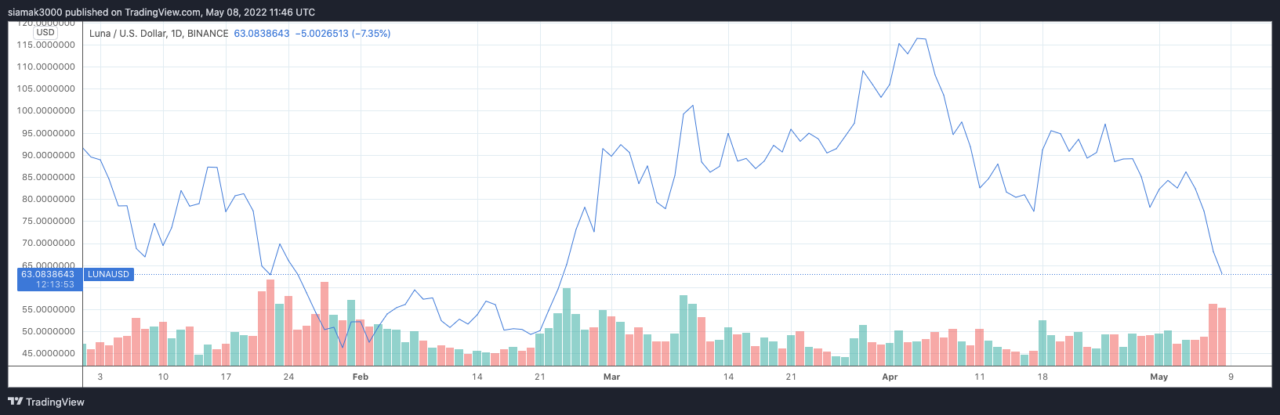

On Sunday (May 8), the price of $LUNA, which is the native staking and governance token of Terra protocol, fell to its lowest level in ten and a half weeks partly due to rumors that stablecoin TerraUSD ($UST) might have come under a co-ordinated attack.

What Is Terra ($LUNA)?

The official Terra documentation has this to say about the Terra Protocol:

“The Terra protocol is the leading decentralized and open-source public blockchain protocol for algorithmic stablecoins. Using a combination of open market arbitrage incentives and decentralized Oracle voting, the Terra protocol creates stablecoins that consistently track the price of any fiat currency.

“Users can spend, save, trade, or exchange Terra stablecoins instantly, all on the Terra blockchain. Luna provides its holders with staking rewards and governance power. The Terra ecosystem is a quickly expanding network of decentralized applications, creating a stable demand for Terra and increasing the price of Luna.“

As for the protocol’s two main tokens, it says:

- Terra: “Stablecoins that track the price of fiat currencies. Users mint new Terra by burning Luna. Stablecoins are named for their fiat counterparts. For example, the base Terra stablecoin tracks the price of the IMF’s SDR, named TerraSDR, or SDT. Other stablecoin denominations include TerraUSD or UST, and TerraKRW or KRT. All Terra denominations exist in the same pool.“

- Luna: “The Terra protocol’s native staking token that absorbs the price volatility of Terra. Luna is used for governance and in mining. Users stake Luna to validators who record and verify transactions on the blockchain in exchange for rewards from transaction fees. The more Terra is used, the more Luna is worth.“

And this is Binance Academy’s brief explanation of what Terra is:

“Terra is a blockchain network built using Cosmos SDK specializing in stablecoin creation. Rather than use fiat or over-collateralized crypto as reserves, each Terra stablecoin is convertible into the network’s native token, LUNA. LUNA allows holders to pay network fees, participate in governance, stake in the Tendermint Delegated Proof of Stake consensus mechanism, and peg stablecoins.

“To peg a stablecoin like TerraUSD (UST), a USD value of LUNA is convertible at a 1:1 ratio with UST tokens. If UST’s price is, for example, at $0.98, arbitrageurs swap 1 UST for $1 of USD and make 2 cents. This mechanism increases UST demand and also reduces its supply as the UST is burned. The stablecoin then returns to its peg.

“When UST is above $1, say at $1.02, arbitrageurs convert $1 of LUNA into 1 UST and make 2 cents. The supply of UST increases, and demand for UST also decreases, bringing the price back to peg. Apart from reducing stablecoin volatility, validators and delegators stake LUNA for rewards. These two actors play an essential part in keeping the network secure and confirming transactions.

