In this article, we look at how several important on-chain metrics — that give us an idea of the health of the Cardano network — performed in April 2022.

Please note all the data and charts used in this article come from a Google Data Studio dashboard called “Cardano Blockchain Insights“.

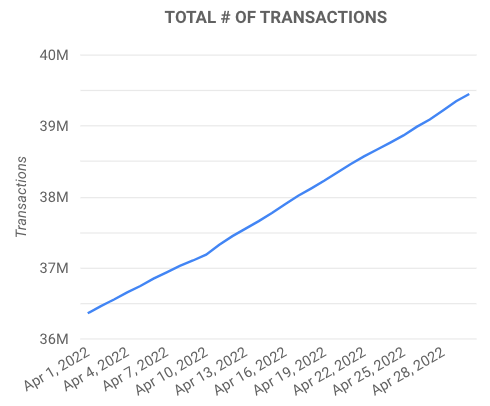

First, the total number of on the Cardano network went up from 8.5%.

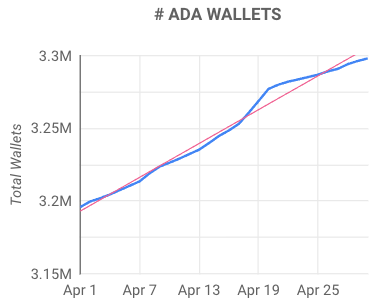

Second, the number of $ADA addresses increased from 3,195,821 to 3,298,113, i.e. went up by 3.2%.

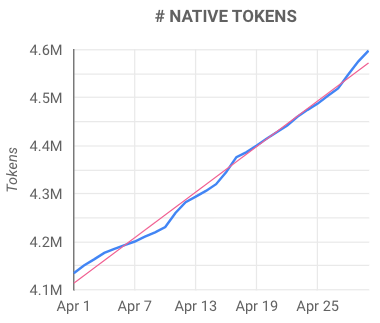

Third, the number of native tokens on the Cardano blockchain went from 4,134,394 to 4,598,178, which is an increase of 11.21%.

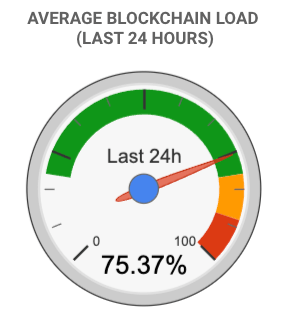

Finally, it is worth noting that currently (i.e. as of 2:20 p.m. UTC on May 2), the average blockchain load in the past 24-hour period is 75.37%.

In early February, Kraken Intelligence, the research arm of crypto exchange Kraken, released a highly impressive research 42-page report (titled “Cardano: A new generation in smart contract platform design”).

Here are a few key highlights from Kraken’s report:

- “Importantly, Cardano is very much a value-driven project, emphasizing community governance, academic peer-review, and the importance of high assurance programming.“

- “Cardano’s values have noticeably directed the project’s developments and design decisions, and as a result, the blockchain looks like it has been designed with the purpose and standards of providing decentralized, global, financial infrastructure rather than only focusing on providing a Web experience.“

- “With ambitious goals, Cardano recognizes the necessity for their infrastructure to run correctly the first time it runs. This is in contrast to a ‘launch now, fix as we go’ philosophy employed by many Silicon Valley development teams.“

- “… Cardano adopted Haskell in an effort to build a product with unmatched advantages in reliability and security and to position itself as a viable solution for institutional-grade, global financial infrastructure.“

- “Cardano saw a massive uptick in adoption starting late 2020 and throughout the course of 2021… Cardano underwent exponential growth in nearly every adoption metric listed, both on-chain and off-chain.”

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured Image by “Quantitatives” via Unsplash