A panel of cryptocurrency industry experts has predicted the price of the second-largest cryptocurrency by market capitalization, Ethereum ($ETH), could jot $5,780 by the end of the year, and surge to $11,760 by 2025.

The figures come from a panel of experts Finder surveyed that gave predictions on the future of the cryptocurrency. Finder measures expert predictions using weekly and quarterly surveys, and found that experts became more bearish on the cryptocurrency since the start of the year.

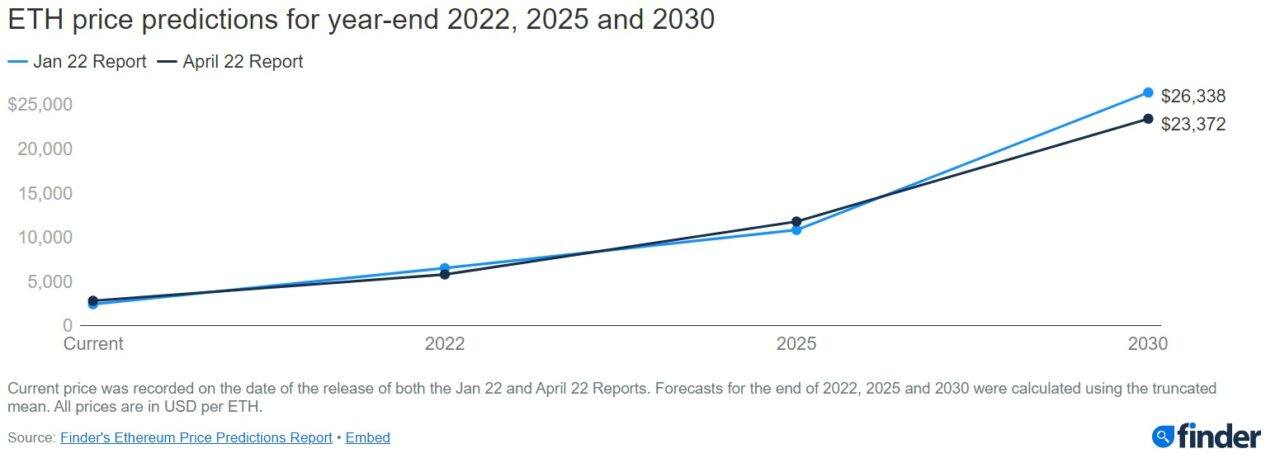

The firm’s latest quarterly survey asked “a panel of 36 industry experts for their thoughts on how Ethereum will perform over the next decade.” Compared to the survey conducted in January 2022, it found experts lowered their predictions from $6,500 for the end of the year.

As for 2025, experts earlier predicted the cryptocurrency would trade at $10,810, but have now upped their price predictions to $11,760. Experts’ predictions for 2030, however, dropped from $26,330 to $23,370.

Some experts, including senior lecturer at the University of Canberra John Hawkins, were rather bearish on the cryptocurrency, saying it and other non-stablecoins “seems to fairly mindlessly follow the BTC price and seem to be part of a common speculative bubble.”

Panel members, the company added, discussed Ethereum’s upcoming merge with its Beacon Chain – which will see the network move to a Proof-of-Stake consensus algorithm – as a move that will improve ETH’s position as a leading blockchain. Thomson Reuters’ Joseph Raczynski was quoted saying:

People have been waiting for this for years. It should be far more secure, 99% more energy-efficient, and deflationary. If that isn’t the trifecta of potential, as a leading blockchain, I don’t know what would be.

Martin Fröhler, CEO of Morpher, predicted ETH would end the year at $10,000 and cited the effects of the merge as a potential reason for that, as the cryptocurrency “will undergo the equivalent of 3 Bitcoin halvings” with the update and will become a “deflationary asset yielding 5-10& APY.”

Fröhler’s words echo a Coinbase report that suggested Ethereum staking yields could double after the network’s merge as “rewards will incorporate net transaction (ex-base) fees currently paid to miners.”

Finder’s panel, when asked whether it’s time to buy, sell, or HODL the cryptocurrency, saw 61% respond that now it’s time to buy, while 32% suggested holders should maintain their positions. Only 6% said now is the time to sell.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash