The “Mary” upgrade — applied to the Cardano mainnet on March 1 — introduced multi-asset support, which enabled the minting of NFTs. Since then, the rate of growth of Cardano’s NFT ecosystem has surprised even IOG Founder and CEO Charles Hoskinson.

On 18 February 2021, Input Output Global (aka “IOG”), the company responsible for Cardano’s research and development, published a blog post titled “Building native tokens on Cardano for pleasure and profit”, which announced:

“With the ‘Mary’ protocol upgrade, which will be implemented using our hard fork combinator technology, native tokens and multi-asset capability are coming to Cardano.“

IOG’s blog post went on to say:

“Native tokens will bring multi-asset support to Cardano, allowing users to create uniquely defined (custom) tokens and carry out transactions with them directly on the Cardano blockchain…

“The use of tokens for financial operations is becoming ever more popular. It can cut costs at the same time as improving transparency, enhancing liquidity, and, of course, being independent of centralized entities such as big banks. Tokenization is the process of representing real assets (eg, fiat currencies, stocks, precious metals, and property) in a digital form, which can be used to create financial instruments for commercial activities.

“Cardano will provide many tokenization options. With the ‘Mary’ upgrade, the ledger’s accounting infrastructure will process not only ada transactions but also transactions that simultaneously carry several asset types. Native support grants distinct advantages for developers as there is no need to create smart contracts to handle custom token creation or transactions. This means that the accounting ledger will track the ownership and transfer of assets instead, removing extra complexity and potential for manual errors, while ensuring significant cost efficiency.“

Then, on 1 March 2021, IOG tweeted that the “Mary” had fork had taken place on the Cardano mainnet:

The first Cardano NFTs to go on sale were from CardanoKidz team, which provided the following update on 10 March 2021:

In April 2022, Cardano’s NFT trading volume was around $27 million (as reported by “opencnft“):

On 9 June 2022, the IOG CEO did an interview with Yahoo Finance, during which he had this to say about Cardano’s NFT market:

“One surprising area of growth on Cardano is in the NFT space. About 40% of all the applications that are being deployed are NFT-related… About $270 million a month in NFT volume. So, $3 billion a year, and there’s tons of incredible work in the metaverse space, like Cornucopias and others, and it’s really impressive to see how fast it’s grown in just the last year.“

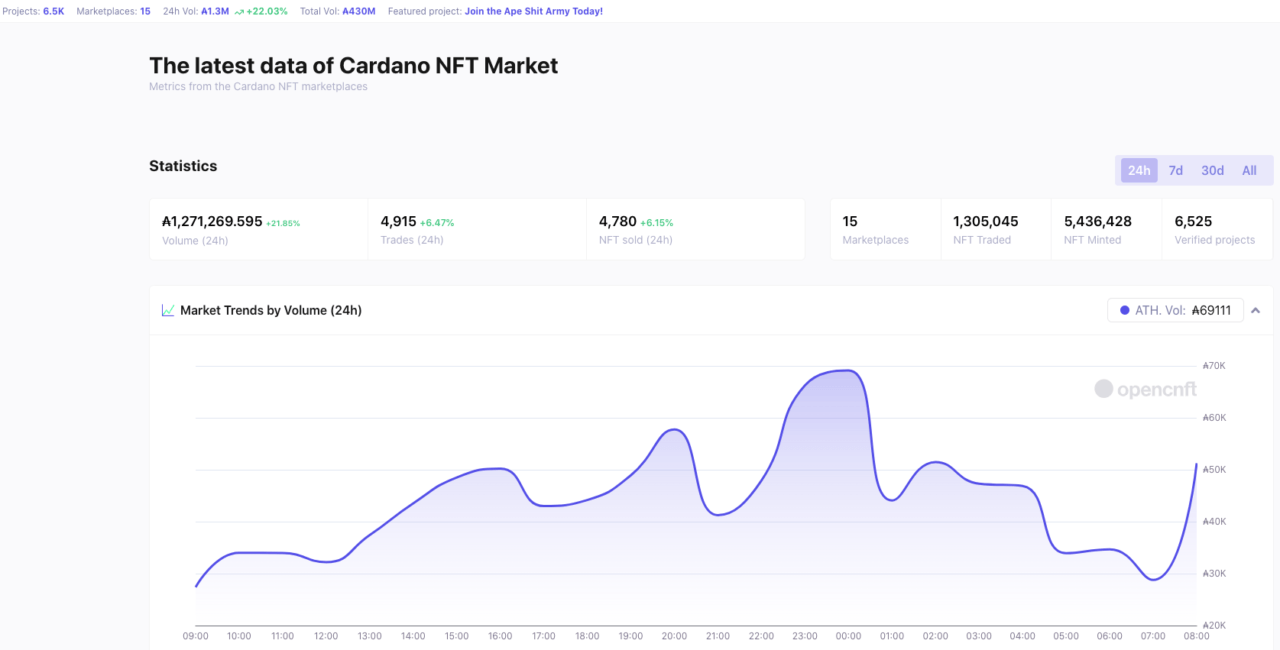

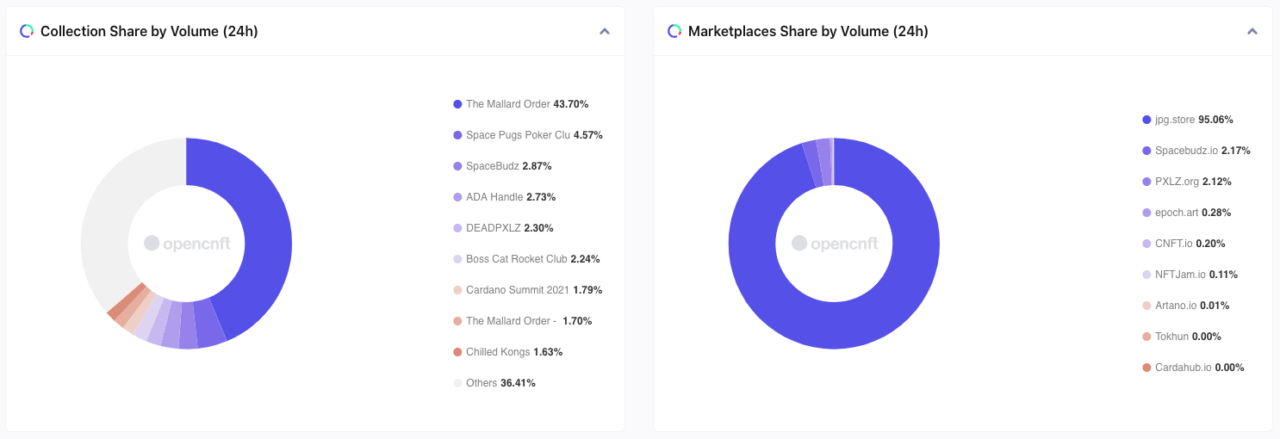

According to “opencnft.io“, here is the current state of Cardano’s NFT market:

As you can see, as of 9:25 a.m. UTC on August 2, Cardano NFTs 24-hour trading volume was around 1.3 million ADA (or around $627,000).

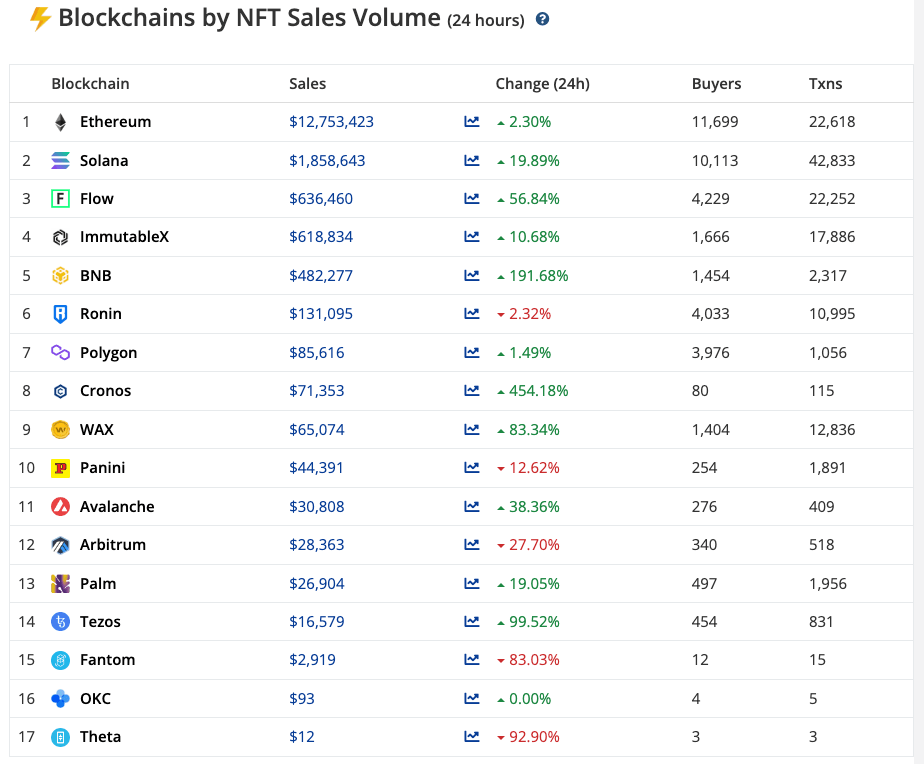

So, how does number compared to the 24-hour sales volume for other blockchains?

If the data from CryptoSlam is accurate, this would make Cardano the most popular blockchain for NFTs by 24-hour trasing volume:

Image Credit

Featured Image by Quantitatives via Unsplash