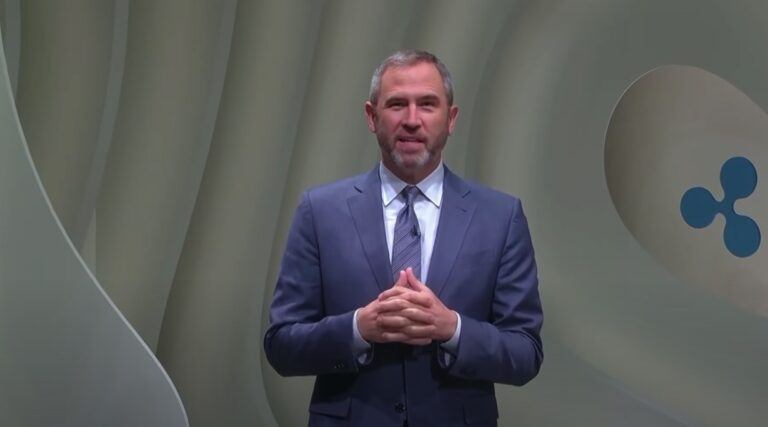

On Tuesday (April 26), Brad Garlinghouse, CEO of Californian FinTech firm Ripple, talked about his company’s court battle with the U.S. Securities and Exchange Commission (SEC), which is arguing that $XRP is an unregistered security, as well as how $XRP is being used outside the U.S.

As you may remember, on 22 December 2020, the SEC announced that it had “filed an action against Ripple Labs Inc. and two of its executives, who are also significant security holders, alleging that they raised over $1.3 billion through an unregistered, ongoing digital asset securities offering.” Essentially, the SEC is arguing that XRP is a security under U.S. federal securities laws.

Yesterday, the Ripple’s SEC was talking about this lawsuit during an interview on Bloomberg TV’s “Bloomberg Crypto” program.

When asked how the case was going, Garlinghouse replied:

“The reason why the Twitter crypto community care so much about this question is it’s not just about Ripple… the whole industry is impacted by this decision. And the core question… boils down to a 1946 Supreme Court case that has become known as the Howey Test, a test to determine is something a security or not…

“The irony is [that] the only country on the planet that thinks XRP is a security is the United States… The case has gone well… the SEC in our judgement has certainly moved slowly. Typically, in these situations ,when the SEC brings the case, they want to move quickly. They have been dragging their feet.

“Gary Gensler recently publicly that justice delayed is justice denied, and unfortunately justice is being delayed here by continuing efforts by the SEC to push things out.”

The Ripple CEO was then told by the interviewer that Bloomberg’s litigation analysts believe that ultimately the SEC will win the lawsuit, and asked how would Ripple respond if that prediction comes true.

He replied:

“I think that the Howey Test is being stretched beyond recognition again… So, the idea that XRP, which we use as a currency, is a security, I think is, you know, just misguided.

“But look, unfortunately, Ripple is already operating in a world where it’s as if we have lost, right? So, in the United States, XRP has all for all intents and purposes, there’s no liquidity. It’s been halted and frozen on most US based exchanges.

“Despite that fact, Ripple had a record year last year. We continued to grow very quickly across our major product groups. Even Q1 was a record for us. Now, unfortunately, that growth is almost all coming from outside the United States, and we are in hiring more and more people outside the United States, but our customer base now is about 95% non US payment companies.”

The Ripple CEO was also asked how those customers outside the U.S. are using digital asset XRP.

He answered:

“The demand for our core product, which uses XRP to facilitate these cross-border payments, grew 8X year over year. So, from Q1 last year to Q1 this year, it grew 8X, and that’s off a base already, measured in the billions. So, from our point of view, demand has skyrocketed.“

On April 15, Garlinghouse explained why his firm uses the $XRP token for payments, why he is “incredibly bullish” on crypto, and why Biden’s executive order about crypto regulation is “very significant”.

Garlinghouse, who was in France for Paris Blockchain Week Summit (PBWS), made these comments during an interview with CNBC.

The Ripple CEO said:

“Ripple uses the XRP token in our tech stack. We use it to enable that cross-border extremely fast and extremely reliable transaction. We use XRP because of its attributes that make it fast and inexpensive. There are other tokens that people use for other use cases that don’t work as well for payments.

“The XRP ledger, from its origins, has really enabled payments at scale… Bitcoin, while it’s very good for digital gold, its speed and cost per transaction make it less attractive for a payment type use case. So, Ripple continues [to use] XRP because [of] its core attributes as a really efficient technology… And I think you’ll see Ripple use the XRP ledger for other use cases as well. We’re certainly making investments, as I mentioned in the carbon credit marketplace, and other verticals that we think could be compelling.“

As for his outlook for crypto market for the rest of the year, Garlinghouse said:

“I guess [it’s] really hard to know the timing, but I’m incredibly bullish on crypto overall, and frankly that’s because the macro factors, and there’s two that I’ll highlight…

“The macro factor on inflation globally… You saw in this past week record inflation in four decades inflation… Inflation in the United States at 8.5%. The other factor — as you and I have talked about the move from crypto overall towards an institutional use case, solving real problems for real customers, and these scaled solutions that aren’t just about speculative activity that has really driven some of the historic crypto market activity.“

And regarding crypto regulation in the U.S. and more specifically the lawsuit the U.S. Securities and Exchange Commission (SEC) initiated against Ripple in December 2020, the Ripple CEO had this to say:

“The core question there is around a nuanced legal question: is XRP a security and did Ripple sell XRP as an investment contracted? Did Ripple sell unregistered securities? Did I, Brad Garlinghouse, sell XRP as an unregistered security?

“I think it’s very clear that in the United States, the laws have not been clear, and for the SEC then to go back in time and say you should have known all along, it’s a hard case. I think what we’re seeing in the court process — which does continue to play out — is a judicial process that recognises some of this.

“Even, this past couple days, a ruling from the court finally requiring the SEC to publish information about some speeches that the Director of Corporate Finance Hinman gave about Ether not being a security. And the fact that even now you have the SEC not able to answer the question is Ether a security. They won’t answer that question.

“They’re saying there’s clarity, but then they won’t provide clarity. They’re saying they won’t comment on specific projects, but they comment on Bitcoin. Bitcoin is one of the largest projects, but yet still just a project.“

And finally, when asked about the Executive Order on “Ensuring Responsible Development of Digital Assets”, which was signed by President Biden on March 9, Garlinghouse stated:

“I think it was very significant. I was very positive. Frankly, the leadership we’ve seen outside of the United States in crypto regulation is way ahead of where it has been in the U.S. It’s something we’ve been saying for years, and I think at the core of the executive order from the Biden administration is acknowledging that exact point that the competitiveness of the U.S. in these developing markets around crypto, around blockchain technologies, has fallen behind.

“And more and more investment, and more and more talent is going outside the United States. When entrepreneurs here in Paris talk to me about starting companies in the crypto space, one of the first things I’ll recommend to them is you shouldn’t start the company in the United States because there isn’t that clarity… Even for Ripple, we’ll hire over 300 people this year. Well over half of those, I expect to be non-US-based.“

According to CNBC’s report, the Ripple CEO also talked about the SEC’s lawsuit against his company (as well as personally against him and Ripple’s Executive Chairman Chris Larsen) during a Fireside Chat (at PBWS 2022) with CNBC reporter Ryan Browner:

“The lawsuit has gone exceedingly well, and much better than I could have hoped when it began about 15 months ago… But the wheels of justice move slowly.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.