Important information: This is a sponsored story. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice. Tax rules can change and the value of any benefits depends on individual circumstances.

AnchorSwap, an inclusive decentralized finance (DeFi) ecosystem with an automated market maker (AMM) decentralized exchange at the heart of it, is bringing “crypto for everyone” through its DeFi products.

The platform is built on top of the Binance Smart Chain (BSC) to ensure transactions on its ecosystem have low fees attached to them and can be used by anyone within the cryptocurrency space. It currently offers users a decentralized exchange based on an AMM protocol, along with liquidity farms, pools, and a blockchain-based lottery service.

The DEX has six active pools covering major tokens on the Binance Smart Chain including its native $ANCHOR token. These pools are for BNB, ANCHOR, BUSD, BTCB, ETH, and PancakeSwap’s native CAKE token.

AnchorSwap is part of AnchorFinance, an ecosystem supported by legal entities like B&GR GmbH, a virtual asset service provider, Chiffre IT Solution DOO, a blockchain product development company, and The Crypto Team, a VIP sales office in Dubai.

The company is a licensed fiat to cryptocurrency gateway and is authorized for a number of activities according to its license, including software development, numerous financial activities, computer programming and consulting, and more.

What sets AnchorSwap apart

AnchorSwap sets itself apart from other decentralized finance platforms by offering a multi-product all-around DeFi ecosystem that isn’t just based on a cheaper-to-use blockchain but is also built on top of solid fundamentals that help users do more with their crypto.

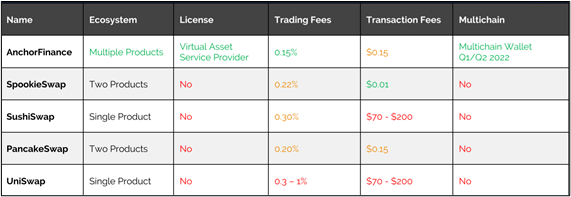

AnchorFinance has developed multiple products under its Virtual Asset Service Provider license and charges a simple 0.15% trading fee on the AnchorSwap decentralized exchange, which is added to the $0.15 transaction fees that the average Binance Smart Chain transaction incurs.

Other popular decentralized platforms either have one or two products and have transaction fees that can be as high as $200 on the Ethereum network, on top of a 0.3% to 1% trading fee, depending on the pools being used. SushiSwap, PancakeSwap, and Uniswap are built on top of single chains, while AnchorSwap is going multichain in the first half of 2022.

AnchorFinance also follows the highest security standards while its products are suitable for both cryptocurrency newcomers and advanced users looking to diversify their exposure or settle in an all-in-one platform.

Honoring its slogan, AnchorFinance aims to bring “crypto for everyone” through its services.

The future of AnchorFinance

AnchorFinance has a number of new products and services getting ready to launch. In the future it’s set to launch a non-fungible token (NFT) platform for the first half of 2022, offering its users access to this booming market.

The platform’s NFT marketplace aims to create and share NFTs through a straightforward user experience that’s easy to use even for newcomers. Coding experience isn’t required to use the platform.

On top of that, AnchorFinance is launching its AnchorLink multichain wallet in the second quarter of this year. This cutting edge application will allow users to store their tokens on a wallet built with AnchorFinance’s ecosystem as well as exchange fiat to crypto, swap the cryptos and stake in the farms and pools.

$ANCHOR Tokenomics

The $ANCHOR token, which is at the heart of AnchorFinance, is built on top of the Binance Smart Chain, as mentioned above, and has a number of use cases associated with it within that ecosystem.

The ANCHOR token has a limited supply of 250 million that is expected to be reached by the end of next year. A 9% of the tokens being issued are shared with the platform’s development team to ensure its steady growth.

Moreover, each ANCHOR transaction incurs a 2.5% tax, out of which 2% are automatically distributed to AnchorSwap’s liquidity pools and 0.5% are burned to ensure a deflationary policy is maintained.

You can learn more about AnchorSwap on the platform’s website.