On Monday (July 25), a FinTech award-winning Singapore-based payment solution provider announced a partnership with Californian FinTech firm Ripple in order to use the latter’s XRP-powered On-Demand Liquidity (ODL) solution.

ODL uses XRP as a bridge currency, “enabling instant and low cost settlement without the need to hold pre-funded capital in a destination market.”

FOMO Pay, which was founded in 2015, provides “clients with payment processing and collection services for mobile payment methods and value-added services.” Its business solutions serve “clients from a wide range of industries, including the telecom, publishing, tourism and hospitality, F&B, education and retail industries.”

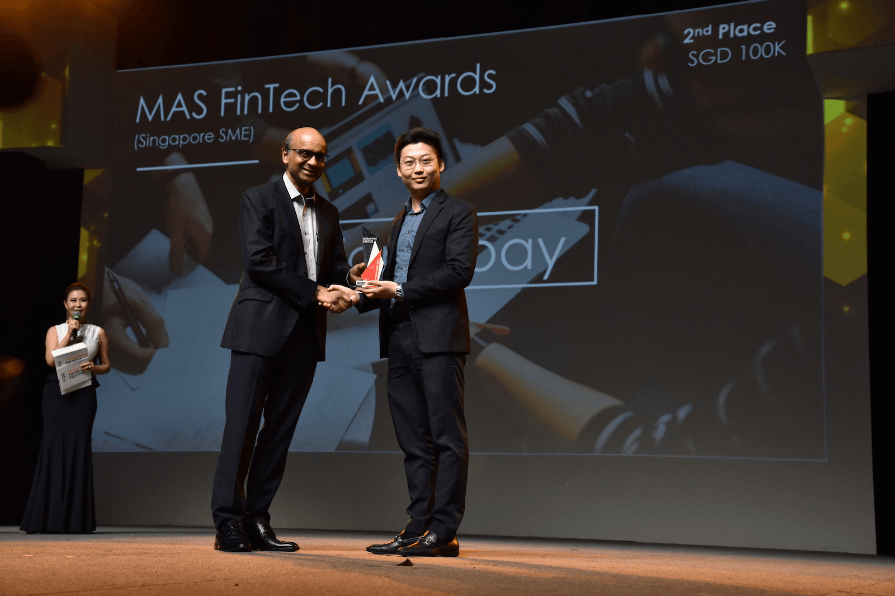

As FOMO Pay reported in a blog post published on 20 November 2017, the Monetary Authority of Singapore (MAS) and The Association of Banks in Singapore (ABS) awarded to FOMO Pay on 16 November 2017 an MAS FinTech Award in the SME Category at the 2017 Singapore FinTech Awards. Deputy Prime Minister and MAS Chairman Mr Tharman Shanmugaratnam presented the award to the FOMO Pay CEO at a ceremony “attended by more than 3,000 attendees.” FOMO Pay’s one-stop QR code payment solution was “selected as one of the 30 finalists then awarded later by a panel of 11 judges.”

Yesterday, Ripple issued a press release, which stated that “traditional treasury payments are subject to the same pain points and friction as cross-border payments due to the archaic infrastructure that correspondent banking relies on,” and in fact, “an estimated USD 3.5B is spent annually to address issues associated with treasury and liquidity.”

Louis Liu, Founder and CEO of FOMO Pay, had this to say:

“As one of the leading payment institutions in Singapore, FOMO Pay aims to provide our clients with more efficient and cost-effective payment modes in different currencies. We are excited to partner with Ripple to leverage On-Demand Liquidity for treasury management, which allows us to achieve affordable and instant settlement in EUR and USD globally.“

And Brooks Entwistle, SVP and Managing Director at Ripple, added:

“With the Asia Pacific region teeming with opportunities to solve existing silos and inefficiencies with payments, we’re seeing many forward-looking financial institutions clamoring for the next evolution of payment infrastructures – and notably based on crypto and blockchain technologies. This is why we are so excited to launch this crypto-enabled treasury management use case for ODL with innovative customers like FOMO Pay.“