On Tuesday (March 29), crypto analytics startup IntoTheBlock (ITB) commented on the increasing institutional appetite for Cardano’s $ADA token.

ITB calls itself “an intelligence company that uses machine learning and statistical modeling to deliver actionable intelligence for crypto assets.”

Here are a few insights about $ADA from ITB:

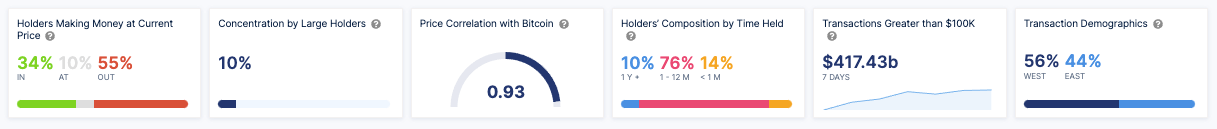

- 34% “in the money” (i.e. current price > average cost); 55% “out of the money” (i.e. current price < average cost)

- concentration by large holders — i.e. “the total holdings of whales (addresses that own more than 1% of the circulating supply) and Investors (addresses that own between 0.1% and 1% of the circulating supply)” is 10%

- 30-day price correlation with Bitcoin is 0.93

- holders’ composition by time held: 10% have held for over a year; 76% have held for one to twelve months; and 14% have held for less than one month

- In the last 14 days, 56% of transactions occurred during Western trading times and 44% during Eastern trading times

On March 29, ITB tweeted that “the volume of on-chain transactions >$100k has increased by 50x just in 2022” and on March 28, “a total of 69.09b $ADA were moved in these large transactions, representing 99% of the total on-chain volume.”

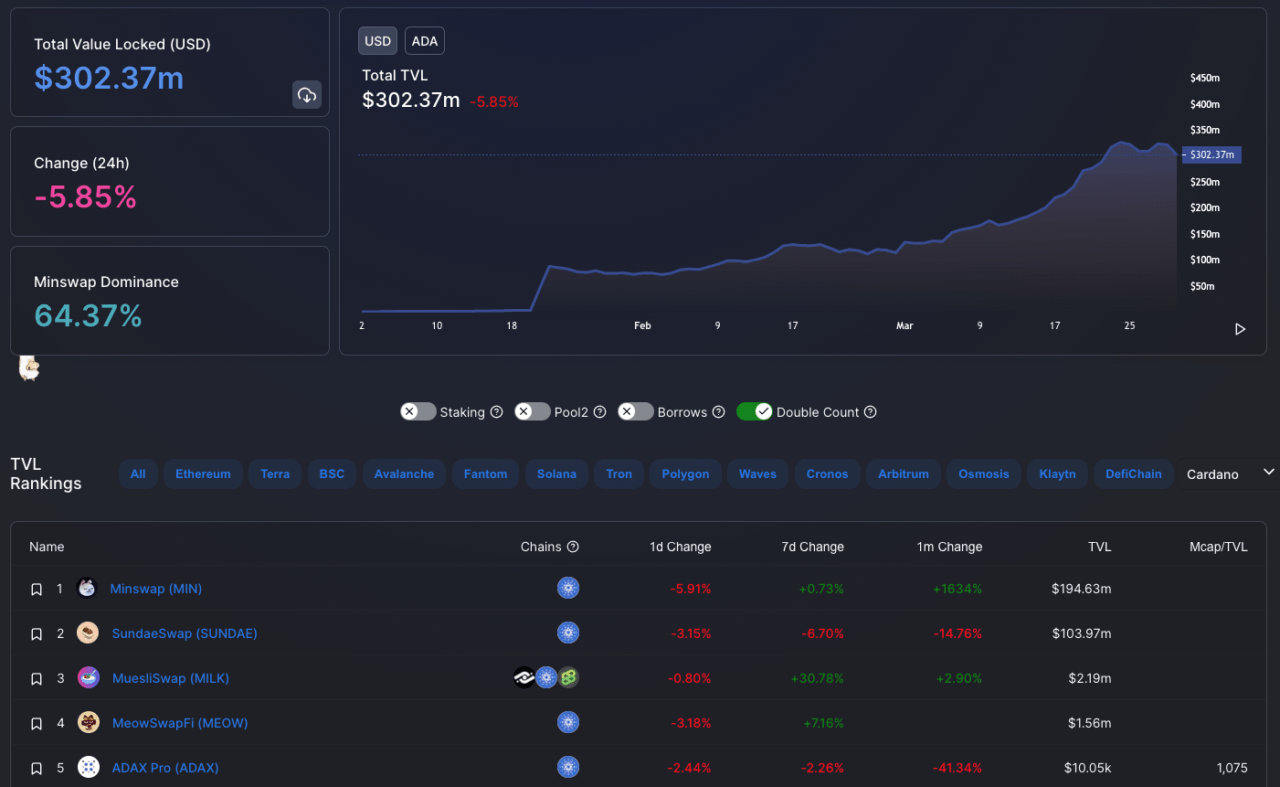

According to data by DeFi Llama, Total Value Locked (TVL) in Cardano’s DeFi protocols currently (as of 5:50 a.m. UTC on March 30) stands at $302.37 million (the all-time high of $326 million was set on March 24).

During the keynote speech at Binance Blockchain Week Dubai 2022 (March 28-30), IOG Co-Founder and CEO Charles Hoskinson had this to say about decentralization:

“If we’re truly decentralized, we have to somehow come together and figure this out. We have to write some sort of constitution for these things; we have to decide ‘What is the Bill of Rights for the use of cryptocurrency and blockchain technology?’…

“There are two paths before us — one, we keep our integrity and we look to decentralization, find these things, understand these things,” he said. “Or, two, we ignore it. In which case we’ll have custodians, we’ll have escort keys, highly centralized, highly optimized consensus algorithms that can be reset at any time. The few will be in control of the many.

“This is the decision, and I don’t make that decision — all of you do.“

According to data by TradingView, on crypto exchange Coinbase, $ADA has gone from $0.8651 to $1.1947 (where it is at 6:00 a.m. UTC on March 30), which means a gain of 36.4%.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured Image by “Quantitatives” via Unsplash