Terra ($LUNA) has been seeing its market capitalization grow steadily over the last few months, to now be among the largest by market capitalization. Within the top 10, it recently surpassed Cardano ($ADA and Avalanche ($AVAX).

According to available data, LUNA’s market capitalization is now standing at $33.5 billion after the cryptocurrency’s price rose nearly 12% over the last seven days. Cardano’s market capitalization, in contrast, is at $32 billion after a 0.14% decline, while Avalanche’s market cap is at $21.35 billion after a 3% rise.

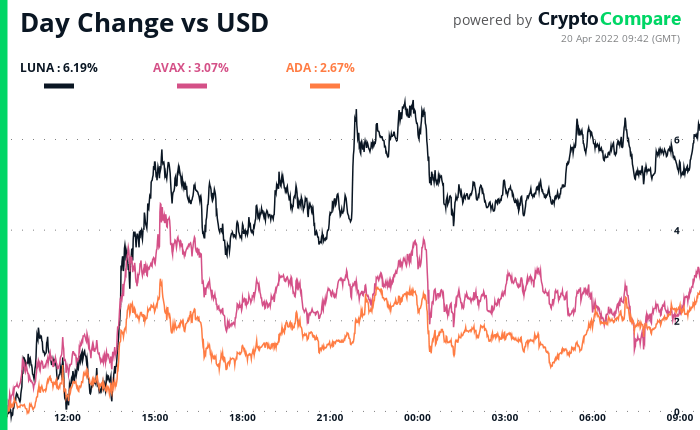

In the last 24-hour period, ADA went up 2.67% while AVAX moved up little over 3%. LUNA, on the other hand, surged over 6%.

Terra’s LUNA s currently trading above the $95 mark, below its all-time high near $120. The cryptocurrency’s price has been rising as its flagship stablecoin UST has been seeing growing adoption, while its decentralized finance (DeFi) space has been seeing a rise in total value locked.

Terra’s DeFi ecosystem is dominated by Anchor ($ANC), which allows users to earn interest close to 20% a year on deposits in UST. The near-20% interest rate isn’t achievable in regular banks nowadays. Terra’s founder Do Kwon has in the past suggested the high interest rate is a reflection of the level of returns DeFi can currently offer investors.

Anchor’s high rates play a vital role in creating demand for UST, meaning a sudden drop could test the cryptocurrency’s peg to the value of the U.S. dollar. Anchor pays deposits with money earned from lending UST to borrowers, in addition to staking rewards.

Anchor’s community has, however, recently noticed the protocol was burning yield reserves faster than expected, forcing $450 million to be injected into it to avoid rates from dropping. If the rates were to drop, analysts expect a scenario similar to one seen when there was a rush to withdraw UST from Abracadabra, another Terra-based protocol, that led to a 36% crash in the price of LUNA.

At the time of writing, Anchor has nearly $16 billion worth of cryptoassets locked on it, while UST has a $17.77 billion market capitalization. The stablecoin recently surpassed BUSD’s market capitalization to become the third-largest stablecoin, behind USDC and USDT.

Despite flipping BUSD in circulating supply – and as a result market capitalization – UST’s trading volumes are well below those of BUSD, a stablecoin supported by leading cryptocurrency exchange Binance.

Terraform Labs, the company responsible for the development of Terra, has been making headlines over the last few weeks as it builds up a BTC reserve for the algorithmic stablecoin. The Luna Foundation Guard (LFG) a non-profit mandated to build reserves for Terra’s algorithmic stablecoin UST, holds close to 40,000 BTC as a reserve for the stablecoin.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash