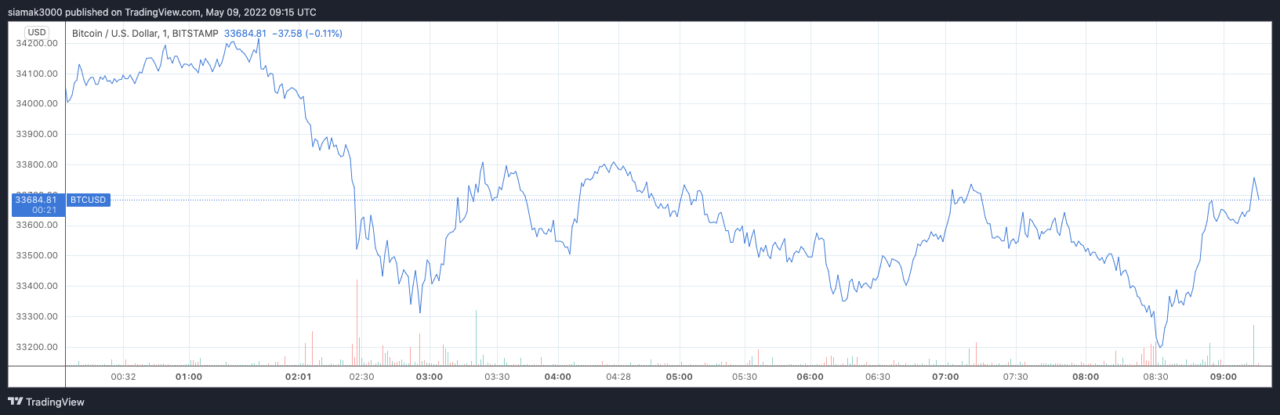

As the Bitcoin price fell on Monday (May 9) to an intraday low of around $33,196 (on Bitstamp), which is the lowest it has been since 23 July 2021, one prominent crypto analyst explained why the $BTC price could be headed to as low as $24,300.

Dylan LeClair, Head of Market Research at Bitcoin Magazine, Senior Research Analyst at UTXO Management, Co-Founder of 21st Paradigm, says that the worst may be far from over since historically in near markets the Bitcoin price has fallen to its realized price (currently, around $24,300).

Data from blockchain analytics startup Glassnode shows that the $BTC hash rate is now at a one-month low.

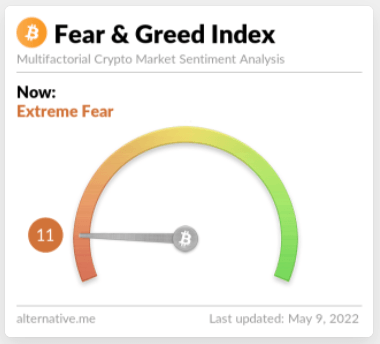

As for market sentiment, the famous Crypto Fear & Greed Index is at the “Extreme Fear” level.

As for why Bitcoin is struggling right now — along with stocks and nearly all non-stablecoin cryptoassets — the main reasons is, of course, the macro headwind of rising interest rates (due to central banks trying to bring down inflation). Geo-political tensions are not helping either. And finally, this past weekend, the struggles of the Terra ($LUNA) ecosystem made things even worse for the cryptoasset sector since some people now fear that if things get really bad, Luna Foundation Guard might end up having to sell some/all of its Bitcoin holdings, which could lower the price of Bitcoin.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured Image by “Donbrandon” via Pixabay.com