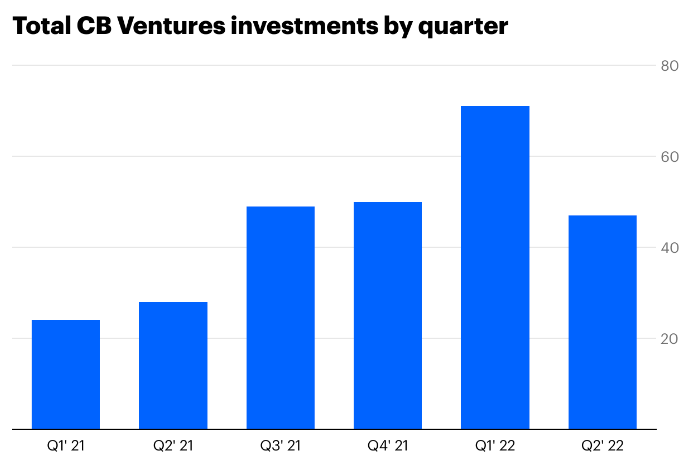

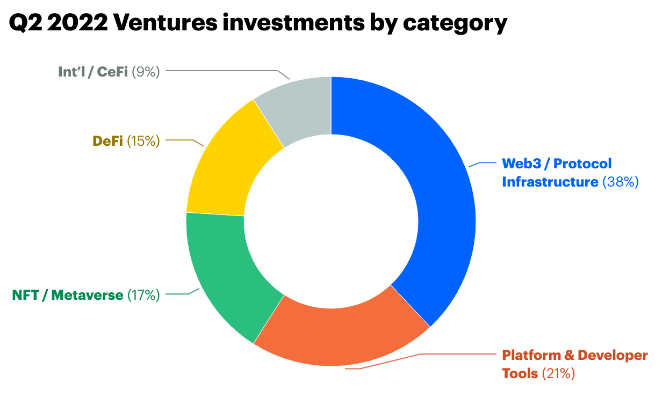

Coinbase Ventures, which is the venture capital arm of Coinbase (NASDAQ: COIN), talked about several interesting topics in a report released on Thursday (July 21).

In a blog post published on July 21, Coinbase Ventures started by talking about the venture landscape:

“The broader venture market began to show signs of cooling in Q1, with total funding dropping for the first time since Q2 2019. That trend continued in Q2, with total venture funding dropping 23%, marking the largest dip in a decade… Crypto venture funding still saw a record Q1, but as we wrote in our last letter, we’d already begun seeing signs of a slowdown that we expected to surface in Q2… Crypto venture funding still saw a record Q1, but as we wrote in our last letter, we’d already begun seeing signs of a slowdown that we expected to surface in Q2.“

They then talked about Web3:

“With an estimated 3.2B+ gamers in the world, we strongly believe that Web3 gaming will onboard the next massive wave of crypto users. Web3 gaming remained a sector of heavy investment in Q2, with The Block estimating that $2.6B+ was raised. Our activity over the last few quarters only strengthens our conviction… As we saw in Q1, founders with strong track records in Web2 gaming continue to embrace this category… The space has also attracted Justin Kan, co-founder of the game streaming platform Twitch, which was sold to Amazon for $1B. Kan’s new company, Fractal*, is building a marketplace for NFT gaming assets…

“It will take some time for this sector to mature, but it’s growing increasingly clear that blockchain gaming will be a massive category in the future… Beyond gaming, the next generation of Web3 user applications are working to upend the captive models of Web2 and to give users control over their audiences and communities. One company we’re particularly excited about is Farcaster*: a sufficiently decentralized social network founded by Coinbase alumns Dan Romero and Varun Srinivasan.“

As for Solana ($SOL) and its ecosystem, they said:

“Noticeable in our Q2 activity was the continued momentum behind the Solana ecosystem. While Ethereum and the EVM remain king as far as developer traction and compatible apps, we’re noting a clear trend in early teams placing importance on Solana. All in, we did 10 deals building on Solana in Q2… Increasingly, we’re seeing teams opt to support both the EVM and Solana from the onset — like recent additions in Coherent and Moralis… Add in the fact that multiple large funds have publicly expressed support for the ecosystem, and it suggests that Solana’s staying power is real.“