The total sales volume of non-fungible tokens (NFTs) on the Solana ($SOL) blockchain has recently surpassed the $1.5 billion mark as the network distances itself from other Ethereum competitors including Polygon ($MATIC) and Avalanche ($AVAX).

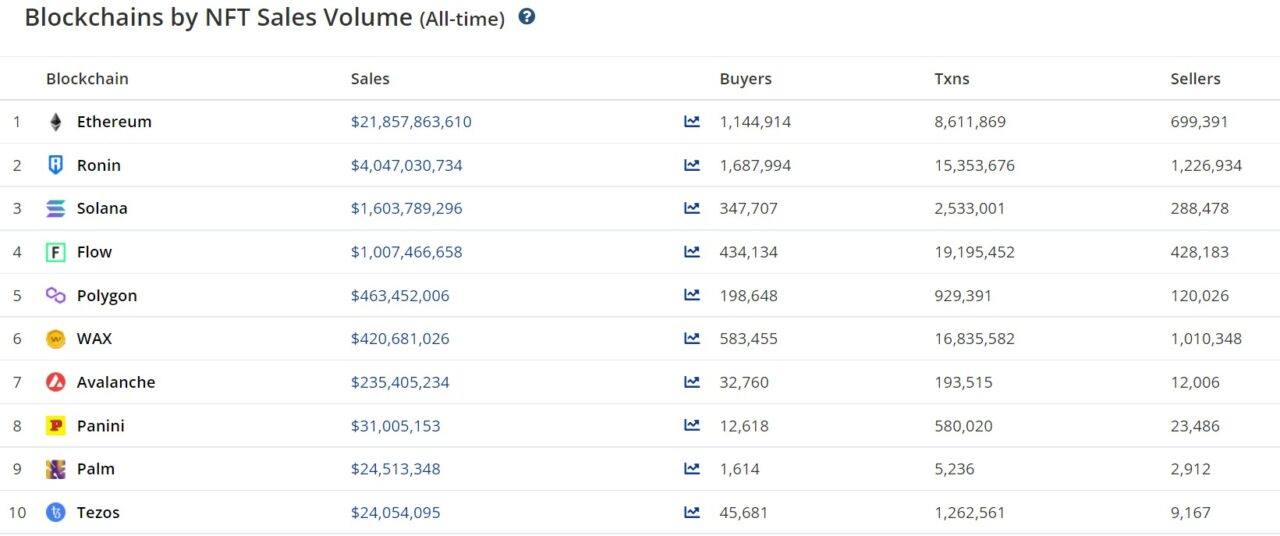

According to CryptoSlam data, Ethereum leads the market when it comes to NFT sales, having seen over $21.8 billion worth of these tokens go to over 1.14 million buyers over 8.6 million transactions. It’s followed by the Axie Infinity sidechain Ronin, which was hacked late last month.

Solana comes in third place with now $1.6 billion in sales over 2.5 million transactions to 357,000 buyers, data shows. Next to it comes Flow, with $1 billion in sales. Flow, it’s worth noting, is the sidechain used for NBA Top Shot, a popular NFT game.

Flow is followed by Polyon, WAX, and Avalanche. Other top cryptocurrency networks by market capitalization leading in NFT sales include Tezos with $24 million in sales and Waves, with $22.9 million in sales.

The increased sales volume comes as support for the Solana ecosystem has been growing. As CryptoGlobe reported, last month Nasdaq-listed cryptocurrency trading platform Coinbase announced its Coinbase Wallet’s desktop extension was adding support for Solana and its SPL tokens.

Similarly, pro-cryptocurrency web browser Opera revealed its built-in crypto wallet and web 3.0 browser is adding support for several major networks, including Solana, Polygon, Axie Infinity’s Ronin, Nervos, Celo, and IXO.

Demand for SOL has been growing over the last few weeks. In an interview with CryptoGlobe Ophelia Snyder, co-founder and president at Switzerland-based firm 21Shares AG, which is considered one of the pioneers in issuing cryptocurrency exchange-traded products (ETPs), has revealed that some of its most successful products at launch were products offering exposure to Solana and Polkadot.

In January, analysts at JPMorgan led by Nikolaos Panigirtzoglou have revealed they see Ethereum, the second-largest cryptocurrency by market capitalization, losing market share to rivals like Solana when it comes to NFTs.

The analysts wrote that just like with decentralized applications “congestion and high gas fees” have been “inducting NFT applications to use other blockchains.” The analysts found that Solana has been a primary beneficiary as it has been seizing market share from Ethereum.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash