated portfolio allocations, institutional allocations between 2.5% and 6.5% could impact bitcoin’s price by $200,000 and $500,000, respectively, as shown below.“

According to data by TradingView, on Binance, currently (as of 4:16 p.m. UTC on August 9) Bitcoin is trading around $23,106.

Image Credit

Featured Image via Pixabay