On Wednesday (June 22), Max Raskin, Adjunct Professor of Law at New York University School of Law, said that Bitcoin “isn’t going away because the ideology underlying it isn’t going away.”

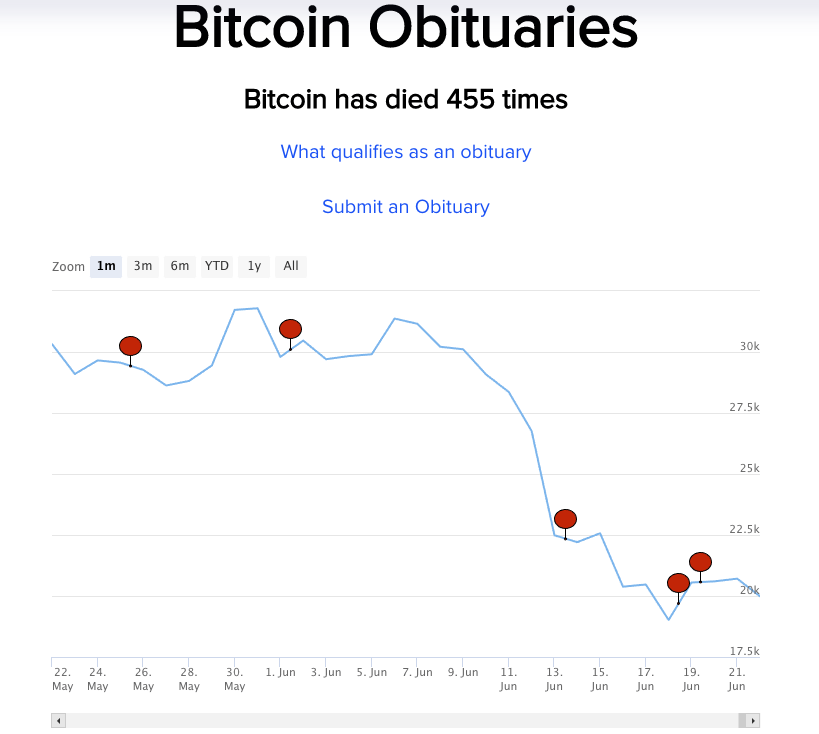

In an op-ed piece (titled: “Don’t Believe the Obits for Bitcoin”) for Wall Street Journal (WSJ), Raskin said that Bitcoin’s recent price crash to below the psychologically important $20,000 level is “simply another of bitcoin’s ‘many deaths’.”

Raskin says although some people who bought Bitcoin near its all-time high (reached on 10 November 2021) might be shocked and upset to see Bitcoin currently trading around the $20K level and asking how the Bitcoin price could have fallen so much, the better question is this: “Why is this internet-created money, started by an unknown programmer on an obscure web forum, trading so high?“

He then went on to say that “Bitcoin isn’t going away because the ideology underlying it isn’t going away”, and why Bitcoin’s latest price crash is not going to mean much to early investors:

“It may seem paradoxical to invest in a ‘predictable’ money that loses 70% of its value, but early investors believe that in the long run the predictability of supply will be more important than demand-driven booms and busts. Bitcoin ownership is highly centralized in the hands of individuals who seldom move their coins. If you weathered the 2011 crash from $30 to $2 or the 2018 plummet from $19,000 to $5,000, this latest crash won’t shatter your belief in this project.“

On June 19, Binance Co-Founder and CEO Changpeng Zhao (aka “CZ”) tweeted that — although he was not offering any kind of financial advice — buying some $BTC every time there is another “bitcoin is dead” headline might not be a bad Bitcoin investing strategy.

Image Credit

Featured Image by “SnapLaunch” via Pixabay.com