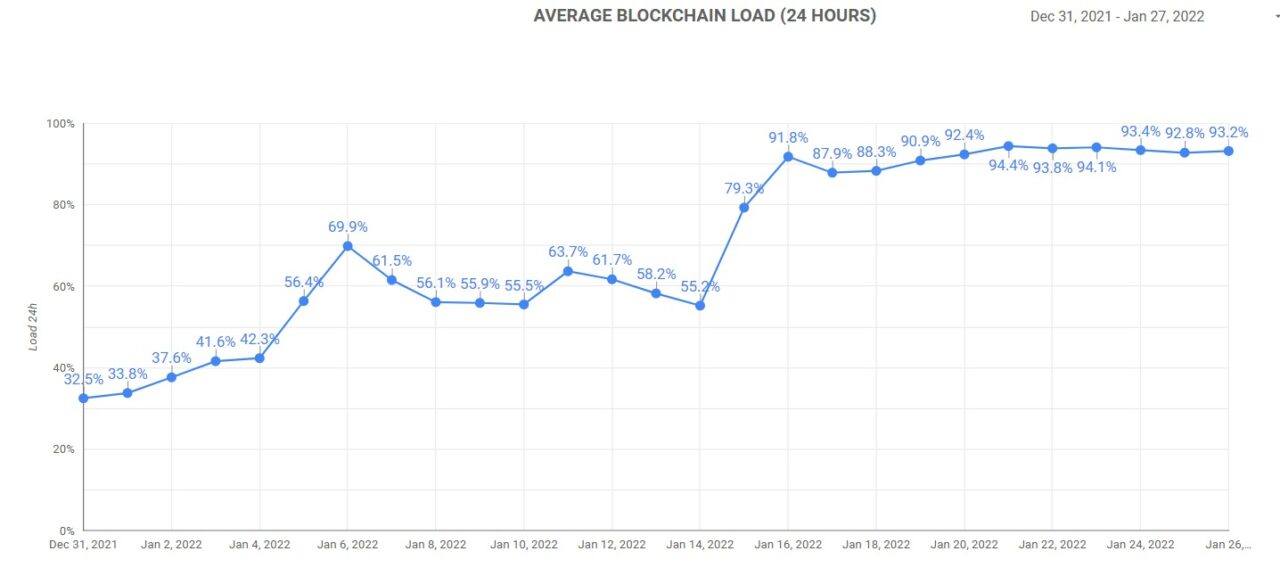

The average blockchain load on the Cardano ($ADA) network has consistently been above 90% over the last few days as decentralized finance (DeFi) applications on the cryptocurrency’s network keep gaining steam.

According to Cardano blockchain insights shared on Google’s Data Studio, the cryptocurrency’s network load started surging between January 14 and 15, weeks after the launch of the network’s first usable DeFi application MuesliSwap, which went live after conducting an under-the-radar offering and got to over $1 million in total value locked in two days.

The network’s blockchain load seemingly started surging ahead of the launch of SundawSwap, a “native, scalable decentralized exchange and automated liquidity provision protocol.” The exchange is backed by cFund, Alameda Research, and Double Peak Group.

As CryptoGlobe reported at the time, as Cardano’s blockchain load surged the transaction volume on its network surged to briefly surpass that of the Ethereum blockchain. Cardano’s transaction volume was accompanied by a notable price rise at the time.

Since its launch, SundaeSwap has seen the total value locked on its platform explode to surpass the $72 million mark, while MuesliSwap’s total value locked has since swollen to surpass $2.6 million. In total, DeFiLlama data shows DeFi on Cardano is currently close to having $75 million of total value locked. In comparison, $117 billion are locked on Ethereum and $7.7 billion on Solana.

CryptoCompare’s latest Asset report has shown that in December the number of addresses holding Cardano grew to a new all-time high of 4 million. The report detailed the 4 million figure includes a significant decline in the number of traders holding the cryptocurrency, which plunged 29.4% from 981,000 to 692,000. Long-term holders, the report adds, grew 5.78% to 279,000 last month.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash