On Monday (June 13), with most top 50 cryptoassets suffering double-digit percentage losses in the past 24-hour period, Ryan Watkins, who is a Co-Founder of crypto-focused investment firm Pangea Fund Management, talked about the importance of “not missing the forest for the trees.”

Watkins, who is a former Senior Research Analyst at Messari, and his friend Daniel Cheung, started their own crypto hedge fund — Pangea Fund Management, which is backed by private investment firm Bain Capital — last month:

Back on May 4, Watkins said that although “crypto public markets offer the greatest investment opportunity across any asset class over the next decade,” it is “underserved by liquid managers built for the industry’s next leg of growth as it’s leading projects scale from 1 to 100.” He went on to add that they aim to be “active participants in protocol governance and support the cryptoeconomy’s leading infrastructure protocols as they ride up the S curve to global adoption.”

Well, earlier today, Watkins said that although the current macro event provided the “spark” for the “wildfire” we are witnessing in the crypto market, it should be acknowledged that “the harsh truth is there’s a lot of dead wood to burn in crypto.”

He went on to say:

“Nothing wrong with being a long-term optimist on this industry. I’m fully convinced there is no better industry to bet on over the next decade than crypto. But just because crypto may be the best secular growth story does not mean crypto is 100% secular.“

It is worth mentioning that Watkins warned everyone about the danger signs back on February 11:

Image Credit

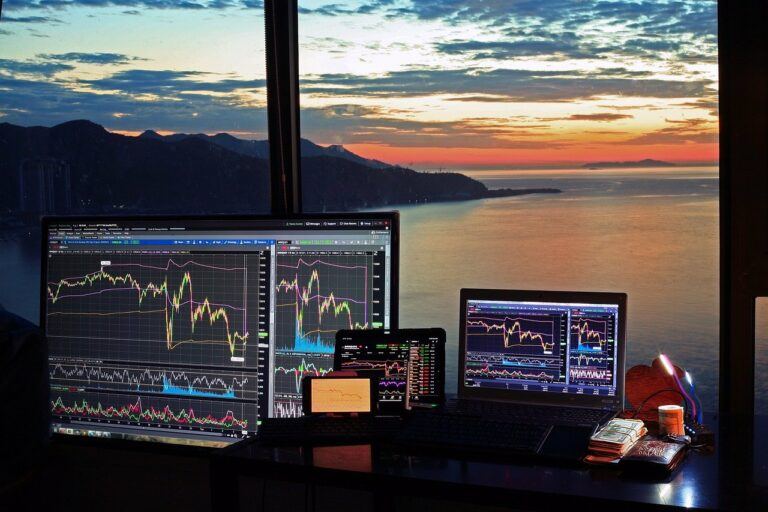

Featured Image by “sergeitokmakov” via Pixabay.com