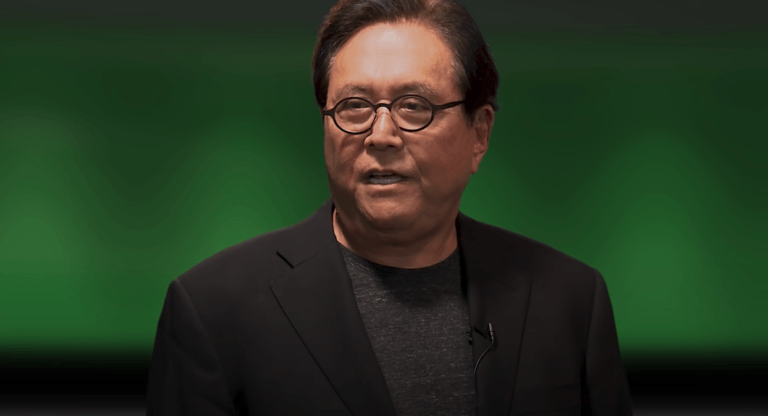

On Thursday (May 12), Robert Kiyosaki, the highly successful author of the “Rich Dad Poor Dad” series of personal finance books, shared his latest thoughts on Bitcoin.

“Rich Dad Poor Dad“, which is one of the top 10 personal finance books of all time, “advocates the importance of financial literacy (financial education), financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence (financial IQ) to improve one’s business and financial aptitude.”

At various times during the current COVID-19 pandemic, Kiyosaki has been criticizing the Federal Reserve’s response to the resulting economic fallout and strongly urging his large following on social media platforms to protect themselves from what he feels is inevitable high inflation (and possibly hyperinflation) in the future by using their fiat holdings to buy silver, gold, and Bitcoin.

Episode #263 of Anthony Pompliano’s “Pomp Podcast”, which was released on 7 April 2021, featured an interview with Kiyosaki. During that interview, Pompliano asked for Kiyosaki’s thoughts on “traditional inflation hedge” assets.

Kiyosaki said:

“Gold and silver are God’s money. Bitcoin is open source people’s money.“

On April 25, Kiyosaki published a tweet warning that the markets were heading for potentially the biggest economic depression in history.

Yesterday, Kiyosaki said that he is happy about the recent drops in the Bitcoin because he is hoping to buy more $BTC below the $20K level, and ideally around $17K.

And earlier today, he explained why he said in the above tweet why crashes are good if your goal is to get rich(er).

To make sure you receive a FREE newsletter every Friday that features highlights from that week’s most popular stories, click here.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.