On Monday (May 16), Do Kwon, Co-founder and CEO of Terraform Labs — as well as a director at Luna Foundation Guard (LFG), put up a new proposal up for a governance vote on May 18 (“Asia time”).

As leading digital asset market data provider CryptoCompare said in an excellent comprehensive report (titled: “Exploring UST’s Fall From Grace”) published on May 13, “the recent blowup in the Terra ecosystem has been one of the most impactful events in the history of crypto – comparable with the collapse of Mt. Gox in 2014 and the sharp market crash in January 2018 and in March 2020.”

In a series of tweets sent out on May 15, Binance Co-Founder and CEO Changpeng Zhao (aka “CZ”) said:

- Although Binance Labs “invested $3m USD in Terra (the layer 0 blockchain) in 2018”, stablecoin TerraUSD ($UST) did not exist at that time, and Binance did not “participate in the 2nd round of Luna’s fund raising” nor did it “acquire any UST.”

- Binance Labs has “invested in hundreds of projects over the last 4 years, including exchange ‘competitors’ and many ‘competing’ blockchains.” A few have “fallen by the wayside” and a few have “been extremely successful”.

- Over “the last few days,” Binance “tried hard to support the Terra community.” In his tweets, he had tried to address various issues based on his understanding of the situation.

- He wants to see “much more” transparency from Terraform Labs, “including specific on-chain transactions (txids) of all the funds”.

- Although “failures can/will happen”, it is “extremely important” to have “transparency, speedy communication and owning responsibility to the community.”

- Regardless of whatever solution is chosen in the end, Binance stands ready to “support the community” in any way it can.

According to Terraform Labs’ new proposal, “while UST has been the central narrative of Terra’s growth story over the last year, the distribution of UST has led to the development of one of the strongest developer ecosystems in crypto,” which means that “the Terra ecosystem and its community are worth preserving.”

Here is a summary of the plan:

- “Fork the Terra chain into a new chain without the algorithmic stablecoin. The old chain to be called Terra Classic (token Luna Classic – LUNC), and the new chain to be called Terra (token Luna – LUNA)

- “Luna to be airdropped across Luna Classic stakers, Luna Classic holders, residual UST holders, and essential app developers of Terra Classic.

- “TFL’s wallet (terra1dp0taj85ruc299rkdvzp4z5pfg6z6swaed74e6) will be removed in the whitelist for the airdrop, making Terra a fully community owned chain

- “Allocate a large portion of the token distribution in 1) providing emergency runway for existing Terra dapp developers 2) align interest of devs with the long term success of the ecosystem

- “Network security to be incentivized with token inflation. Target staking rewards of 7% p.a.“

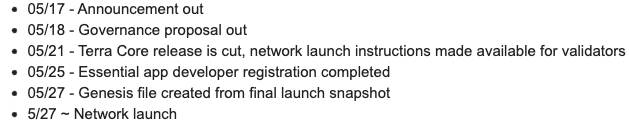

And this is the proposed timeline:

CZ does not appear to be too impressed with this proposal, judging by the following very succinct tweet, which merely contains the acronym “SMH”, which stands for “shaking my head”:

This is not too surprising since on May 14 CZ had this to say on Twitter about the idea of making a new fork of the Terra blockchain:

“Forking does not give the new fork any value. That’s wishful thinking.“

As for the ramifications of the $LUNA / $UST debacle for the crypto space, the above-mentioned CryptoCompare report says:

“Looking forward, the digital asset space is undoubtedly in a bear market. The Terra ecosystem, which was previously the second biggest by Total Value Locked (TVL) just under Ethereum (with a peak TVL of $21.7bn on May 5th) has been dismantled – any projects that raised funds in LUNA or UST will close or be in disarray for the foreseeable future.

“As aforementioned, we believe it will take time for the market volatility in the ecosystem to subside – in these coming weeks we will find out the true cost of this crash. Many projects that were launched during the bull market of the last two years will struggle to survive, specifically those that provide no long-term value, and that may not have access to further capital. Thus, it is very possible, even probable, that crypto markets have some more downside to go, particularly amidst a restrictive macroeconomic environment.

“Having said this, the digital asset space has forever experienced these volatile events. The drawdowns we are currently seeing in Bitcoin and Ethereum, over 50% down from all-time highs, have been experienced on many previous occasions – the COVID-19 crash, the bubble burst of 2018, and the bankruptcy of Mt. Gox in 2014 are some important examples. Cryptocurrencies persevered following all of these events, and we believe this will be no different.

“Digital assets are an important technological innovation, and the vast amount of intellectual capital flowing to the sector from financial services and web2.0, typically seen as the most prestigious industries for recent graduates, provides comfort in the future of the industry.

“In fact, the need for a decentralized alternative to traditional financial systems is as important as ever. With global inflation rates at 40-year highs, and an incoming recession with increasing interest rates, the traditional financial system and the real world economy is heading into a downturn. Digitalization will continue to consume backdated industries, and this will only benefit digital assets.

“This crash points towards the beginning of a possible year(s) long bear cycle, where developers will continue to build and come up with new innovative services in the space. For investors with a long-term timeframe (i.e. 10 years +), the next few months may prove to be a valuable buying opportunity.“

To make sure you receive a FREE weekly newsletter that features highlights from that week’s most popular stories, click here.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.