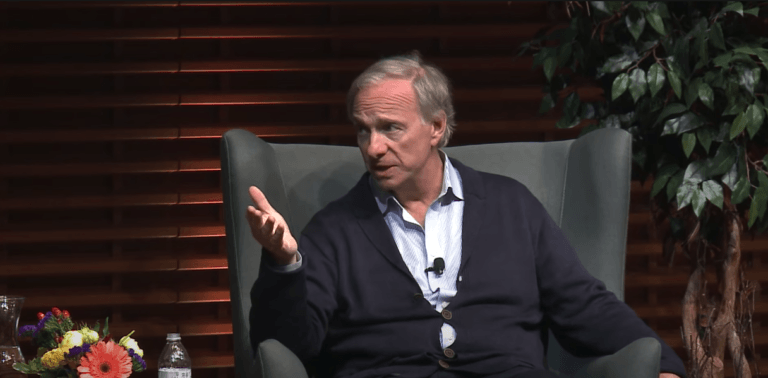

On Tuesday (May 24), legendary billionaire hedge fund manager Ray Dalio, founder, co-chairman, and co-chief investment officer of Bridgewater Associates, was interviewed at Davos 22 by Andrew Ross Sorkin on CNBC’s “Squawk Box”.

The 72-year American whose net worth is estimated to be around $22 billion (as of 25 May 2022) created asset management firm Bridgewater Associates from his New York City apartment just two years after receiving his MBA from Harvard Business School. Bridgewater Associates had $138 billion in assets under management as of April 2020 and its many institutional clients include “pension funds, endowments, foundations, foreign governments, and central banks.”

Dalio had an interview with Yahoo Finance correspondent Julia La Roche took place on 26 October 2020 at a virtual event called “Yahoo Finance All Markets Summit: Road to Recovery“.

Near the end of the interview, Dalio was asked for his take on digital currencies. This is how he replied:

“Digital currencies — let me break them down into two types. There’s the type in which it’s like a Bitcoin type of currency that’ll be an alternative currency in terms of its supply/demand and an alternative storehold of wealth… and then there’s digital currencies — that means they’ll be other types of currencies, let’s say the dollar or the euro or the Chinese Renminbi be that is digitalized.

“I think we’re going to see a lot more of that second type, but I think that there are three main problems of the first type… Theoretically it’s good, but the three basic things are a currency has to be an effective medium of exchange, storehold of wealth, and the governments want to control it.

“So, I today can’t take my bitcoin yet and go buy things easily with it, and as a storehold of wealth, it’s so volatile that its volatility based on speculation is so much greater that it’s not an effective storehold of wealth and which is also one of the reasons it’s a problem to be a transaction vehicle because if a vendor says I’m going to get paid in Bitcoin and they don’t know what that means in terms of their other liabilities — that’s a problem.

“And then thirdly… if it becomes material, governments won’t allow it. I mean, they’ll outlaw it, and they’ll use whatever teeth they have to enforce that. They would say, okay, you can’t transact with Bitcoin, you can’t have Bitcoin. So, then you have to sort of be almost like ‘is it a felony and I’m gonna have to be a felon in order to transact?’

“They outlawed gold, you know, what’s what’s wrong with gold? But gold was a storehold of wealth, and so if I was to say would I prefer bitcoin to gold, no, I wouldn’t prefer Bitcoin to gold. Gold will be the vehicle that central banks and countries use as an alternative to the regular cash because each central bank can print cash but through transactions, through time, when countries dealt with each other, they used gold because they didn’t have to worry about being devalued by some country that’s going to print the gold.

“And so it still is our third largest reserve [asset]. If you take central bank reserves, the largest is the dollar, the second largest is the euro, and the third largest is gold… But I don’t think digital currencies will succeed and in the way people hope they would for those reasons.”

Anyway, here is what Dalio had to say during his interview with Sorkin at this year’s World Economic Forum (WEF) Annual Meeting in Davos, Switzerland.

Below are some excerpts from this interview (based on a transcript provided by CNBC).

Dalio On Cash

“Of course, cash is still trash. Cash – i’m asking you, do you know how fast you’re losing buying power in cash?“

Dalio on Fiat Currencies

“So when I say cash is trash, what I mean is all currencies in relationship to the euro, in relationship to the yen, all of those currencies like in the 1930′s will be currencies that will go down in relationship to goods and services.“

Dalio on Blockchain Technology and Cryptocurrencies

“Cryptocurrencies in particular — I think blockchain’s great. But let’s call it a digital gold. I think a digital gold, which would be a Bitcoin kind of thing, is something that — probably in the interest of diversification of finding an alternative to gold — has a little spot relative to gold and then relative to other assets...

“What is the type of money that you could move between countries that’s a medium of exchange and a storehold of wealth? So that’s what I’m talking about, and I’m saying that Bitcoin has made a tremendous achievement over the last 11 years… It’s a tiny percentage of my portfolio. I think the Bitcoin people get too preoccupied with it. The gold bugs get too preoccupied with it. And I think you have to look at the broader set of assets that serve that purpose.“

To make sure you receive a FREE newsletter every Friday that features highlights from that week’s most popular stories, click here.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.