“You can purchase LUNA via Binance and then store it, stake it, and participate in governance with Terra Station, the official wallet and dashboard for the Terra blockchain network.“

Price Action of $LUNA and $UST

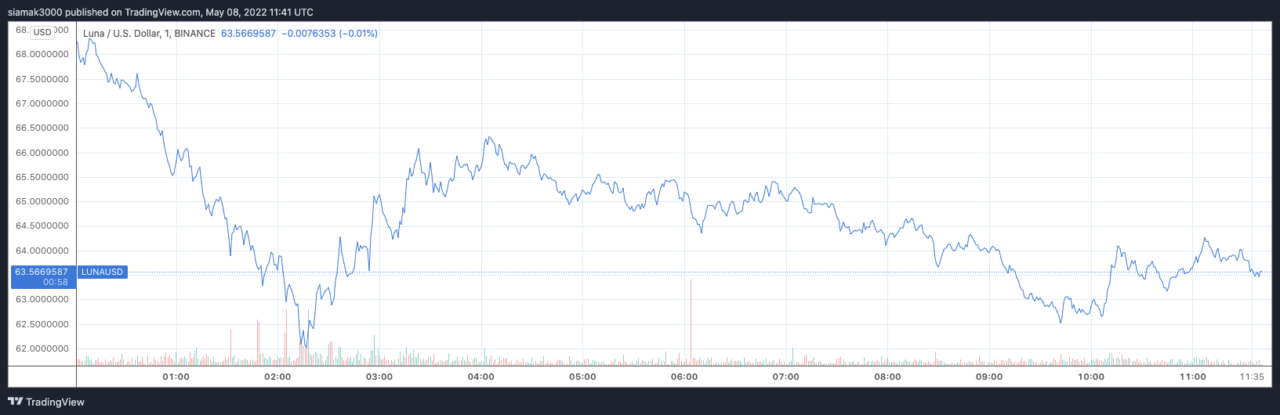

According to data by TradingView, at 2:17 a.m. UTC on May 8, the price of $LUNA fell to $62.01 (on crypto exchange Binance), which is the lowest it has been since February 24, the day on which Russia started its “special military operation” in Ukraine.

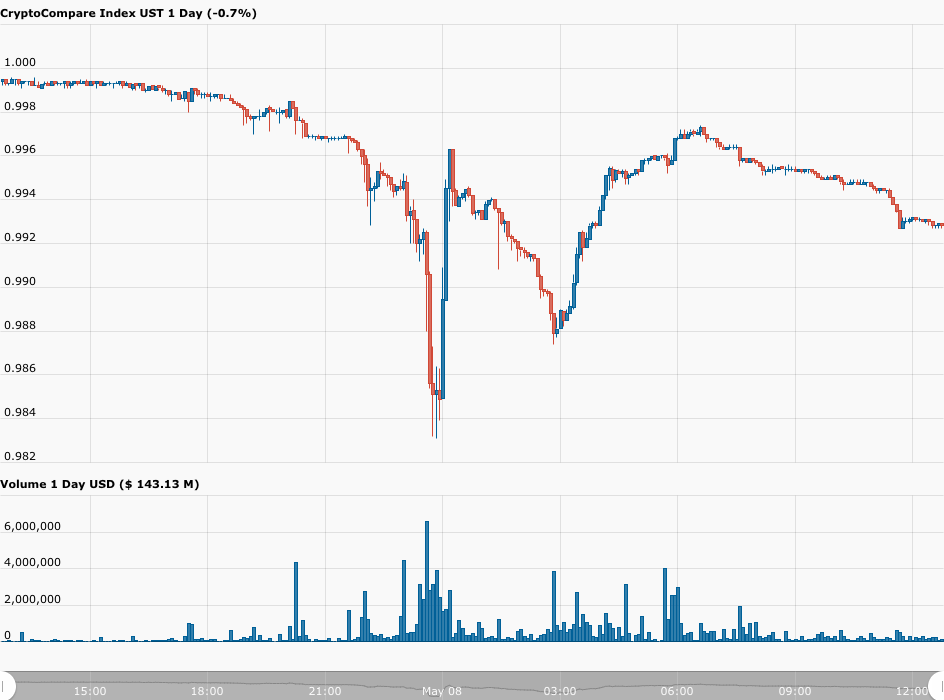

As for algorithmic stablecoin $UST, per data from CryptoCompare, at 10:50 p.m. UTC on May 7, it fell to an intraday low of $0.9831.

Some members of the crypto community claimed that the drop in the value of $LUNA was partly the result of a deliberate and co-cordinated attack.

For instance, Caetano Manfrini, legal officer at Brazilian crypto business forum GEMMA, said:

Here is another example:

Crypto influencer Ran Neuner, who is the host of the YouTube show “Crypto Banter”, was another of people that agreed with this view, but he did not seem too upset because he believes that “every attack makes $LUNA more resilient.”

However, Do Kwon, Co-founder and CEO of Terraform Labs — as well as a director at Luna Foundation Guard (LFG), did not appear too concerned about the temporary de-pegging of $UST:

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured Image by “rkarkowski” via Pixabay