In December, a total of 1,464 bitcoin options contracts were traded on the Chicago Mercantile Exchange, showing volume went up 20.6% compared to November. This is the highest level seen since May when crypto prices were at an all-time high and appeared amid a crypto market meltdown.

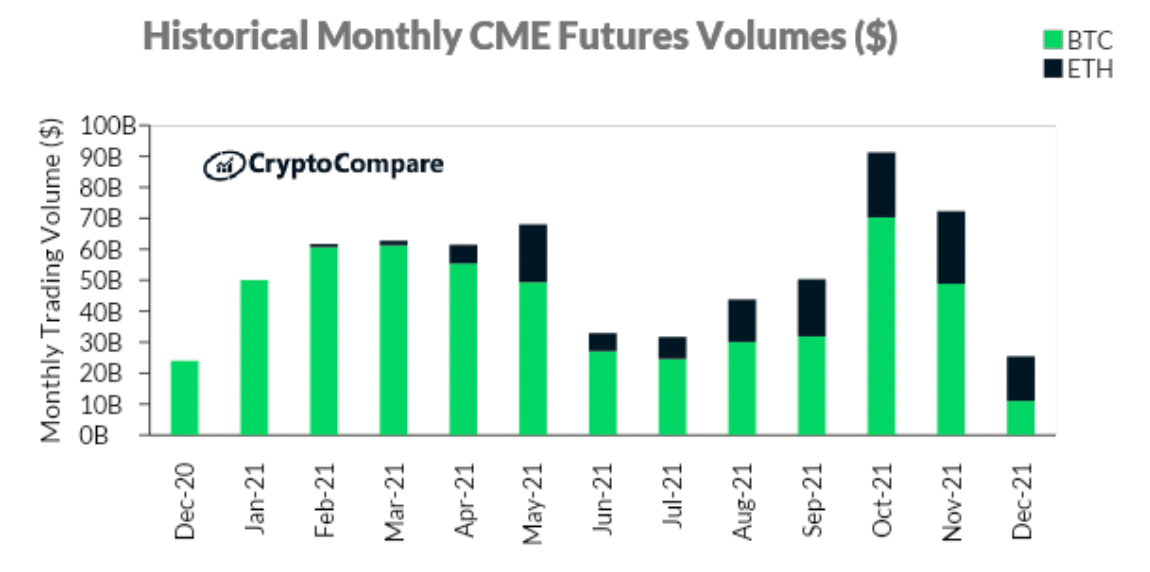

According to CryptoCompare’s December 2021 Exchange Review report, a daily intra-month high of 313 were traded on December 31, a 152% increase from the daily maximum in November. Futures volumes, in contrast, plunged 64.8% to $25.5 billion, their lowest level last year.

CryptoCompare’s report details that last month the price of Bitcoin closed at $46,187 after dropping over 18.9% that month, while Ethereum closed at $3,676 after dropping over 20.5% over the same period.

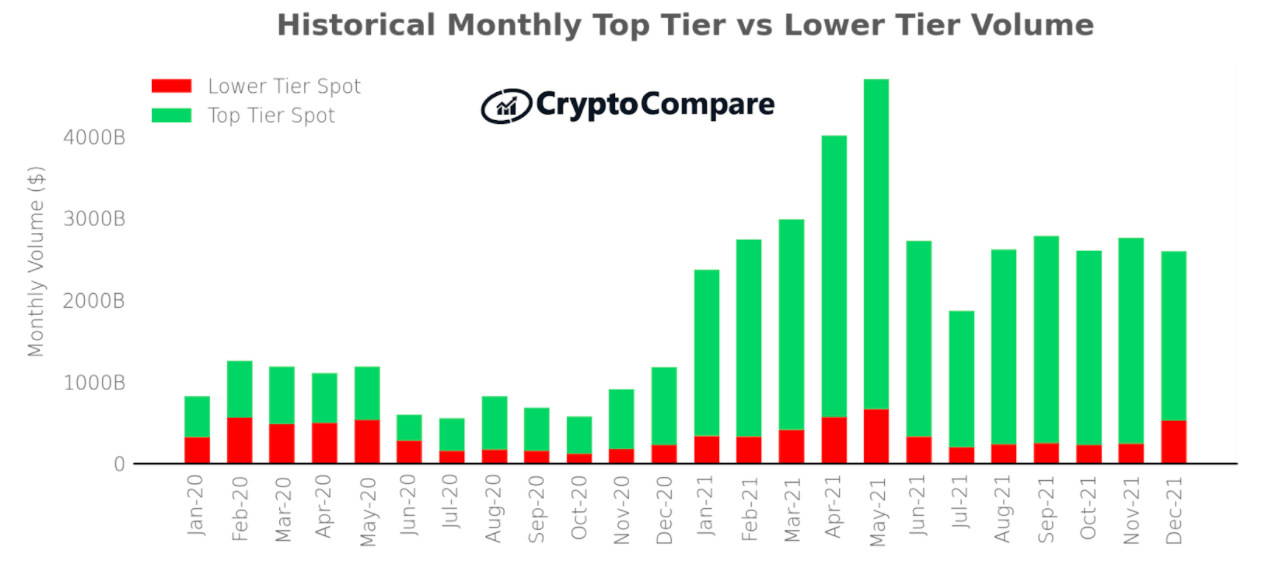

The crypto market downturn saw spot trading volumes decrease to $2.6 trillion over that month, with a daily maximum of $174 billion being traded on December 4. Prices dropped amid inflation worries brought on by a consumer price report in the U.S. showing 6.8% annual inflation, the highest level seen since 1982.

While trading volumes drop, Top-Tier exchanges, rated according to CryptoCompare’s Exchange Benchmark methodology, have seen their trading volume drop 17.9% to $2.1 trillion, while lower-tier exchanges saw their volumes rise 117.8% to $518 billion. As a result, Top-Tier exchanges now account for 80% of the total volume, down from 92.1% in November.

The report adds that bitcoin trading into leading stablecoin USDT increase by 5% in December to 3.4 million BTC. Trading into the U.S. dollar increased to 1 million bitcoin, while into the Japanese yen it move up to 249,000 BTC, and into EUR p to 220,000 BTC.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured Image via Pixabay